Many small businesses had to adapt to survive during the pandemic—and those same adaptations could now be helping them to thrive.

That’s one of the standout findings of our latest Small Business Insights survey of 2,000 small businesses across the U.S., which reveals revenue from online sales is more important than ever—even for brick-and-mortar businesses. In fact, it’s now the number one priority for the nation’s small businesses. Use the chapter links to jump to each section of the report.

The Pivot to DigitalAlmost nine out of ten small businesses (88%) say online sales will be an important source of revenue in 2022. Likewise, almost all (97%) say digital technology will be important to their business next year.

Graphic: Small Business Challenge: 9 out of 10 small businesses need revenue from online sales

Top Priorities For 2022Facing rising costs, boosting revenue from online sales is now the No.1 priority for small businesses. Almost all small businesses (97%) are concerned about inflation, and many plan to raise prices.

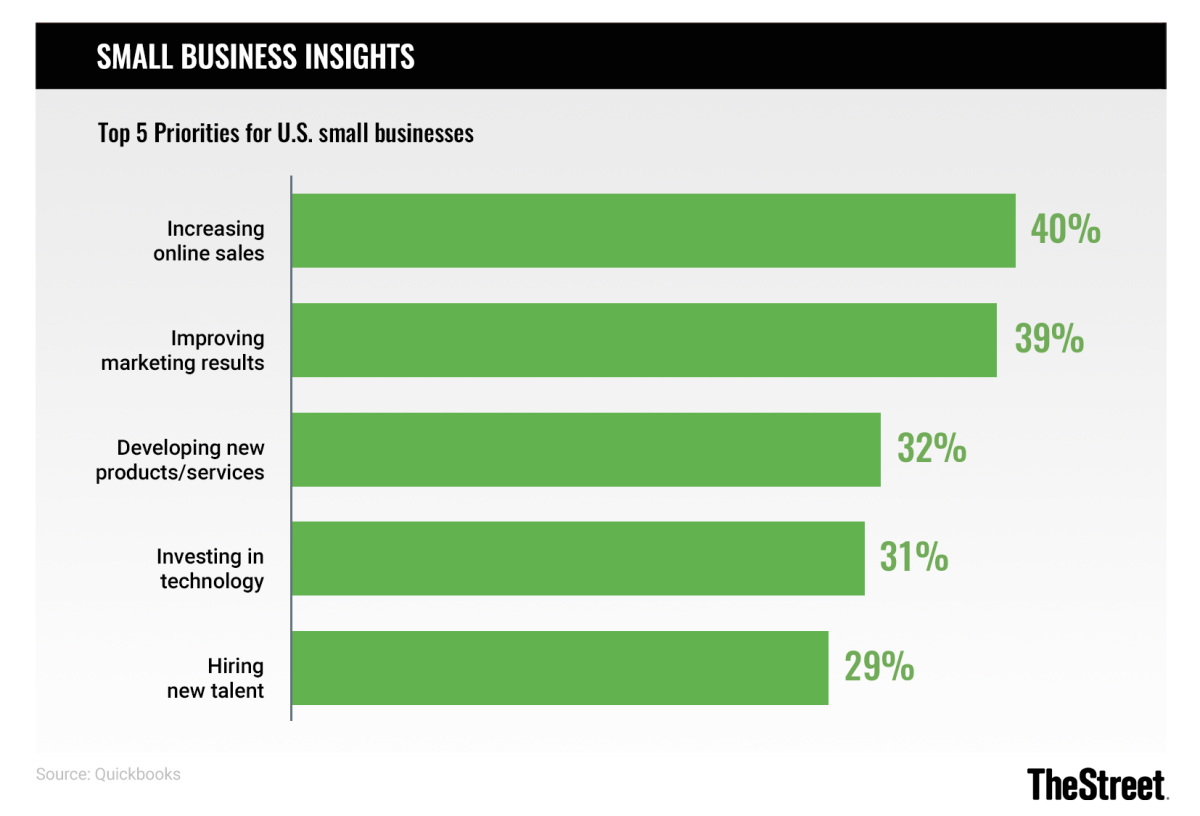

Graphic: Small Business Insights: Top 5 Priorities for U.S. Small Businesses

Hiring Not FiringMore than two in five small businesses (44%) plan to expand their workforce over the next three months, while just 3% predict that their workforce will get smaller. This suggests the strong hiring trend we reported in September 2021 looks set to continue in 2022.

Graphic: Small Business Insights: Hiring Trends

Economic OutlookEconomic confidence remains high. Businesses with fully integrated online and offline sales (known as “omnichannel” businesses) are the most optimistic about the economy.

Graphic: Small Business Insights: Views On the Economy – Source: Quickbooks

Most Small Businesses Continued to Pivot This YearThe pivot to digital is a well-established trend for small businesses. This year, three-quarters (75%) had to make significant changes to their business due to the ongoing impact of the COVID-19 pandemic. One in four (25%) changed their entire business model. The top three changes they made are:

More use of digital technologyMore revenue from online salesMore focus on cutting costsGraphic: Small Business Insights: Pandemic Challenges – Source: Quickbooks

Online Revenue Predicted to Grow In 2022Revenue generated online — either directly, from a company’s own website, or from other sources such as social media — will be important to almost nine out of ten small businesses (88%) in 2022. This isn’t limited to e-commerce businesses. Almost three-quarters of brick-and-mortar businesses (74%) say online revenue is important.

Overall, more than two in five small businesses (42%) say they will become more reliant on online sales in 2022 compared to 2021. More than one in ten (12%) already get 100% of their revenue online.

Graphic: Small Business Insights: Online Sales Dependency In 2022 – Source: Quickbooks

Revenue from social media now accounts for 33% of small business revenue, on average. Even brick-and-mortar businesses get 22% of their sales via social media.

Graphic: Small Business Insights: Revenue Dependent on Social Media – Source: Quickbooks

Online Revenue Is the Top Priority For Small BusinessesBoosting revenue from online sales is currently the top priority for small businesses in the U.S. That’s closely followed by the need to get better results from marketing. Investment in innovation is also high on the list.

Graphic: Small Business Insights: Top 5 Priorities for Small Businesses (U.S.) – Source: Quickbooks

Digital Technology Will Be Even More Important In 2022Almost all small businesses (97%) say digital technology will play an important role in their business over the next 12 months. Of these, more than one in two (52%) say they will become more reliant on digital technology in 2022.

For many, this isn’t just about running the day-to-day operations of their business, it’s about performance. Four out of five small businesses (80%) agree that they are more likely to succeed if they invest in digital technology.

Graphic: Small Business Insights: The Role Digitial Technology Plays In Success – Source: Quickbooks

Rising Costs Force Small Businesses to Put Revenue FirstAs we’ve seen, small businesses are laser-focused on revenue right now. Our survey reveals why. Inflation is a concern for 97% of them — largely unchanged since our previous Small Business Insights report was published in September. Rising costs are one of the biggest threats small businesses currently face. And many consumers have similar concerns.

Graphic: Small Business Insights: Biggest Threats In 2022 – Source: Quickbooks

Supply Chain Problems Exacerbate Cost PressuresThe top three cost pressures for small businesses are materials, shipping, and equipment — in that order. Labor costs are also a worry for many (more on this in the Hiring section of this report).

The challenge of higher shipping costs is compounded by the fact that almost three-quarters of small businesses (71%) have experienced supply chain problems this year. Of these, 38% expect these problems to continue. Encouragingly, the other 62% say their supply chain problems have already been resolved or that they expect them to be resolved soon.

Graphic: Small Business Insights: The Impact of Supply Chain Challenges – Source: Quickbooks

Two Solutions to Rising Costs: New Customers, Higher PricesSmall businesses are reacting to mounting cost pressures in two ways. First, they want to find new customers. In fact, the urgency to expand their customer base is currently the No.1 cause of stress for small businesses. Second, many say they could be forced to raise their own prices. Almost two-thirds (63%) plan to increase prices over the next three months. Back in September 2021, around three out of five (57%) were considering raising prices.

Graphic: Small Business Insights: Business Plans Include Price Increases – Source: Quickbooks

Hiring Remains a High Priority For Small Businesses More than two in five small businesses (44%) expect to expand their workforce over the next three months, according to our survey. This suggests the strong hiring trend we revealed in our September Small Business Insights report is set to continue into 2022. Just 3% predict that their workforce will get smaller.

Graphic: Small Business Insights: Hiring Plans Over the Next Few Months – Source: Quickbooks

Skills Shortages and Labor Costs Remain a Concern QuickBooks Payroll data released in September shows that most small business workforces are back to their pre-pandemic levels. But labor costs remain a concern for almost nine out of ten (88%). This is largely unchanged since September when 85% were worried about labor costs.

Small businesses are also still struggling to find talent. Almost one in two (48%) say hiring is getting harder, while just 16% say it’s getting easier. Similarly, two in five (42%) say it’s getting harder to retain skilled workers. Another recent survey commissioned by QuickBooks reveals why: two in five U.S. employees (40%) are currently looking for new jobs to get better pay or benefits.

Graphic: Small Business Insights: Hiring Challenges in 2022 – Source: Quickbooks

Wage Increases Predicted to ContinueTo attract new talent, more than two in five small businesses (44%) are increasing pay while roughly a third (30%) are hiring younger workers than before. Others are relaxing experience requirements. To retain talent, almost one in two (46%) will increase pay for existing employees during the next pay review. More than a third (36%) will offer larger bonuses.

Graphic: Small Business Insights: Top Ways to Tackle Hiring Challenges – Source: Quickbooks

Positive Outlook For 2022 Despite the challenges, the majority of small businesses (53%) remain optimistic about the economy. Roughly half as many (28%) are pessimistic. Confidence has dipped slightly since our last Small Business Insights report in September when three out of five (60%) said they were optimistic.

Small businesses with fully integrated online and offline sales (known as “omnichannel” businesses) are the most upbeat. More than two-thirds (68%) are optimistic about the economy.

Graphic: Small Business Insights: Outlook On the Economy – Source: Quickbooks

Many Predict Growth Over the Next Three MonthsSeven out of ten small businesses (70%) predict their business will grow in the first months of 2022. Similarly, more than two-thirds (69%) predict higher revenues. More than a third (36%) plan to increase capital investment.

Graphic: Small Business Insights: Growth Predictions for 2022 – Source: Quickbooks

Small Businesses Need Their Accountants Accountants will continue to play an important role in small business success in 2022. Almost three-quarters of small businesses (73%) have internal or outsourced accounting support. According to them, the top three benefits of having an accountant are:

Helping them to make better decisionsSaving them moneyImproving their long-term survivalSmall businesses with accountants are also more likely to feel “very confident” they are paying their taxes correctly.

Graphic: Small Business Insights: New Businesses With Accountants – Source: Quickbooks

Want More Insights?Find out what 8,000 American workers said about their spending plans for 2022, and how many of them want to start a small business of their own in our New Business Insights report.

MethodologyQuickBooks commissioned Qualtrics to survey 2,000 small business owners and decision-makers throughout the U.S. in November 2021. Respondents’ businesses have up to 100 employees and more than $5,000 in annual revenue. Roughly a third (35%) are brick-and-mortar businesses. The remainder is omnichannel, multi-channel, or primarily online. A quarter (26%) are product-based businesses, one in two (50%) are service-based and the remainder sells both products and services. Around one in six (17%) are located in rural areas while the remainder is in urban or suburban locations. Percentages have been rounded to the nearest decimal place. Respondents received remuneration.

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations, or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.