Stocks spent most of Wednesday in positive territory, but went on a roller-coaster ride after the Federal Reserve, as expected, issued its third straight 75 basis point rate hike.

The Fed’s rate hike sparked plenty of chatter among Wall Street’s experts, with the main focus on what the central bank plans to do next. Today’s move brought the Fed’s benchmark federal funds rate to between 3.0% and 3.25%, with projections from the 19 voting members of the Federal Open Market Committee (FOMC) targeting a range of 4.25% and 4.5% by year’s end – a half-percentage point higher than where it was in June. Doing the math, that means rates need to rise another 1.25% over the central bank’s remaining two meetings (in November and December).

“Today we heard and saw more of the same, and the market shouldn’t be too surprised given the Fed and its officials telegraphed that more big hikes were in the cards for the foreseeable future,” says Mike Loewengart, head of model portfolio construction at Morgan Stanley. “The market seems to have hoped beyond hope that they would hear some reference to an end to rate hikes on the horizon, but that’s certainly not what we got today.”

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

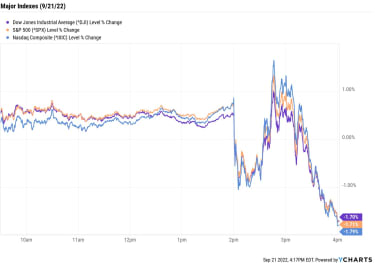

And that, in turn, sent the major market indexes moving quickly from green to red in the immediate aftermath of the Fed’s announcement. However, the wild ride wasn’t over, with stocks temporarily bouncing back before ultimately ending lower. At the close, the Dow Jones Industrial Average was down 1.7% at 30,183, the S&P 500 Index was off 1.7% at 3,789, and the Nasdaq Composite had shed 1.8% to 11,220.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 gave back 1.4% to 1,762.U.S. crude futures fell 1.2% to finish at $82.94 per barrel.Gold futures edged up 0.3% to $1,675.70 an ounce.Bitcoin barely budged, last seen at $19,002.41. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Stitch Fix (SFIX) was off nearly 7% at its session low after the online clothing retailer reported earnings, but eventually swung to a 2.8% gain. In its fiscal fourth quarter, SFIX recorded a 16% year-over-year decline in revenue, a 9% drop in active clients and an operating loss of $99 million, much wider than the $20.7 million loss incurred in the year-ago period. “While the company remains focused on the path back to profitability (reducing headcount, rationalizing footprint, improving efficiencies, etc), we remain concerned about the high inventory levels which could continue to impact SFIX’s flexibility, likely through the current fiscal year,” says UBS Global Research analyst Kunal Madhukar (Neutral). “Thus, while expectations are much lower now and the shares are trading at all-time lows, we think the continued uncertainty could keep investors on the sidelines until visibility improves.”General Mills (GIS) was another post-earnings winner, jumping 5.7% after its results. In its first quarter, the maker of Bisquick reported earnings of $1.11 per share on $4.7 billion in revenue, more than analysts were expecting. The company also raised its full-year forecast amid expectations strong sales growth will offset macro-economic headwinds. “While the beat was largely anticipated by investors we speak with, few expected the company to raise guidance this early in the year,” says Goldman Sachs analyst Jason English. Still, the analyst maintained a Sell rating on GIS.Use Dividend Stocks as DefenseWith the Fed unlikely to cut rates soon, investors should continue to be defensive with their portfolios. “Recent data have confirmed the necessity of the Fed’s tough stance,” says Gargi Chaudhuri, head of iShares investment strategy. The Fed has “forcefully asserted its intention” on moving policy stance to a restrictive level to tame inflation, and the idea that the central bank “will raise rates and immediately cut again in mid-2023 should now be put back into storage alongside the beach chairs,” she adds. As such, Chaudhuri believes investors should “position defensively within equities given higher chances of an economic slowdown.”

In addition to sectors like healthcare or utilities that are traditionally considered “safer” than others, we often tout the benefits of including dividend-paying stocks in your portfolio to protect against market uncertainty. However, not all dividend stocks are created equal. Income investors wanting to find high-quality names should start with the Dividend Aristocrats, companies that have grown their shareholder payouts for at least 25 straight years. There are also these high-paying dividend stocks boasting yields of 5% or more, well above the S&P 500’s current 1.7% yield. The names featured here have solid fundamentals, generous yields and backing from the analyst community. Check them out.