If the goal is to find stocks to buy when prices are lower rather than higher, it stands to reason that the time to go looking for the best stocks to buy is right now.

After all, the market is off by more than a fifth so far this year, which means it’s probably safe to assume that most investors are fearful. And if most investors are fearful, well… doesn’t Warren Buffett say that this is the time to get at least a little bit greedy?

Finding quality stocks to buy when seemingly everything is selling off is easier said than done, of course. And if you’re looking for help from Wall Street analysts, good luck. There’s a saying about analysts: “In a bull market you don’t need them; in a bear market you don’t want them.”

That’s far too harsh as an assessment – but understandable as a sentiment. It’s well known that Wall Street analysts are reluctant to slap Sell calls on the stocks they cover. There are a number of reasons for this reticence, but that’s a discussion for another day.

Perhaps less well known is that analysts are also pretty stingy when it comes to bestowing the highest conviction Buy recommendations on the names they follow.

As of Sept. 22, only five stocks in the S&P 500 carried consensus recommendations of Sell or Strong Sell, according to data from S&P Global Market Intelligence. At the other end of the ratings spectrum, 392 of the index’s 500 stocks had consensus recommendations of Buy or Strong Buy.

That’s far too many Buy calls, to be sure. We know for a fact that the vast majority of stocks turn out to be duds. Research shows that the entirety of the $75.7 trillion in net global stock market wealth created between 1990 and 2020 was generated solely by the top-performing 2.4% of stocks.

To be fair, when analysts issue Buy recommendations, all they’re saying is that they expect the stock in question to outperform the broader market by some margin, or deliver, say, a 15% total return, over the next 12 months or so. Every research shop has different definitions and metrics, but analysts are not making 30-year calls.

And yet, consensus Buy calls are so abundant that it’s only natural to be at least somewhat skeptical of their value.

Happily, there is a subset of consensus Buy calls that are not so freely dispensed. Within the Street’s decidedly overoptimistic universe of 392 consensus Buy-rated stocks, only 24 – or 4.8% of all the names in the S&P 500 – get a consensus recommendation of Strong Buy.

True, Strong Buy calls are nowhere near as rare as Sell or Strong Sell calls. But they are special nonetheless. Perhaps – just perhaps – analysts are on to something when they collectively possess such high conviction on a name?

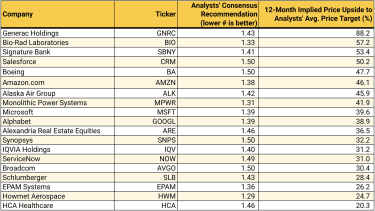

With that as our admittedly hopeful hypothesis, we used S&P Global Market Intelligence data to screen the S&P 500 for stocks with Strong Buy consensus recommendations and implied upside of at least 20% in the next 12 months or so, based on share prices and analysts’ average price targets as of Sept. 21.

Have a look at the table below and you’ll see that only 19 stocks made the cut.

Prominent names include beaten-down mega-cap stocks such as Microsoft (MSFT), Amazon.com (AMZN) and Google parent Alphabet (GOOGL). Real estate investment trusts (REITs) HCA Healthcare (HCA) and Alexandria Real Estate Equities (ARE) also make appearances. You will likewise see representatives from the financial, energy and industrial sectors, to name just a few.

But all these stocks do have at least three things in common: They are in the S&P 500, they sport Strong Buy consensus recommendations from Wall Street industry analysts, and their average price targets give them implied upside of anywhere from 20% to nearly 90% in the not-too-distant future.

Kiplinger, S&P Global Market Intelligence