Stock Market Today

A twin bill of bearish reports only added to worries about the wisdom of the Fed hiking rates even as recession remains a possibility.Markets closed mixed Tuesday after a choppy session driven by downbeat economic data and mounting anxiety over the Federal Reserve’s determination to stamp out inflation.

On the economic front, a weak reading on new business activity and lower-than-expected new home sales weighed on sentiment even before the opening bell. The S&P Global Flash Composite Purchasing Managers Output Index fell 2.7 points to 45 in August. That’s the weakest reading since May 2020, and indicates contraction in demand for both the manufacturing and services sectors of the economy. Meanwhile, the Commerce Department said sales of new single-family homes fell 12.6% to an annualized 511,000 in July, well short of economists’ forecasts.

The twin bill of bearish reports only added to market participants’ worries about the wisdom of the Fed hiking interest rates even as recession remains a possibility.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

“Resilience in the U.S. economy is seeping away as consumers are sideswiped by spiraling prices and companies see demand evaporate amid a whirlwind of pressures,” writes Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. “While central bank policymakers will find it hard to ignore the darker clouds gathering over the U.S. economy, for now more rate hikes are likely in a bid to ensure a lid is fixed firmly on inflation.”

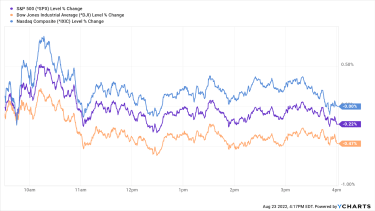

The blue-chip Dow Jones Industrial Average lost 0.5% to finish at 32,909, while the broader S&P 500 slid 0.2% to 4,128. The tech-heavy Nasdaq Composite, however, was unchanged at 12,381.

Other news in the stock market today:

The small-cap Russell 2000 added 0.2% to 1,919.U.S. crude futures rose 3.6% to $93.62 per barrel.Gold futures gained 0.7% to $1,760.60 an ounce.Bitcoin increased 2.1% to $21,540 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) All Eyes on PowellThe market is likely to remain obsessed with the Fed all week, and that means heightened volatility remains the order of the day. The central bank convenes its annual policy symposium in Jackson Hole, Wyo., on Friday. Chairman Jerome Powell is scheduled to speak at 10:00 a.m. Eastern time. And until he does, markets will be on edge about what the Fed chief might signal – even if it turns out to be absolutely nothing new.

“We expect Powell to reiterate the case for slowing the pace of tightening laid out in his July press conference and the July minutes released last week,” writes Jan Hatzius, chief economist, Global Investment Research Division at Goldman Sachs. “He is likely to balance that message by stressing that the FOMC remains committed to bringing inflation down and that upcoming policy decisions will depend on incoming data.”

Regardless of what transpires in Jackson Hole, the tools at the Fed’s disposal are both blunt and slow acting. Although inflation has shown signs of slowing, rising prices remain a serious concern. Investors would do well to check out the best stocks for fighting inflation.

And as for volatility? That sure isn’t going away anytime soon. If anything, it could pick up once A-Team traders return to their desks from their August vacations. Investors with frazzled nerves might want to investigate low-volatility exchange-traded funds. Indeed, the best low-vol ETFs might just help them sleep at night despite roller coaster markets.

Is Your Retirement Portfolio a Tax Bomb?

retirement planning

Is Your Retirement Portfolio a Tax Bomb?A warning to high earners and super savers: That massive 401(k) or traditional IRA that you worked so hard to build may become a big problem in retire…

August 22, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Save More on Green Home Improvements Under the Inflation Reduction Act

Tax Breaks

Save More on Green Home Improvements Under the Inflation Reduction ActTax credits for energy-efficient home improvements are extended and expanded by the Inflation Reduction Act.

August 19, 2022

Playing Favorites: 5 Top Stocks for Inflation

stocks

Playing Favorites: 5 Top Stocks for InflationHigher prices have been a major headache for investors this year, but these top stocks could help ease the impact of inflation.

August 22, 2022

Stock Market Today (8/22/22): Dow Plunges 643 Points as Treasury Yields Climb

Stock Market Today

Stock Market Today (8/22/22): Dow Plunges 643 Points as Treasury Yields ClimbGrowth stocks were some of the biggest losers today as government-bond yields spiked.

August 22, 2022

Peloton Interactive Stock Volatile Ahead of Earnings

stocks

Peloton Interactive Stock Volatile Ahead of EarningsOur preview of the upcoming week’s earnings reports includes Peloton Interactive (PTON), Salesforce (CRM) and Snowflake (SNOW).

August 22, 2022

Stock Market Today (8/19/22): Nasdaq, S&P Snap Weekly Win Streaks as Tech Slumps

Stock Market Today

Stock Market Today (8/19/22): Nasdaq, S&P Snap Weekly Win Streaks as Tech SlumpsThe 10-year Treasury yield hit its highest level since late July after Fed officials chimed in on rate hikes.

August 19, 2022