It’s been a crazy year and it’s only June! There’s been inflation pressures, global unrest, an ongoing pandemic, and so much more. And while it might be difficult to be thinking ahead to 2023, that is exactly what you should be doing. Tax experts say NOW is the time to connect with your Certified Public Accountant, financial planner, and tax preparer and ask the right questions to better prepare you for the road ahead.

Retirement Daily’s Robert Powell caught up with Jeffrey Levine, CPA and tax pro from Buckingham Strategic Wealth Partners to break down the three key questions to ask your CPA – right now.

Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

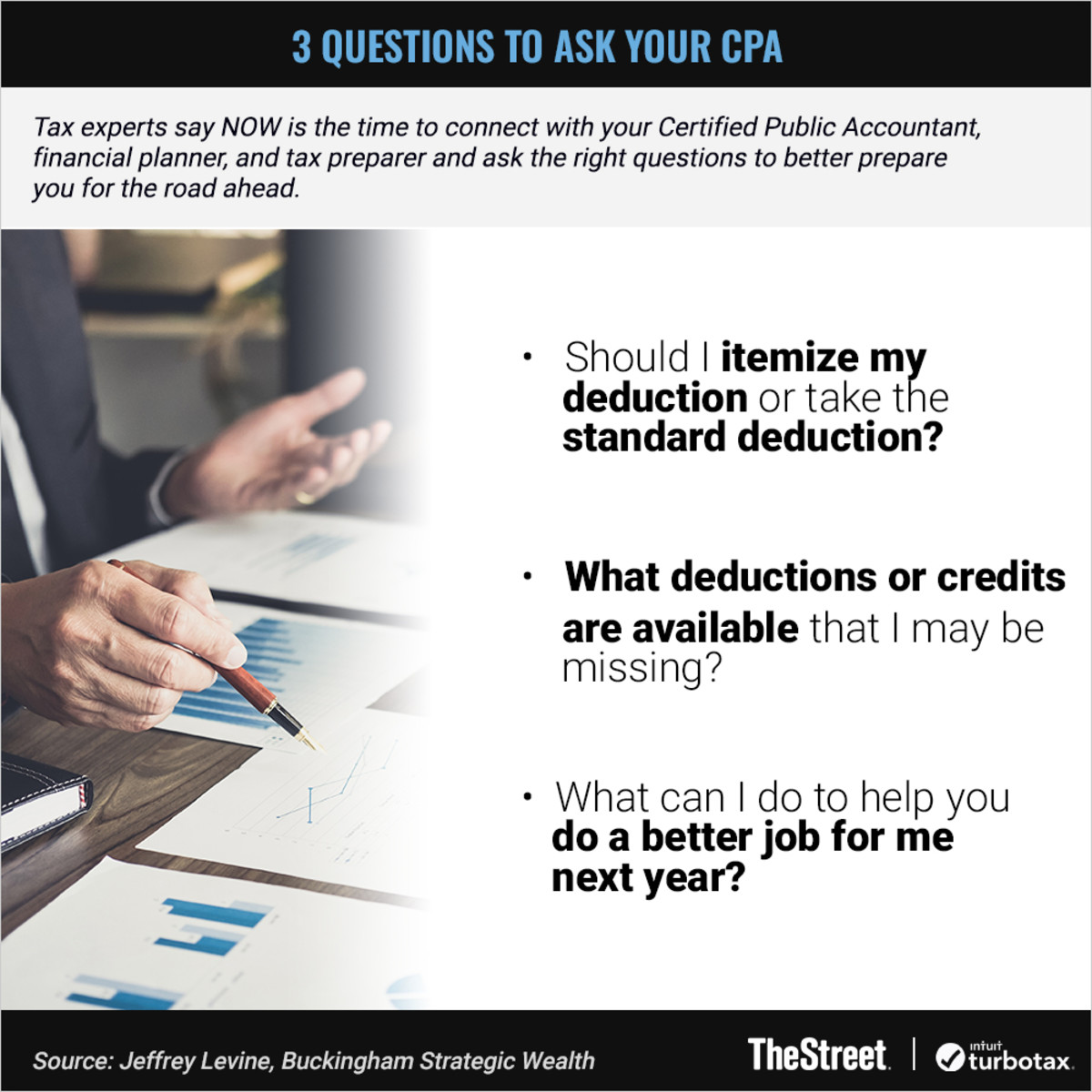

Graphic: 3 Questions to Ask Your CPA

3 Questions to Ask Your CPAShould I itemize my deduction or take the standard deduction?What deductions or credits are available that I may be missing?What can I do to help you do a better job for me next year?Quotes| 3 Critical Questions to Ask Your CPA Jeffrey Levine, Chief Planning Officer, Buckingham Strategic Wealth Jeffrey Levine, Chief Planning Officer, Buckingham Strategic WealthVideo Transcript| Jeffrey Levine, CPA and Tax Expert, Buckingham Strategic WealthRobert Powell: What are three critical questions you should be asking your CPA right now? Well, here to talk with me about that is Jeffrey Levine from Buckingham Wealth Partners. Jeffrey, what words of guidance do you have for us?

Jeffrey Levine: I think one of the most important things for individuals to know is whether they itemize their deductions or whether they take the standard deduction. So if you’re not sure already which of those apply to you, then I would make sure you ask your CPA. If you take the standard deduction, as most people do today, then a lot of the things that people talk about as being a tax benefit, for instance, giving to charity or having mortgage interest, actually won’t help you, at least not unless you have a lot more of them.

Another question I think that would be important to ask is whether I itemize or not, what sort of deductions or credits do you see out there that I haven’t been taking advantage of that I may be entitled to take? So if you don’t itemize, in other words, if you take the standard deduction, there are still a group of deductions known as above-the-line deductions. Things like IRA contribution deductions, deductions for self-employed individuals for health insurance premiums, etc., that you can still take even if you take the standard deduction. And of course, whether you take the standard deduction or not, you may be entitled to various credits under the tax code. So asking your CPA, hey, what might I be missing, could help you pay a lower tax bill next year.

And then finally, I would always ask your CPA, what can I do to help you do a better job for me next year? Now that might mean being more organized. It might mean having certain records. But ultimately, if you make your CPA’s job easier, they will be able to do a better job for you. So those three key questions would be where I would probably start.

Editor’s Note: This content has been reviewed by a TurboTax CPA expert.

TheStreet’s Zach Faulds produced this video and contributed to the writing of this article.