Stocks managed to eke out gains on light volume Wednesday as traders remained cautious ahead of Federal Reserve Chairman Jerome Powell’s highly anticipated speech later this week.

The Fed chief will speak at the central bank’s annual policy symposium in Jackson Hole, Wyo., on Friday morning. And until he does, stocks will likely continue to struggle for direction.

Indeed, fears of a hawkish Fed have sapped traders’ enthusiasm for risk over the past several sessions. Mixed-to-downbeat economic reports have likewise done the recent rally no favors. Most recently, on Wednesday, we learned that U.S. pending home sales fell in July to their lowest level since the start of the pandemic. Paul Gray, CEO of Ironhold Capital, says the data marks a “recession in the housing market.”

“As interest rates and inflation rise simultaneously, many households choose to save money rather than purchase a house due to high borrowing costs and elevated prices brought by inflation,” Gray notes.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Traders and investors are naturally finding it difficult to embrace equities when the Fed is hiking rates amid reports of recessionary activity.

Wednesday was not without drama in select stocks, however. Peloton Interactive (PTON, +20.4%) jumped after it struck a deal to sell bikes and some accessories on Amazon.com. And Bed Bath & Beyond (BBBY, +18%) got a lift after the home goods retailer said it selected a lender to boost its liquidity. After-market trading could also get interesting, with earnings reports due from high-profile growth stocks Nvidia (NVDA, $172.22), Snowflake (SNOW, $159.80) and Dow component Salesforce (CRM, $180.62).

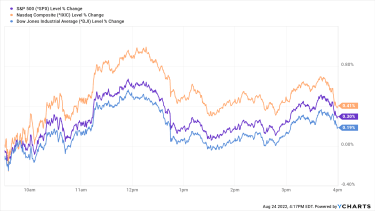

The blue-chip Dow Jones Industrial Average added 0.2% to close at 32,969, while the broader S&P 500 rose 0.3% to 4,140. The tech-heavy Nasdaq Composite ticked up 0.4% to finish at 12,431.

Other news in the stock market today:

The small-cap Russell 2000 added 0.8% to 1,935.U.S. crude futures rose 1.6% to $95.26 per barrel.Gold futures gained 0.2% to $1,765.20 an ounce.Bitcoin increased 0.8% to $21,670 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Don’t Fight the FedIt’s a Wall Street cliche, but it happens to be true: Don’t fight the Fed. With rates headed higher, investors would do well to go with the flow.

For example, rising rates should continue to support a strong dollar. So be sure to check out stocks that win (and stocks that lose) from a rising greenback. Rate-tightening cycles also increase the odds of the economy entering a recession. That’s a recipe for increased volatility – and it affords an opportunity for the best low-volatility stocks to shine.

It’s also the case that rate hikes are a blunt tool to fight inflation. Although the rate of inflation has cooled off recently, higher prices aren’t going away anytime soon. Shares in companies with pricing power can actually deliver sustained outperformance during inflationary periods. With that in mind, have a look at the best stocks to buy to beat inflation.