Investors have pulled cash from global equity-focused mutual funds for at least five weeks

Author of the article:

Bloomberg News

Sagarika Jaisinghani

A person walks past a Bank of America sign in the Manhattan borough of New York City. Photo by REUTERS/Carlo Allegri/File Photo Fund flows are starting to add evidence that investors are throwing in the towel on stocks, according to Bank of America Corp strategists.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

Investors have pulled cash from global equity-focused mutual funds for at least five weeks, yanking US$4.5 billion in the most recent period, according to the bank, which relies on EPFR Global data.

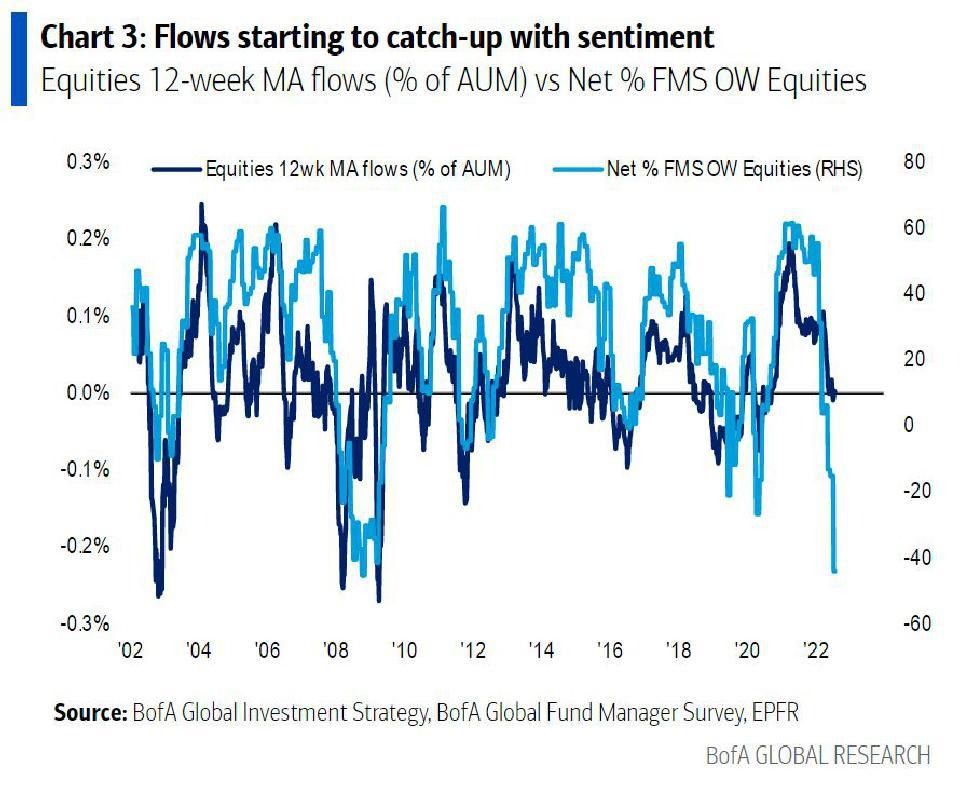

To Bank of America strategists led by Michael Hartnett, it shows that flows are catching up with the market’s pessimism. In the bank’s global fund manager survey, a record net 58 per cent of survey participants said they’re taking lower-than-normal risks.

To be sure, it’s an early trend and the data over a longer time span still shows that flows have been relatively resilient, given the selloff in equities. For the full year, investors have added US$177 billion to stock funds.

Before there can be a bull run in stocks, investors need to see inflation and bond yields peak, as well as a change in the Federal Reserve’s hawkish policy by 2023, said Hartnett. That’s unlikely without a big recession, so he recommends investors sell the S&P 500 at 4,200, a level about five per cent above the last close.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

More On This Topic David Rosenberg: Cyclical sectors next ‘shoe to drop’ — and the TSX is especially vulnerable Tom Bradley: Buying stronger companies in times of weakness can give investors the nerve to be countercyclical Generation moonshot: why young investors are not ready to give up on risk The S&P 500 is up 5.6 per cent so far in July, which would be the biggest monthly advance since October. The index is still down 16 per cent for the year.

Here are some more highlights from Bank of America’s flows report. The data is for the week through July 20.

About US$8.2 billion left bonds, the first outflow in three weeks Cash inflows were US$3.5 billion In terms of equity flows by style factors, U.S. large caps saw inflows Small cap, growth and value had outflows in the week Health care and consumer led inflows among sectors, while materials and energy had the biggest outflows Bloomberg.com

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300