Stock Market Today

The nation’s largest retailer cut its second-quarter and full-year profit forecasts, citing higher fuel and food prices.A profit warning from the nation’s largest retailer ahead of a busy stretch of corporate earnings sent stocks lower at the start of Tuesday’s trading, and the selling continued as the session wore on.

Late Monday, Walmart (WMT) said that it now expects second-quarter earnings per share to be down 8% to 9% year-over-year and operating income to fall at least 13%, compared to May guidance for both metrics to be flat to up slightly.

“The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars,” said Doug McMillon, CEO at Walmart, in the company’s press release. The company also cut its full-year profit forecast, as it expects even more pressure on general merchandise over the next two quarters.

WMT stock slid 7.6% on the news – making it easily the worst-performing Dow Jones stock today – and other retailers like Target (TGT, -3.6%) and Dollar Tree (DLTR, -6.3%) fell in sympathy.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

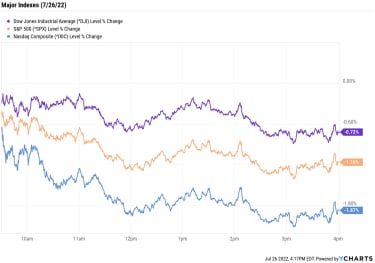

The selling weighed on the broader benchmarks as well, with the Dow Jones Industrial Average shedding 0.7% to end at 31,761, while the S&P 500 Index gave back 1.2% to 3,921. The Nasdaq Composite was the biggest decliner, though, sinking 1.9% to 11,562, as cybersecurity stocks Zscaler (ZS, -9.1%) and Palo Alto Networks (PANW, -7.9%) tumbled.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 gave back 0.7% to 1,805.U.S. crude futures fell 1.8% to $94.98 per barrel.Gold futures finished marginally lower at $1,717.70 an ounce.Bitcoin plummeted 4.7% to $20,914.14. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Shopify (SHOP) plunged 14.1% after the e-commerce platform said it is laying off 10% of its global workforce. In a letter to staff, CEO Tobi Lutke said management misjudged the growth e-commerce would see after the pandemic boom faded and now the company must adjust to meet slowing demand. SHOP will unveil its second-quarter earnings report before tomorrow’s open.General Motors (GM) shed 3.4% after the carmaker reported second-quarter adjusted earnings per share of $1.14, falling short of analysts’ consensus estimate. GM also said it was not able to ship roughly 100,000 vehicles by the end of the quarter due to parts shortages. On the upside, the company’s Q2 revenue of $35.8 billion came in higher than expected and it maintained its full-year forecast. “We now see full-year results coming in at the lower end of guidance as it struggles with inflation, supply-chain issues, and weaker volumes than a year ago,” says CFRA Research analyst Garrett Nelson, who lowered his rating on GM to Hold from Buy. “We think still more patience is going to be required of investors before shares begin to turn the corner – and its EV transition could see some speed bumps.Play Defense With Low-Vol StocksOngoing concerns about inflation were also evident in the latest consumer sentiment data that hit the Street today. Specifically, the Conference Board’s consumer confidence survey for July fell to 95.7 from June’s 98.4, marking its third straight monthly decline and the lowest reading since February 2021. Survey participants continued to cite rising gas and food prices as their main worries.

“As the Fed raises interest rates to rein in inflation, purchasing intentions for cars, homes, and major appliances all pulled back further in July. Looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months,” the report indicated.

The latest rate hike from the Federal Reserve is due out tomorrow, with the market pricing in a 75 basis-point (a basis point is one-one hundredth of a percentage point) increase. However, “the Fed has indicated nothing’s off the table for this Wednesday’s meeting and that will sway markets one way or another,” says Jeff Klingelhofer, co-head of investments at Thornburg Investment Management. The central bank has to nail this, he adds. “Too high of a hike will send markets spiraling and too low will keep inflation burning hot.”

For investors, the uncertainty can be unnerving, but Klingelhofer says the best thing they can do in today’s market is to get defensive via high-quality fixed-income plays and dividend-paying stocks. Another way for investors to prioritize defense is with low-volatility stocks, which can provide stability to portfolios amid the market’s twists and turns. Here, we take a look at 10 top-rated names that fit this bill.

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

July 22, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

3 Main Reasons Why the Government Denies Social Security Disability Benefits

personal finance

3 Main Reasons Why the Government Denies Social Security Disability BenefitsTo help improve your chances at being approved for SSDI benefits, it helps to better understand why so many applicants get turned down.

July 16, 2022

Best Airline Stocks to Buy Amid a Rocky Recovery

stocks

Best Airline Stocks to Buy Amid a Rocky RecoveryAirline stocks are widely viewed as major beneficiaries of a global reopening. But some names look better than others, especially in the face of macro…

July 26, 2022

Stock Market Today (7/25/22): Stocks End Lower Ahead of Tech Earnings, Fed Meeting

Stock Market Today

Stock Market Today (7/25/22): Stocks End Lower Ahead of Tech Earnings, Fed MeetingConsumer discretionary stocks lagged after grill maker Weber (WEBR) warned of ongoing macroeconomic headwinds.

July 25, 2022

10 Best Low-Volatility Stocks to Buy Now

stocks

10 Best Low-Volatility Stocks to Buy NowOne way for investors to hedge during broad-market downturns is with low-volatility stocks. Here are 10 to consider.

July 25, 2022

Apple (AAPL) Headlines Busy Week of Tech Earnings

stocks

Apple (AAPL) Headlines Busy Week of Tech EarningsOur preview of the upcoming week’s earnings reports includes Apple (AAPL), Amazon.com (AMZN), Alphabet (GOOGL), Meta Platforms (META) and Microsoft (M…

July 25, 2022