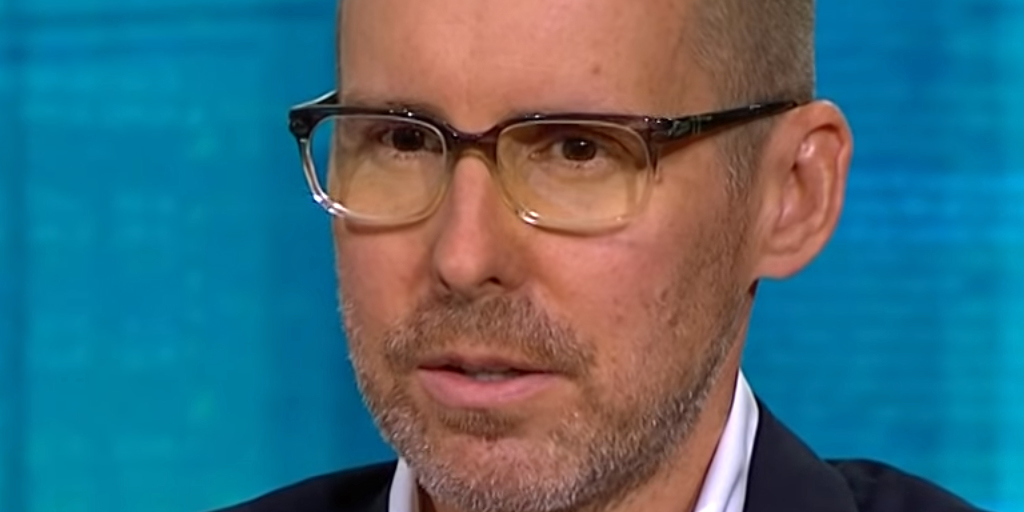

Mark Spitznagel warned the Fed’s rate hikes risk causing huge damage to markets and the US economy. The Universa Investments boss cautioned higher interest rates could turn inflation into deflation. Spitznagel questioned whether the Fed will be able to stop a widescale crash if it causes one. Loading Something is loading.

The Federal Reserve’s efforts to crush inflation risk sparking a collapse in asset prices, and plunging the US economy into a severe recession with painful deflation, Mark Spitznagel has warned.

“If the Fed’s going to try to normalize rates, they’re going to bring inflation down very, very quickly, but it’s also going to cause devastation,” he told Bloomberg on Wednesday.

Spitznagel is the cofounder of Universa Investments, a so-called “Black Swan” fund that specializes in hedging portfolios against extreme and unpredictable events.

He accused the Fed of inflating asset prices for 25 years with near-zero interest rates and a loose money supply, and argued a return to its historical policies is now impossible.

“I don’t think that the Fed can ever normalize rates again,” he said.

The author of “Safe Haven: Investing for Financial Storms” underlined the peculiarity of the Fed intentionally spooking investors and cooling the economy, when normally it’s scrambling to shore up asset prices and buttress growth. He cautioned the central bank could lose control of the current situation.

“The controlled burn can turn into a wildfire cascade,” he said. “That is the real risk here, and that’s what investors need to think about — not the type of losses that occurred this year, but rather the type of losses that this can turn into, where the Fed actually can’t do anything to stop it.”

Spitznagel asserted that Fed officials have to select between two bad options, elevated inflation or a recession. He predicted they will choose to protect financial markets, at the cost of allowing inflation to remain above their 2% target.

Moreover, the investor raised the prospect of the Fed tightening its monetary policy too much, causing rising prices to reverse direction.

“We should really worry more about deflation,” he said. “That’s a huge, huge risk people are not thinking about. If the Fed pops this bubble, we will be in a deflationary spiral.”

Nassim Nicholas Taleb, the author of “The Black Swan: The Impact of the Highly Improbable” and a Universa adviser, echoed Spitznagel’s outlook on Thursday.

“We’ve had 15 years of Disneyland that basically has destroyed the economic structure,” he told CNBC, referring to rock-bottom interest rates. Historically cheap money has inflated asset bubbles and created “tumors” like bitcoin, he added.

Read more: HSBC’s global investment chief warns of ‘false rallies’ for stocks, reveals how investors can spot the true start of a new bull run, and offers his take on the housing market

Deal icon An icon in the shape of a lightning bolt. Keep reading

More: MI Exclusive Markets Stocks Mark Spitznagel Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.