Stock Market Today

Slack in manufacturing data and low consumer confidence tanked early-session optimism and left the major indexes with deep losses Tuesday.Stocks started the day on solid footing as investors cheered reports that China is easing back its COVID-related restrictions by reducing the quarantine period for international travelers coming into the country to 10 days from 21 days.

Those gains were short-lived, however, with markets taking a sharp turn lower after a round of weak economic data here at home.

For starters, the Richmond Fed Manufacturing Index, which measures manufacturing activity along the East Coast, fell to -19 in June from -9 in May, marking its lowest reading since May 2020. Additionally, the Conference Board’s latest consumer confidence survey fell to 98.7 in June, its second consecutive monthly decline and lowest level since February 2021.

“Continued pressure from rising prices is clearly impacting the mindset of the consumer,” says Cliff Hodge, chief investment officer for Cornerstone Wealth. “Getting inflation under control will be the Fed’s number one priority.”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Also weighing on investor sentiment today was the latest earnings report from Nike (NKE, -7.0%). While the athletic apparel retailer posted beats on both the top and bottom lines in its fiscal fourth quarter, it gave weaker-than-expected current-quarter revenue guidance due to COVID-related disruptions in China.

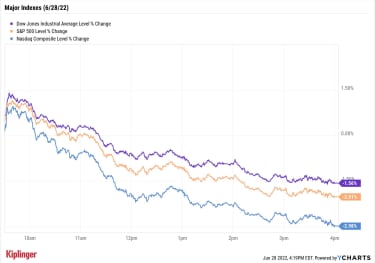

By the close, the Dow Jones Industrial Average was down 1.6% to 30,946, the S&P 500 was off 2.0% to 3,821 and the Nasdaq Composite had given back 3.0% to end at 11,181. The only market sector in the green? Energy (+2.7%), set aloft by a 2.0% climb in U.S. crude oil futures to $111.76 per barrel, driven by the aforementioned loosening of China’s COVID policies.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 declined 1.9% to 1,738.U.S. crude futures gained 2% to end at $111.76 per barrel, marking its third straight win.Gold futures edged down 0.2% to settle at $1,821.20 an ounce.Bitcoin slumped 2.9% to $20,249.80. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Occidental Petroleum (OXY) jumped 4.8% after a regulatory filing released last night revealed Warren Buffett’s Berkshire Hathaway (BRK.B) bought another 794,000 shares of the energy stock on June 23 worth roughly $44 million. Buffett has been buying OXY stock with a flourish this year and the latest share purchase brings his holding company’s total stake to 16.4%.Snowflake (SNOW) – another member of the Berkshire Hathaway equity portfolio – was up more than 4% earlier after Jefferies analyst Brent Thill upgraded the cloud stock to Buy from Hold. “We are upgrading SNOW after a significant compression on its multiple in the last six to eight months, in part driven by a broader sector drawdown and by continued execution and strength in top-line growth,” the analyst says, calling out SNOW’s “best-in-class fundamentals” and “high quality growth.” However, broad-market headwinds eventually pressured the stock to a 3.0% loss on the day.China’s move to relax its COVID restrictions also created a boon for several casino stocks. Las Vegas Sands (LVS, +4.0%), Melco Resorts & Entertainment (MLCO, +5.1%) and Wynn Resorts (WYNN, +3.2%) were all higher on the news. Don’t Just Fall Back. Counter-Attack!It’s a safe assumption that most investors are preoccupied with defense right now. It’s not hard to see why: We’re in the midst of a bear market, and the number of recession forecasts grows by the day.

Wells Fargo, for instance, says a U.S. recession is “now more likely than not,” though it believes that recession is coming in mid-2023. And in fact, they say other parts of the world could catch our ailment: “We believe European countries and emerging-market nations with strong trade linkages to the U.S. are also at risk of falling into recession,” Wells economists say.

But soccer legend José Mourinho would probably tell you it’s not enough to sit back and play defense – you also need a spirited counterattack. Protective sectors such as utilities and consumer staples might help you keep what you have, but picking up a few beat-up growth stocks and dusting them off could help you generate considerable outperformance once the stock market finds its footing.

2022’s first-half slump “has opened attractive entry points, particularly into some growth stocks that have been punished beyond what their fundamentals would imply,” says Tony DeSpirito, chief investment officer of Blackrock’s U.S. Fundamental Equities, adding that a focus on strong balance sheets and ample free cash flow will serve investors well. As we look ahead to the second half of 2022, we explore 15 growth stocks with these kinds of qualities.

An Easy Way to Find How Much You Will Spend in Retirement

retirement planning

An Easy Way to Find How Much You Will Spend in RetirementOne simple math equation can help you determine where to start building your retirement income plan, and whether your money should last.

June 27, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

8 Money Tips for Seniors Suffering from Inflation

Inflation

8 Money Tips for Seniors Suffering from InflationThis year has been an especially tough one for seniors on fixed incomes. To stay on track, try these eight financial survival tips.

June 26, 2022

Stock Market Today (6/27/22): Stocks Limp Out of the Starting Gate

Stock Market Today

Stock Market Today (6/27/22): Stocks Limp Out of the Starting GateMonday’s session saw stocks give back a little territory from last week’s rebound rally, but experts are seeing a few reasons to be optimistic.

June 27, 2022

5 Best Dow Dividend Stocks to Buy Now

blue chip stocks

5 Best Dow Dividend Stocks to Buy NowThis mini-portfolio of blue-chip dividend payers is well-positioned to both generate income and hold up to headwinds for the rest of 2022.

June 27, 2022

Micron Technology Earnings Expected to Show Strong Growth

stocks

Micron Technology Earnings Expected to Show Strong GrowthOur preview of the upcoming week’s earnings reports includes Micron Technology (MU), Nike (NKE) and Walgreens Boots Alliance (WBA).

June 27, 2022

Stock Market Today (6/24/22): Stocks Stick the Landing in Successful Short Week

Stock Market Today

Stock Market Today (6/24/22): Stocks Stick the Landing in Successful Short WeekSmall hints that inflation might have peaked and that the U.S. might evade recession stoked broad buying Friday.

June 24, 2022