Stock Market Today

Investors piled into bonds and yield-bearing sectors such as utility stocks and consumer staples Thursday as the economy’s fate continues to be shrouded in uncertainty.Defensive stocks and the Nasdaq were in rare alignment, leading the way Thursday as much of Wall Street watched Federal Reserve Chair Jerome Powell continue his economic tightrope walk.

A day after telling the Senate Banking Committee that a recession is “certainly a possibility,” Powell told the House Financial Services Committee that “I don’t think that a recession is inevitable” – but again stressed the importance of pushing inflation down to 2%.

“With Chairman Powell finally acknowledging that while a soft landing is possible, the Fed’s commitment towards curtailing inflation might lead the economy into a recession, the market is wavering between a growth scare and an all-out recession,” says Quincy Krosby, chief equity strategist for LPL Financial. “With a still-strong labor market, there’s a growing sense that the Fed is now moving quickly to make up for lost time in its fight against inflation.”

The tightness of the labor market remained evident in the Labor Department’s latest unemployment data. Initial claims for the week ended June 18 came to 229,000 – a little above the median forecast of 226,000 but below the prior week’s revised 231,000.

However, the June purchasing manager’s index (PMI) showed some signs of strain, with the manufacturing reading declining to 52.4 from 57.0 and services PMI down to 51.6 from 53.4. While both figures still represent expansion, that expansion was far slower than economists were expecting.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

The 10-year Treasury yield continued to fall, to a session low of 3.01%, as investors bought bonds and ducked for cover. (Remember: Bond prices and yields move in opposite directions.) People were also seeking out safety in parts of the equity market – utilities (+2.4%) led the way, with healthcare (+2.2%) and consumer staples (+1.9%) also putting up decent gains. But the drop in rates also allowed technology and tech-esque stocks such as Amazon.com (AMZN, +3.2%) and Intuit (INTU, +5.2%) to float higher.

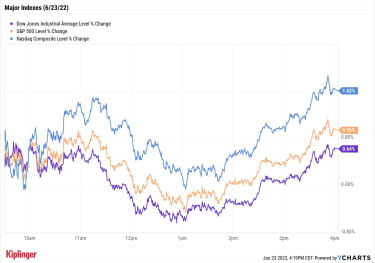

The result was a robust 1.6% advance in the Nasdaq Composite, to 11,232. It was followed by a 1.0% gain to 3,795 for the S&P 500, while the Dow Jones Industrial Average closed 0.6% higher to 30,677.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 enjoyed a 1.3% improvement to 1,711.U.S. crude futures shed 1.8% to settle at $104.27 per barrel.Gold futures slipped 0.5% to end at $1,829.80 per ounce, marking a fourth straight loss.Bitcoin enjoyed a 3.9% burst to $20,901.70. Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) WeWork (WE) spiked 15.7% after Credit Suisse analyst Tayo Okusanya initiated coverage on the office-space-sharing stock with an Outperform rating and an $11 price target – roughly 76% higher than today’s closing price of $6.26. The office sharing stock is a top pick in Credit Suisse’s real estate investment trust (REIT) coverage and will likely benefit from “a combination of technological innovation (e.g. 5G), industry disruption (e.g. hybrid work and co-working adoption), aging demographic trends and overall U.S migration trends,” Okusanya says.KB Home (KBH) shot up 8.6% after the homebuilder reported earnings. In its fiscal second quarter, KBH recorded higher-than-expected adjusted earnings of $2.32 per share and revenue of $1.7 billion, marking year-over-year growth of 55% and 19%, respectively. Still, CFRA Research analyst Kenneth Leon maintained a Hold rating on KBH stock. “Our Hold rating on KBH is based on an expected decline in homebuying demand, with rising mortgage rates above 6% and going higher,” Leon says. “Bearish views on rising rates and housing affordability are likely to hurt traffic and KBH’s performance.”Is Artificial Intelligence the Smart Play?Technology stocks have been among the best performers since the S&P 500 hit its bear-market bottom (or at least, as low as it’s gone so far) on June 16. The sector is up 4.6% since then – a welcome respite amid what has been a 25%-plus downturn in 2022.

But perhaps the time is coming for investors to pick up some of these beaten-down tech shares.

You might consider looking in some of the most battered areas of technology, as some industries have been harder hit than others. Artificial intelligence (AI), for instance, has taken a truly nasty shot to the chin. Using the TrueShares Technology, AI & Deep Learning Fund (LRNZ) – a thematic exchange-traded fund (ETF) – as a proxy, AI stocks are off some almost 40% this year.

AI, however, is a massive and growing market that’s expected to reach $62 billion by the end of 2022 – a 21% jump in size from 2021. That makes investments in the industry, such as these 10 AI stocks, worth monitoring for growth investors, especially when they can be bought on the (relatively) cheap.

7 Standout Places to Retire

Best Places

7 Standout Places to RetireWe picked cities across the U.S. that are affordable and offer the amenities retirees value most. Plus, one of them is bound to be close to family.

June 17, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

I’m Retired. Should I Pay Off My Mortgage?

retirement

I’m Retired. Should I Pay Off My Mortgage?It’s a simple question. The right answer for you could depend on this: Where would you pull the money from to do it?

June 20, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

June 24, 2022

Ron Baron: A Fund Legend Shares Stock-Picking Secrets

mutual funds

Ron Baron: A Fund Legend Shares Stock-Picking SecretsThe ability to buy and hold great growth companies for the long term is important to becoming a successful investor.

June 22, 2022

Baron Funds: The Masters of Growth Investing

mutual funds

Baron Funds: The Masters of Growth InvestingThe Baron Funds have an extraordinarily long and successful track record. Here’s how they do it.

June 22, 2022

Stock Market Today (6/22/22): Market Moves Mostly Sideways in Quiet Session

Stock Market Today

Stock Market Today (6/22/22): Market Moves Mostly Sideways in Quiet SessionStocks managed to not give up most of yesterday’s gains, but Wednesday certainly was a breather amid little to buoy the broader markets.

June 22, 2022