After two record-breaking years of new business creation, there’s no sign of the trend slowing down as QuickBooks projects as many as 17 million new small businesses could be set up in 2022.

The prediction comes from a recent survey of 8,000 U.S. employees, commissioned by QuickBooks in November 2021. The survey reveals that almost three out of five (57%) want to start a business and of these, one in five (20%) will make the leap in 2022 — equivalent to around 17 million people.

Graphic: New Business Starts: Employees Who Want to Start a Business – Source: Quickbooks

More Than 5 million EINs Predicted In 2022When new businesses hire employees or incorporate, rather than remain as sole proprietors, they need an Employer Identification Number (EIN). QuickBooks projections based on U.S. Census Bureau data suggest there will be around 5.3 million EINs registered in 2021, smashing the previous record of 4.3 million set in 2020. The same projection predicts there will be 5.6 million in 2022.

The survey data supports this projection because one in three of these 17 million future business owners say one of the first things they do when they start their business will be to hire employees — meaning roughly 5.6 million will need an EIN.

Graphic: New Business Starts: New Business Starts Per Year – Source: Quickbooks

Why Now, and Why So Many? An overwhelming 83% of people who want to start a business say COVID accelerated their plans. This is either because they spotted a new opportunity online during the pandemic or because it made them rethink their priorities.

Graphic: New Business Starts: Effect of COVID on New Business Plans – Source: Quickbooks

Other reasons people gave for wanting to become business owners include:

“To be my own boss.”“To have more control over my future.”“To earn more money than I could by working for someone else.”This appears to be an international trend. When we ran the same survey in Canada and the U.K., we again found that a significant proportion of the working population wants to branch out and go it alone and that COVID accelerated their plans.

Graphic: New Business Starts: Do You Dream of Owning Your Own Business? – Source: Quickbooks

A Step-by-Step Guide For EntrepreneursHere’s what the next wave of entrepreneurs will be keeping top of mind as they turn their business dreams into a reality in 2022.

1. Get FundingMore than two-thirds of entrepreneurs (67%) plan to fund their new business with personal savings. Nearly one in two (49%) will apply for a small business loan from a bank or financial institution.

Graphic: New Business Starts: How Do You Plan to Fund Your Business? – Source: Quickbooks

For advice on how to fund a new business, check out these resources on the Small Business Administration and U.S. Chamber of Commerce websites.

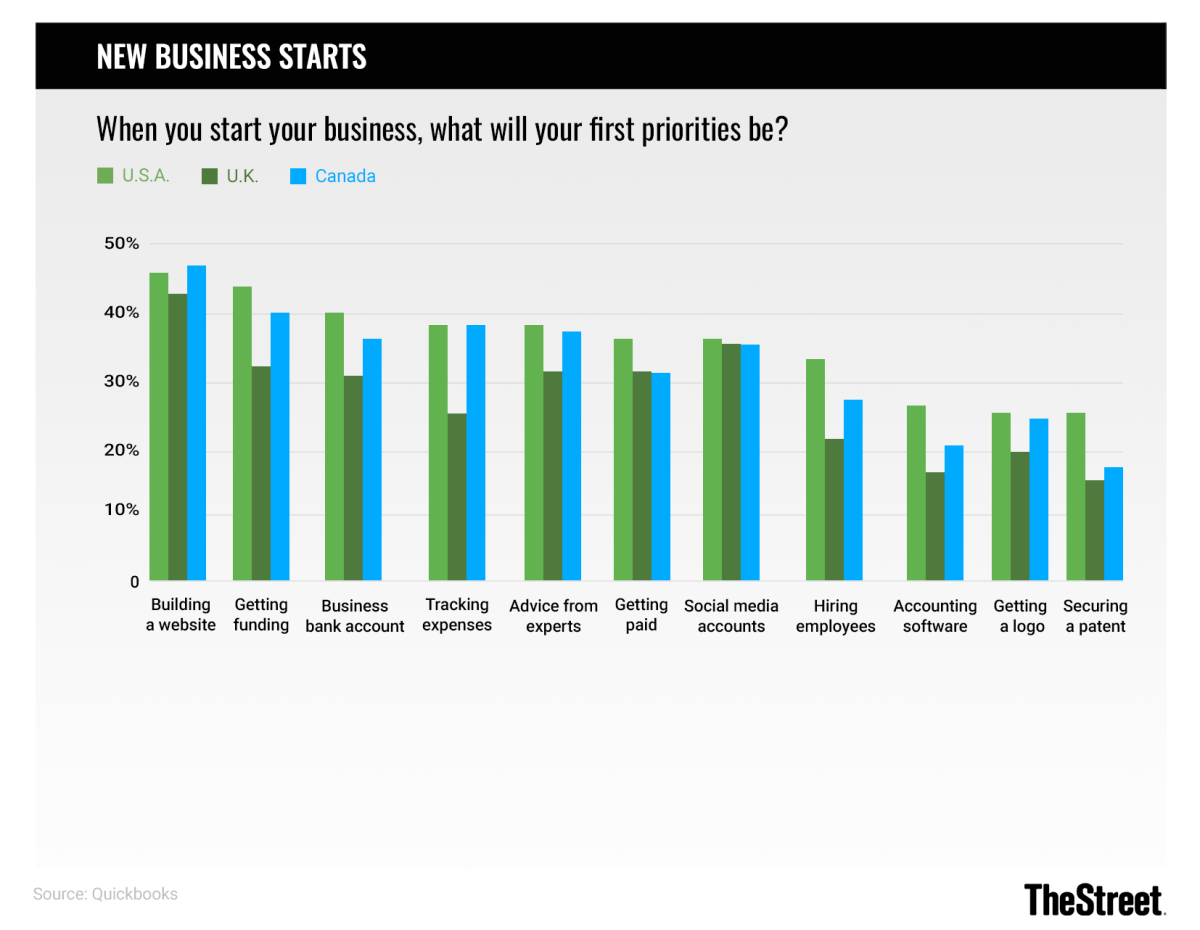

2. Get TrackingOther top priorities for new businesses, according to our survey respondents, are to start tracking expenses and open a business bank account. Almost two in five (38% for expense tracking and 39% for opening a bank account) said these will be among the first things they do when they start their business.

Graphic: New Business Starts: What Will Your First Priorities Be? – Source: Quickbooks

For advice on why it’s important to set up a business bank account to keep your personal expenses separate, check out this helpful guide from QuickBooks.

3. Get OnlineOur survey respondents made it clear they don’t just want to start small businesses, they want to support them as well. Nearly three in five (57%) intend to spend more money at small businesses over the next six months because they want to help local employers. One of the biggest barriers to this is when a small business doesn’t have a user-friendly website.

The key takeaway for anyone considering starting a business right now is to raise awareness in your local community and make building a great website a top priority.

Graphic: New Business Starts: Why Are You Spending More Money at Small Businesses? – Source: Quickbooks

4. Get HiringAs we’ve seen, a third of the prospective business owners (33%) who completed our survey said they plan to hire employees. Despite the fact that many small businesses say hiring is a challenge right now, there is hope. Two in five U.S. employees (40%) are currently looking for new jobs. The main drivers for this are the need to earn more money and get better benefits at work (typically healthcare, paid time off, and a 401k — in that order).

Graphic: New Business Starts: Are You Actively Looking For a New Job? – Source: Quickbooks

One of the ways small businesses can turn this to their advantage is to play up the benefits of working for a small business. Almost four out of five of the survey respondents (78%) said they have worked for a small business at some point in their career. The top three things they report enjoying most about this experience are:

A close relationship with the owner(s)A close relationship with customersA sense of belonging to the company5. Get ThriftySuccessful entrepreneurship often hinges on your ability to solve problems. One of these, according to another recent QuickBooks-commissioned survey of 2,000 small businesses, is the threat of rising prices. As a result, many are having to cut costs and drive up demand. It’s not only small businesses that are concerned about inflation. Almost all U.S. workers (97%) are worried about it as well — and they may reduce spending as a result. The first things they say they will save money on are restaurant meals, days out, and gifts for other people.

Graphic: New Business Starts: Concern About Inflation – Source: Quickbooks

6. Get Out ThereDespite inflation concerns, as we’ve seen (above), people want to keep supporting small businesses by spending their money there. Another factor that may help is that many are ready for life to return to normal after almost two years of pandemic disruption, which may drive up demand. In fact, almost nine out of ten (87%) say they are ready to shop in person again in retail stores. It should be noted, however, that these responses were collected before the emergence of the Omicron variant.

Graphic: New Business Starts: How Do You Feel About the Following? – Source: Quickbooks

In addition, many consumers say they will increase spending at small businesses over the next six months. Just one in ten (11%) say they plan to reduce spending.

Graphic: New Business Starts: Spending Money at Small Businesses – Source: Quickbooks

Small Businesses Play a Critical Role In the EconomyThe 8,000 people who took part in the survey hold small businesses in high regard. Almost nine out of ten (86%) say they are critical to the future of the economy — another reason it’s so encouraging to see the surge in new business growth projected for 2022.

Graphic: New Business Starts: Small Business Critical to the Economy – Source: Quickbooks

Want More Small Business Insights?Find out what 2,000 small businesses owners said about their priorities for 2022 in our latest Small Business Insights report.

MethodologyQuickBooks commissioned Pollfish to survey 14,000 employees in three countries: 8,000 in the U.S., 2,500 in Canada, and 3,500 in the U.K, with a 50:50 split between male and female respondents. Responses were collected in November 2021 via Pollfish’s audience pools and partner network using double opt-ins and random device engagement sampling methodology to ensure accurate targeting.

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations, or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.