1. Did you request an extension in time? If someone was late filing an extension, the extension probably isn’t valid, said Lisa Featherngill, the national director of wealth planning at Comerica Bank. “This isn’t a problem if they are due a refund,” she says. “However, if they owe tax, they can be assessed a late filing penalty.”

Technically, said Featherngill, this is the Failure to File Penalty, and it is 5% of the unpaid tax for each month (or partial month) that a return is late, up to 25% of the unpaid balance.

Note: A valid extension has to be postmarked by the due date of the tax return, or April 18 for 2021 returns.

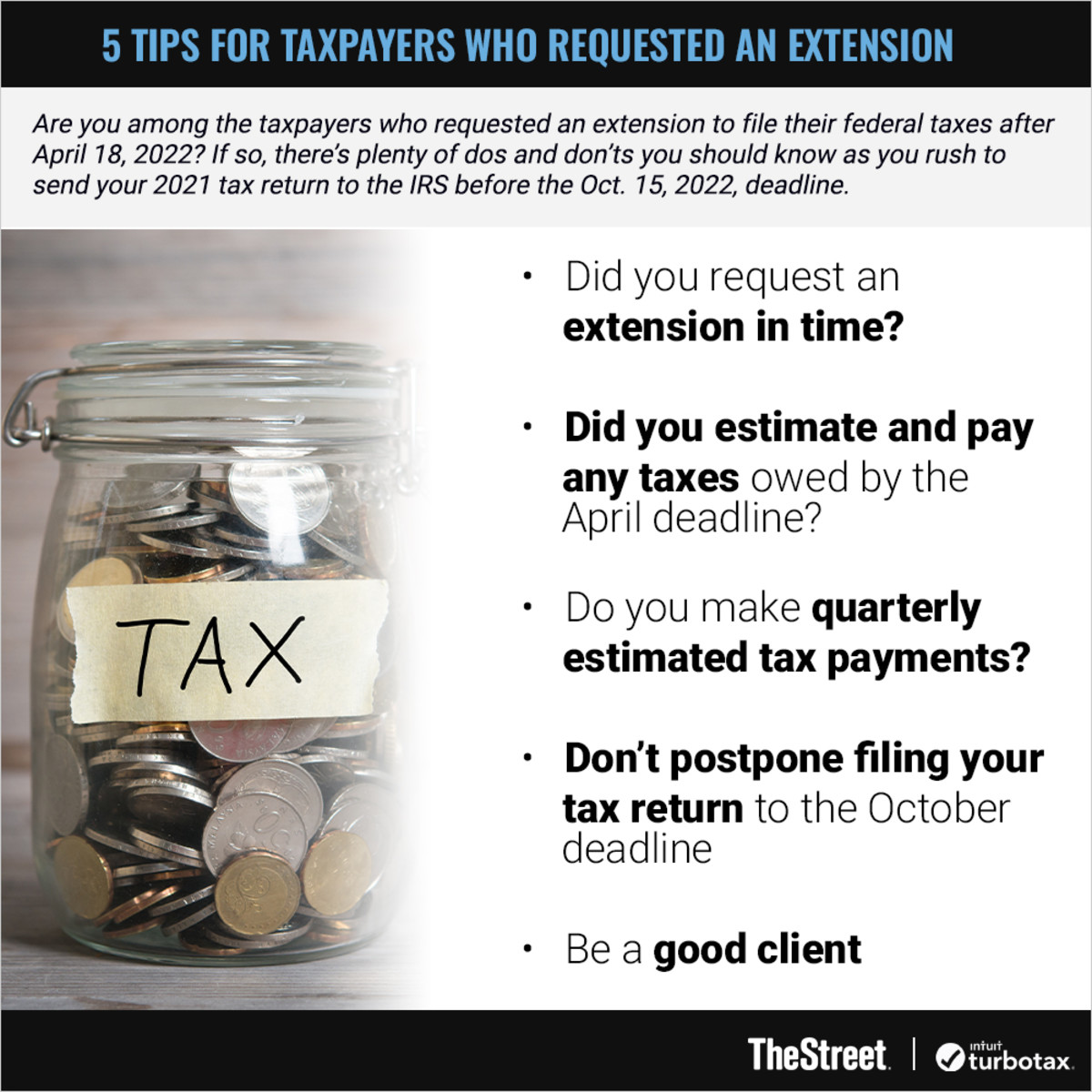

Graphic: 5 Tips for Taxpayers Who Requested an Extension

2. Did you estimate and pay any taxes owed by the April deadline? Taxpayers who request an extension to file their federal taxes must estimate and pay any taxes owed by the April deadline, said Jean-Luc Bourdon, CPA/PFS, the founder of Lucent Wealth Planning. “That estimate may or may not be correct,” he said. “So, when the taxpayer’s tax return is later prepared, they may find out that they owe more than they paid—and face penalties.”

Given that, Bourdon said it’s always best to prepare an extended tax return as soon as possible to know for sure if there’s a tax shortfall. And if there is a tax shortfall, to limit penalties, it’s better to pay it sooner than later, he said.

Meet Our CPA and Tax Expert: Jean-Luc BourdonBio: Jean-Luc Bourdon, CPA, PFS, Wealth Advisor

3. Do you make quarterly estimated tax payments? Taxpayers who make quarterly estimated tax payments should pay attention to their current-year estimates, said Bourdon. “Estimated payments are based on the prior year’s tax return,” he said. “So, when that tax return goes on extension, the quarterly estimated payments might get forgotten.”

Scroll to Continue

It is, said Bourdon, a common oversight.

Another issue: The estimated tax payments may not be sufficient to avoid underpayment penalties. Here again, said Bourdon, it’s best to file the extended tax return as soon as possible to get good estimates for quarterly payments.

Of note, if taxpayers on extension later find out they have underpaid their quarterly estimated payments for the current year, they might be able to catch up with payroll withholdings or other tax withholdings from, say, retirement accounts if applicable, said Bourdon.

4. Don’t postpone filing your tax return to the October deadlineThere’s no prize for filing at the last minute and it often causes much frustration and missed planning opportunities, said Bourdon.

5. Be a good client Over the last few years, the IRS and the complex tax environment have been hard on tax-preparers, said Bourdon. “There’s also a shortage of tax talent,” he said. “Consequently, good tax pros don’t need difficult clients and get to be choosy.”

In fact, some of them fire their worst clients each year, he said. “To avoid receiving a ‘disengagement letter,’ don’t be a last-minute filer,” said Bourdon. “In general, get your complete tax information to your tax-preparer as early as possible. Thank you cards and hugs are good ideas too.” Read Extension of Time To File Your Tax Return.

More Tax Advice From Our Partners at TurboTax.com:

Filing Your Taxes LateCan’t File by the Deadline? Top 3 Reasons to File a Tax ExtensionWhat to Do After You’ve Filed an Income Tax ExtensionDid You Miss the Tax Deadline? 3 Steps You Can Take NextEditor’s Note: The opinions expressed in this article are those of the authors. The content was reviewed for tax accuracy by a TurboTax CPA expert.