Stock Market Today

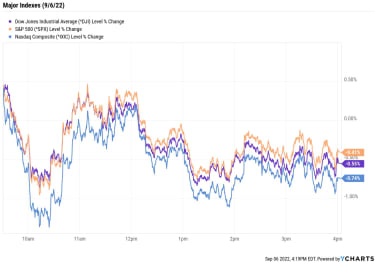

Stocks turned lower after ISM data showed continued strength in the U.S. economy, with the Nasdaq notching its seventh straight loss.It was a choppy start to the short trading week, with stocks spending time in both positive and negative territory Tuesday. Bears gained the upper hand in the afternoon, though, with the three major indexes ending another day in the red.

Although this week’s economic calendar is fairly thin, data from the Institute for Supply Management (ISM) this morning showed that activity in the services sector ticked up to 56.9% in August – the highest level since April – from July’s 56.7%.

“This is the most recent piece of data to suggest the economy remains resilient and as such the market takeaway is that this gives the Fed more room to continue raising rates,” says Michael Reinking, senior market strategist for the New York Stock Exchange. “Futures markets are now pricing in a 75% chance of a 75 basis-point hike later this month from a coin flip late last week.” A basis point is one-one hundredth of a percentage point.

In reaction to today’s ISM data, the 10-year Treasury yield rose to its loftiest level since mid-June. This, in turn, weighed on shares in the communication services (-1.3%) and technology (-0.6%) sectors, with names such as streaming giant Netflix (NFLX, -3.4%) and chipmaker Intel (INTC, -2.8%) seeing notable declines.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

As for the major indexes, the tech-heavy Nasdaq Composite fell 0.7% to 11,544, its seventh straight loss. The S&P 500 Index shed 0.4% to 3,908, and the Dow Jones Industrial Average gave back 0.6% to 31,145.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 shed 1% to land at 1,792.U.S. crude futures posted a modest gain to end at $86.88 per barrel.Gold futures fell 0.6% to finish at $1,712.90 an ounce.Bitcoin spiraled 5.4% to $18,817.97. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Bed Bath & Beyond (BBBY) stock slumped 18.4% after Friday’s death of the home goods retailer’s chief financial officer, Gustavo Arnal, was ruled a suicide by New York City’s medical examiner. “The entire Bed Bath & Beyond Inc. organization is profoundly saddened by this shocking loss,” the company said in a statement. Laura Crossen, BBBY’s chief accounting officer, will take over as finance chief on an interim basis. Bed Bath & Beyond gave a business update last week in which it said it would close underperforming stores and issue a common stock offering. ADT (ADT) rose 16.4% after the home security specialist scored $1.65 billion in new investments from State Farm and Alphabet’s (GOOGL, -1.0%) Google. The funding will be used to “support product innovation,” and “expand access for more customers to smart home innovation and technologies,” ADT said in a statement. The cheap stock under $10 is now up more than 35% from its June lows.Billionaire Investors’ Biggest Q2 Stock BuysIt’s becoming increasingly clear that the summer rally in stocks was not the start of a new bull market. “The 17% rally off the June lows appears to have been just a typical bear market rally,” says Savita Subramanian, head of equity and quantitative strategy at BofA Securities. “Our bull market signposts continue to show no real signs of a bottom, with just 30% being triggered vs. 80%+ triggered in prior bottoms. September has seasonally been a weak month and we expect more pain in the market.”

The market’s head fake creates a situation in which at least some investors might want to re-evaluate their portfolios. And any assessment of your own holdings stands to benefit from a look at what other successful investors are doing.

Warren Buffett, for example, did plenty of bargain-hunting in the second quarter as the S&P 500 fell into bear-market territory. But Buffett was hardly alone. We recently took a look at the top stock picks of billionaire investors during Q2. The rich get richer for a reason, and studying where they’re putting their money – especially during times of market turbulence – can be an instructive exercise for investors.

Karee Venema was long GOOGL as of this writing.

Who Pays When a Test Drive Ends in Engine Failure?

cars

Who Pays When a Test Drive Ends in Engine Failure?A test drive gone wrong ended in a catastrophic engine failure, and the used car sales manager insisted the customer should be on the hook for the maj…

September 5, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Estate Planning: 5 Tips to Pick Trustees, Executors and POAs

estate planning

Estate Planning: 5 Tips to Pick Trustees, Executors and POAsThe decisions on who would be best to carry out your wishes aren’t always clear-cut, and it’s easy to make a mistake. So before you name the agents fo…

September 4, 2022

Stock Market Today (9/2/22): Stocks Swing Lower as Early Jobs-Fueled Rally Fizzles

Stock Market Today

Stock Market Today (9/2/22): Stocks Swing Lower as Early Jobs-Fueled Rally FizzlesThe major indexes all rose more than 1% after data showed job growth slowed in August, but erased those gains by the close.

September 2, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week.

September 2, 2022

Is the Stock Market Closed on Labor Day?

Markets

Is the Stock Market Closed on Labor Day?Stock markets and bond markets alike will enjoy their annual three-day weekend as America observes Labor Day.

September 2, 2022

Stock Market Today (9/1/22): Nasdaq Falls for a Fifth Straight Day

Stock Market Today

Stock Market Today (9/1/22): Nasdaq Falls for a Fifth Straight DayStronger-than-expected economic data weighed on markets for most of the session, but the S&P 500 and Dow ended the day in the green.

September 1, 2022