Only 1-in-5 tax filers claim a little-known tax credit called the Saver’s Credit (Retirement Savings Contributions Credit). There are others, too.

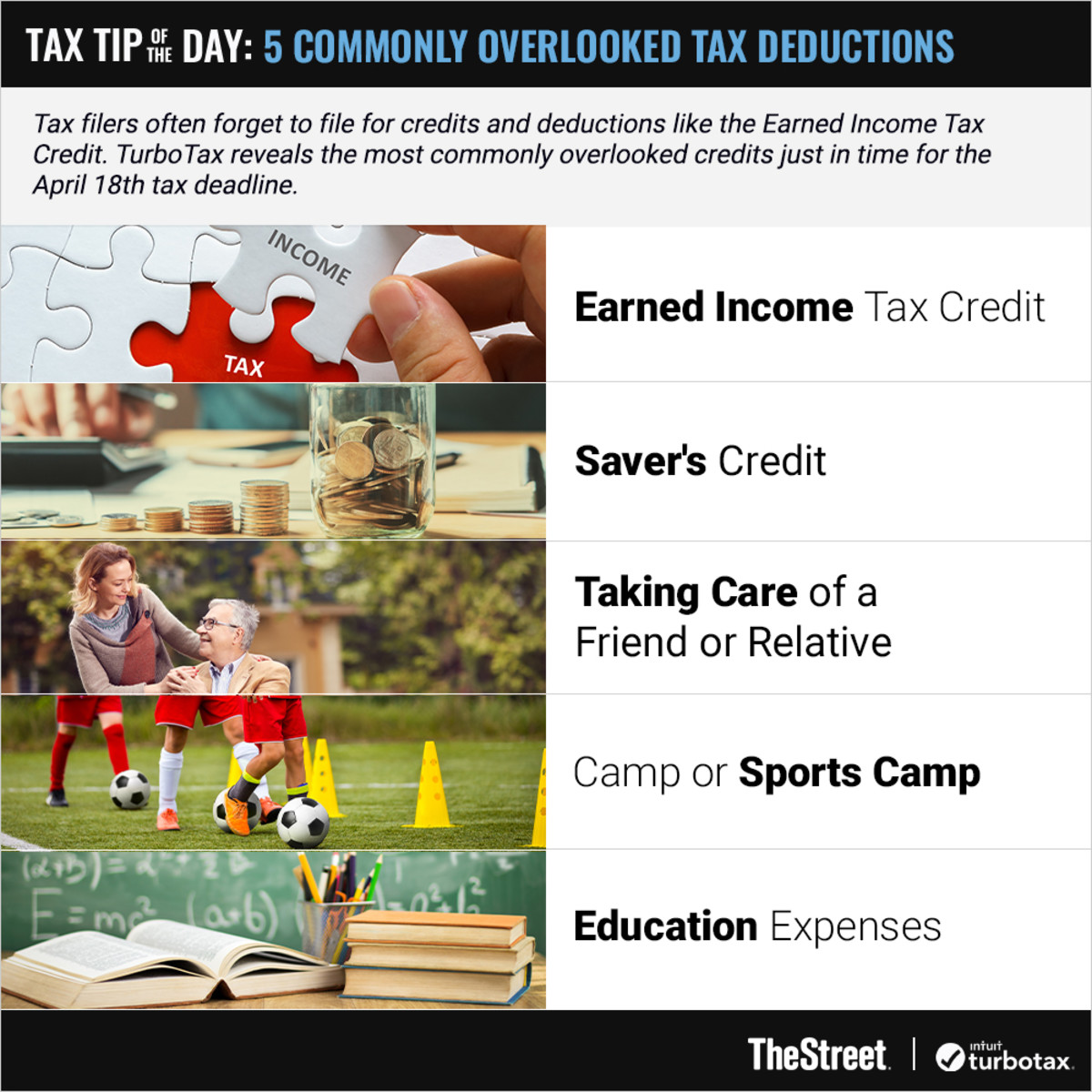

5 Tax Deductions Commonly OverlookedEarned Income Tax CreditSaver’s CreditTaking Care of a Friend or RelativeCamp or Sports Camp Education Expenses Graphic: Tax Tip of The Day: 5 Commonly Overlooked Tax Deductions

Watch the video above, Lisa Greene-Lewis, CPA and TurboTax expert explains the 5 most overlooked deductions above. Plus, she details 5 additional tax deductions and credits that tax filers often forget!

TheStreet Editors Recommend: The 10 Most Overlooked Tax Deductions

Video Transcript:Tracy Byrnes: All right, you’re putting your tax return together. It’s that time of year. There are so many overlooked tax deductions and credits that people forget. We don’t want you to Lisa Greene-Lewis, CPA and TurboTax expert is here with us right now to start and give you a list of the top 10 that you need to remember. The first is the Earned Income Tax Credit.

Lisa Greene-Lewis: Yes. The first one, many people forget. The IRS reports every year that one in five people miss out on this credit, and it’s a huge credit. It can be worth over $6000 for a family with three kids.

Tracy Byrnes: The saver’s credit, a lot of people don’t know about this.

Lisa Greene-Lewis: The saver’s credit, that’s another one. The IRS reports that one in five people miss it. And it’s a little-known credit that you get just for making investments into your retirement. And so that credit, can be worth up to $1,000 if you’re single, and up to $2,000 married, filing jointly.

Tracy Byrnes: Taking care of a friend or relative is interesting because so many people think you only get dependent credit if you have a kid, but that’s not true.

Lisa Greene-Lewis: Right. So many people miss out on this one. If you’re taking care of a friend. They’ve been crashing on your couch, and you’ve been supporting them for the whole year, you may be able to get a credit up to $500 for that.

Tracy Byrnes: It’s something. I’d take it. Camp or sports camp for your kids can be a deduction, can’t it?

Lisa Greene-Lewis:: Yes, it’s actually a credit. People have heard of the child and dependent care credit for sending your kids to daycare. But also, if you send your kids to summer camp or sports camp so you can work, you can get this credit. And under the American Rescue Plan, the child and dependent care credit were expanded. And it’s up to $8,000 if you have two or more kids.

Tracy Byrnes: Take those credits. Education expenses get really funky for people.

Lisa Greene-Lewis: Yes, so there’s education expenses. If you have a college student, or even for yourself, there may be education credits that you can take. You can take the American opportunity tax credit for the first four years of college. And that’s up to $2,500, or the lifetime learning credit, and that’s up to $2,000. And you don’t have to be earning a degree for that one. You can be taking just one class.

Tracy Byrnes: Yeah, I think a lot of people leave those on the table. Medical expenses, like PPE, are interesting because usually medical expenses are hard to come by.

Lisa Greene-Lewis: Yeah, so I just want to remind people, that there are some new medical expenses that you can take. And that’s under the category of PPE, so the personal protective equipment, like hand sanitizer, masks. If you can itemize your deductions and claim medical expenses, you’ll be able to take those expenses for that equipment.

Tracy Byrnes:: Sales and local taxes, previous state taxes paid, those are super important. But talk about the mileage and car expenses because that increases every year.

Lisa Greene-Lewis: Yes, so mileage, if you’re self-employed, for the tax year 2021, is $0.56 per mile. And you can also deduct mileage for going to a doctor’s appointment. So you have to keep those in mind and make sure that you track those.

Tracy Byrnes: Right, even a charitable event too. And how about unpaid loans to someone? That’s interesting, and I’m sure people forget that.

Lisa Greene-Lewis: Yes, that’s something that so many people don’t know. So if you loan someone money and you haven’t been successful in getting that money back, and you’ve attempted to collect it, and you know that you’re not going to be able to collect that money, you can take a deduction up to $3,000 as a worthless debt.

Tracy Byrnes: All right, Lisa, this can be really confusing. How do we keep this all organized?

Lisa Greene-Lewis: Well, TurboTax will guide you through these deductions and credits so you don’t leave anything out. They’ll ask you simple questions about yourself, and they’ll give you the tax deductions and credits you’re eligible for. And then if you want help along the way, you can connect to a TurboTax Live tax expert, or you can fully hand your taxes off to them.

Tracy Byrnes: This stuff is really important. You don’t want to leave money on the table. Lisa Greene-Lewis, thanks for taking the time with us.

Lisa Greene-Lewis: Thank you for having me.

Editor’s note: Video produced by TheStreet’s Zach Faulds