blue chip stocks

This mini-portfolio of inflation-fighting dividend payers is clobbering the market in 2022 and positioned well against this year’s headline headwinds.If there’s one thing recent macroeconomic and stock market turbulence should reteach us, it’s that the best blue-chip dividend stocks never go out of style. And the Dow’s best dividend stocks are proving that handily so far in 2022.

True, inflation is advancing at the fastest pace in four decades, and the market is seething with anxiety over impending interest rate hikes. Yet the top-rated dividend payers among the 30 Dow Jones stocks are beating the market so far this year – and should continue to give income investors some much-needed peace of mind.

Many of the Dow’s best dividend stocks also happen to be dividend growth stalwarts. Quite a few names in this elite bastion of 30 blue-chip equities are members of the S&P 500 Dividend Aristocrats – an index of 66 best dividend stocks that have increased their payouts for at least 25 consecutive years.

It’s also noteworthy that the Dow Jones’ best dividend stocks hail from sectors that hold up well when inflation runs hot. As we’ll see below, four of the five best Dow dividend stocks are classified as healthcare, energy and consumer staples bets.

The Dow’s Top Dividend Stocks Right NowHere’s how we found the Dow’s best dividend stocks to buy now. Using data from S&P Global Market Intelligence, we screened the blue chip barometer for Wall Street analysts’ highest-rated Dow components with dividend yields of at least 2.0%.

A quick note on S&P Global Market Intelligence’s ratings system: S&P surveys analysts’ stock calls and scores them on a five-point scale, where 1.0 equals a Strong Buy and 5.0 is a Strong Sell. Any score equal to or below 2.5 means that analysts, on average, rate the stock at Buy. The closer a score gets to 1.0, the stronger the consensus Buy recommendation.

That led us to the following five Dow Jones dividend stocks, which we list below by strength of analysts’ consensus recommendations, from lowest to highest. (Market data and analysts’ ratings are as of Feb. 13.)

5. Johnson & JohnsonMarket value: $441.5 billionDividend yield: 2.5%Analysts’ consensus recommendation: 2.11 (Buy)The best healthcare stocks have historically generated market-beating returns during inflationary periods, and Johnson & Johnson (JNJ, $167.71) is one of the top-rated names in the field.

Of the 18 analysts issuing opinions on JNJ tracked by S&P Global Market Intelligence, seven rate it at Strong Buy, two say Buy and nine call it a Hold.

JNJ is set to spin off its consumer health business – the one that makes Tylenol, Listerine and Band Aid – from its pharmaceuticals and medical devices divisions. The breakup is meant to free the faster-growth, higher-margin parts of J&J from the drag of its more mature, less profitable operations.

We’ll see how that goes, but the old arrangement helped JNJ become one of the 30 best stocks of the past 30 years. It’s also worth adding that Johnson & Johnson has increased its dividend for 59 consecutive years.

4. MerckMarket value: $193.6 billionDividend yield: 3.6%Analysts’ consensus recommendation: 2.00 (Buy)Merck (MRK, $76.64) is another Dow healthcare stock putting up market-beating returns in 2022, and analysts see additional outperformance ahead. With an average target price of $92.15, the Street gives MRK implied upside of about 20% over the next 12 months or so.

The Street has admittedly become incrementally less bullish on this Dow Jones stock over the past year, partly due to the pharma giant’s spinoff of Organon (OGN), its women’s health business. Warren Buffett’s Berkshire Hathaway (BRK.B) actually sold off its entire position in Merck in the third quarter – along with all of the OGN shares it received as part of MRK’s spinoff to shareholders.

Nevertheless, the Street’s consensus recommendation stands at Buy. Of the 25 analysts issuing opinions on MRK, 10 rate it at Strong Buy, five say Buy and 10 call it a Hold, per S&P Global Market Intelligence.

3. ChevronMarket value: $267.6 billionDividend yield: 4.1%Analysts’ consensus recommendation: 1.86 (Buy)The best energy stocks tend to outperform when inflation is on the rise, and the Street singles out Chevron (CVX, $138.81) as one of the sector’s top bets.

“In the current volatile energy environment, a company’s balance sheet strength and place on the cost curve are critical, and favor those integrated oil companies that are well positioned to manage a potentially long period of volatile oil prices,” writes Argus Research analyst Bill Selesky (Buy). “CVX is one of these companies.”

The analyst adds that CVX benefits from “best-in-class production growth, industry-low operating costs and a strong balance sheet.” Selesky further praises Chevron’s “strong free cash flow” and “safe and sustainable” dividend.

Of the 29 analysts issuing opinions on this Dow dividend stock, 13 rate it at Strong Buy, seven say Buy and nine have it at Hold, according to S&P Global Market Intelligence.

2. Coca-ColaMarket value: $260.4 billionDividend yield: 2.8%Analysts’ consensus recommendation: 1.85 (Buy)Consumer staples stocks, such as Coca-Cola (KO, $60.29), tend to do well when prices are rising rapidly.

In addition to being one of Warren Buffett’s favorite stocks, KO has increased its dividend annually for nearly six decades. It’s also one of the 30 best global stocks of the past 30 years.

Analysts are increasingly bullish on KO as a post-COVID-19 play. The beverage giant was hit hard by the pandemic, which shut down restaurants, bars, live events and myriad other venues serving its vast portfolio of fizzy drinks, juices, teas, sports and energy drinks, as well as other refreshments. Those sales are now coming back.

Additionally, Coca-Cola’s “unique pricing and franchise model” makes it “better positioned than peers to weather the challenges of the current inflationary environment,” notes UBS Global Research analyst Sean King (Buy).

Twelve analysts rate KO at Strong Buy, six say Buy and eight have it at Hold, per S&P Global Market Intelligence.

1. McDonald’sMarket value: $190.7 billionDividend yield: 2.2%Analysts’ consensus recommendation: 1.73 (Buy)McDonald’s (MCD, $255.16) gets the strongest consensus Buy recommendation of any Dow dividend stock yielding at least 2.0%.

Nineteen analysts rate MCD at Strong Buy, nine call it a Buy and nine have it at Hold. They forecast the global fast food chain to generate average annual earnings per share (EPS) growth of more than 12% over the next three to five years.

Even the best consumer discretionary stocks can struggle in inflationary environments, and shares in MCD are indeed down for the year-to-date. Regardless, the stock is beating the broader market by more than 2 percentage points, and analysts say it’s poised to post positive returns in 2022.

The Street’s average 12-month price target of $255.16 gives MCD stock implied upside of more than 11%. And that’s before factoring in the 2.2% yield on MCD’s dividend – a payout the hamburger chain has increased annually for 45 straight years and counting.

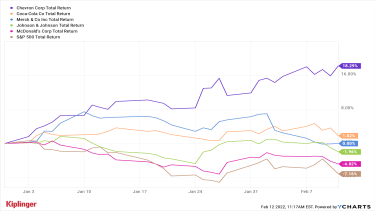

So Far, So GoodHave a look at the chart below and you’ll see that every one of these five Dow dividend stocks is beating the S&P 500 on a total-return basis (price appreciation plus dividends) for the year-to-date through Feb. 13.

YCharts

More impressively, an investor who held a customized portfolio of these five dividend payers would be outperforming the broader market by more than 9 percentage points this year.

Indeed, a market-cap weighted index of these five Dow dividend stocks generated a year-to-date total return of +2.1%, according to data from S&P Global Market Intelligence. That compares with the S&P 500’s year-to-date total return of -7.2%:

Chart data courtesy of S&P Global Market Intelligence

True, Chevron’s YTD total return of 18.3% is doing much of the heavy lifting. Be that as it may, the above chart makes a powerful visual statement: A highly concentrated portfolio of the best Dow dividend stocks is beating the broader market by a wide margin through the first seven weeks of a most troublesome 2022.