Stock Market Today

Treasury yields on the two-year and 10-year notes spiked to their highest levels in over a decade as central banks around the world rush to tame inflation.Wednesday’s selling carried into Thursday as investors continued to take a risk-off approach to markets following the Federal Reserve’s latest policy announcement.

The central bank issued its third jumbo-sized rate increase yesterday and set expectations that it will continue to hike rates over its next few meetings. However, the Fed is not alone in its aggressive stance. Several global central banks have increased their benchmark rates this week in an ongoing effort to tame inflation, including the Bank of England and Switzerland’s National Bank, which earlier today issued 50 basis point and 75 basis point rate hikes, respectively. (A basis point is one one-hundredth of a percentage point.)

“Global equities are struggling as the world anticipates surging rates will trigger a much sooner and possibly severe global recession,” says Edward Moya, senior market strategist at currency data provider OANDA. “Most of these rate hikes around the world are not done yet which means the race to restrictive territory won’t be over until closer to the end of the year.”

The reaction here at home was a selloff in bond prices, which sent yields on government notes spiking. The 10-year Treasury yield surged 19.2 basis points to 3.704% – its highest level since early 2011 – while the 2-year Treasury yield spiked 12.1 basis points to 4.116%, its loftiest perch since late 2007.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

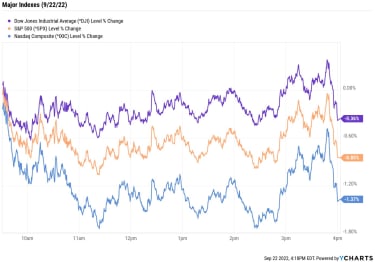

As for stocks, the tech-heavy Nasdaq Composite slumped 1.4% to 11,066, while the S&P 500 Index (-0.8% to 3,757) and the Dow Jones Industrial Average (-0.4% at 30,076) suffered more modest losses.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 spiraled 2.2% to 1,722.U.S. crude futures rose 0.7% to finish at $83.49 per barrel.Gold futures added 0.3% to end at $1,681.10 an ounce.Bitcoin added 1.7% to $19,322.51. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Eli Lilly (LLY) jumped 4.9% after UBS Global Research analyst Colin Bristow upgraded the healthcare stock to Buy from Neutral. The analyst says following positive data for the company’s SURMOUNT-1 obesity drug and Food and Drug Administration (FDA) approval for its diabetes treatment, T2DM, “we now view LLY as being the most attractive name in our large-cap coverage, with the greatest potential upside to numbers.”KB Home (KBH) fell 5.1% after just missing analysts’ consensus top-line estimate for its fiscal third quarter. The homebuilder reported earnings of $2.86 per share, more than expected, but revenue of $1.84 billion fell short. Sector peer Lennar (LEN) also unveiled its quarterly results, reporting higher-than-expected fiscal Q3 earnings of $5.03 per share on inline revenue of $8.9 billion. LEN stock rose 2.0% on the day.Choppy Trading Continues, Consider Defensive ETFsThis is a challenging time for investors, and it’s not likely to get any easier in the near term. “The markets are likely to remain very choppy and range-bound for the foreseeable future in our view because they now have to determine the timing and potential depth of recession ahead plus ongoing inflationary pressures overhead,” says Dan Wantrobski, technical strategist and associate director of research at Janney. He adds that investor sentiment is likely to erode even further as the midterm elections near, and he anticipates a choppy path for stocks in the weeks ahead.

As we’ve mentioned several times over the past few months, the best course of action for investors, then, is to take a more defensive approach with their portfolios. Low-volatility strategies, quality dividend stocks and yield-friendly real estate investment trusts (REITs) are just a few of the ways investors can cope with non-compliant equity markets. Another tack is to take a broader approach with defensive exchange-traded funds (ETFs). The 10 funds featured here cover a number of strategies, but all are designed to protect portfolios against a turbulent investing environment.

What Are the Income Tax Brackets for 2022 vs. 2021?

tax brackets

What Are the Income Tax Brackets for 2022 vs. 2021?Depending on your taxable income, you can end up in one of seven different federal income tax brackets – each with its own marginal tax rate.

September 20, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

How Big Will the Fed Rate Hike Be? Wall Street’s Top Minds Weigh In

interest rates

How Big Will the Fed Rate Hike Be? Wall Street’s Top Minds Weigh InThe Fed rate hike announcement is due out Wednesday afternoon, and markets are anticipating another monster increase.

September 20, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week.

September 23, 2022

19 Best Stocks to Buy Now for High Upside Potential

stocks

19 Best Stocks to Buy Now for High Upside PotentialFinding the best stocks to buy when the market is selling off can be daunting, but the pros believe these 19 top-rated names are poised for big return…

September 23, 2022

Stock Market Today (9/21/22): Stocks Go on Wild Ride as Fed Targets More Rate Hikes

Stock Market Today

Stock Market Today (9/21/22): Stocks Go on Wild Ride as Fed Targets More Rate HikesStock volatility accelerated after the Federal Reserve issued its third straight 75 basis point rate hike and said additional increases are on tap.

September 21, 2022

Fed Rate Hike Meets Expectations, But What Next? Here’s What the Experts Say

interest rates

Fed Rate Hike Meets Expectations, But What Next? Here’s What the Experts SayThe Federal Reserve raised its key interest rate as expected, but all eyes are now on how many more rate hikes are left.

September 21, 2022