Stock Market Today

The 10-year Treasury yield hit its highest level since early 2020 on Friday.Investors saw another volatile session Friday as the broader markets swung wildly in the wake of the latest jobs report.

Before markets opened, the Labor Department said the U.S. added 199,000 new jobs in December, not even half of what economists were expecting.

Still, the unemployment rate fell to 3.9% from November’s 4.2%, average hourly wages jumped 4.7% on an annualized basis, and the 6.4 million jobs the country gained in 2021 were the most on record for any year since the data began being tracked.

“The headline number was quite disappointing, but looking under the surface, we see that wages grew faster than expected and the unemployment rate is already beneath 4%,” says Ryan Detrick, chief market strategist for LPL Financial.

Also on Friday, the 10-year Treasury yield continued its climb, hitting the 1.80% level for the first time since January 2020.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

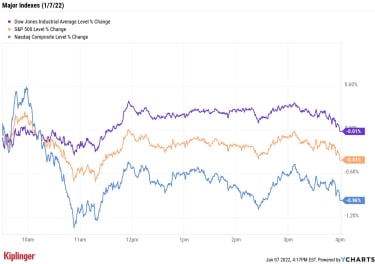

As such, the tech-heavy Nasdaq Composite erased the modest gains it had in early trading to end the day down 1% at 14,935 – closing out its worst week since February (-4.5%).

The S&P 500 Index also gave back an early lead to finish 0.4% lower at 4,677. The Dow Jones Industrial Average, meanwhile, was off 124 points at its session low before swinging to a triple-digit gain and then closing the session down 4.8 points at 36,231.

The S&P 500 and Dow also suffered weekly losses (-1.9%; -0.3%), though not as severe as the Nasdaq.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 slid 1.2% to 2,179.The jobs report was good to gold futures, which improved by 0.5% to $1,797.40 per ounce.U.S. crude oil futures’ recent run stopped on Friday, with next month’s contracts off 0.7% to $78.90 per barrel. But that still represents a nearly 5% rise for oil futures in the first full week of 2022.Bitcoin shed 3% to $41,912.19. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) T-Mobile US (TMUS, -5.0%) struggled more than most to close out the week after its latest subscriber numbers missed the mark. Q4 postpaid net subscriber additions of 844,000 (which brought full-year adds to 2.9 million) were less than analyst expectations for 868,000.The U.S. International Trade Commission ruled in favor of speaker maker Sonos (SONO, +0.7%) Thursday night, saying that Google parent Alphabet (GOOGL, -0.5%) violated Sonos smart speaker patents. The ruling is a potential boon for SONO, which could generate new revenues through licensing agreements. Alphabet says it has already made modifications to affected products, so the ruling won’t mean anything to its existing technology, but it plans to appeal regardless.Gambling stocks headed higher Friday ahead of the beginning of mobile sports gambling in New York state, which is set to commence Saturday. DraftKings (DKNG, +5.6%) and Caesars Entertainment (CZR, +3.5%) were among the companies that have already received a green light to operate in the state. A few other betting names, including Bally’s (BALY, +3.3%) and Wynn Resorts (WYNN, +0.1%), have only been conditionally licensed but are pending final approval.Don’t Read Too Much Into Today’s Jobs Miss”Inflation is the main concern for the Federal Reserve,” says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance. “The report today is unlikely to do anything to change the Fed’s mind in terms of an accelerated rate hike and balance sheet management approach.”

Zaccarelli says that in the existing environment – where markets are reacting to high inflation and the belief the Fed is going to hike rates as soon as March – it’s more prudent for investors to balance their portfolio with more cyclical stocks like financials and industrials versus defensive ones (consumer staples and utilities, for instance).

He also believes value stocks are poised to outperform their growth counterparts in the short term.

As part of our series on the best investment opportunities in 2022, we recently looked at 12 of the top-rated value plays in the new year. These include picks from several industries, including fintech and auto manufacturing. Check them out.

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Meet the Architect of the 401(k) Plan

Financial Planning

Meet the Architect of the 401(k) PlanTed Benna tells Kiplinger how savers can make the most of their 401(k) plans – and how these plans could be better.

December 22, 2021

As You Approach Retirement, C.A.N. You Handle a Market Downturn?

retirement planning

As You Approach Retirement, C.A.N. You Handle a Market Downturn?You know what they say about what goes up. Well, if you’re nervous about what comes next with today’s precipitously climbing stock market, this acrony…

December 20, 2021

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

January 7, 2022

Stock Market Today (1/6/22): Health Insurers Lead Another Slide in Stocks

Stock Market Today

Stock Market Today (1/6/22): Health Insurers Lead Another Slide in StocksStocks remained in the red for another session Thursday but at least largely slowed their downward momentum.

January 6, 2022

Stock Market Today (1/5/22): Fed Shows Its Teeth, Tech Shows Its Tail

Stock Market Today

Stock Market Today (1/5/22): Fed Shows Its Teeth, Tech Shows Its TailThe Fed’s most recent meeting minutes hinted at yet another stimulus wind-down, which yanked hard on technology and real estate shares.

January 5, 2022

Stock Market Today (1/4/22): Dow Hits New Record, Nasdaq Takes a Spill

Stock Market Today

Stock Market Today (1/4/22): Dow Hits New Record, Nasdaq Takes a SpillThe 10-year Treasury yield is closing in on levels not seen since November.

January 4, 2022