It’s a sea of red for equity trading desks around the globe

Author of the article:

Bloomberg News

Rita Nazareth

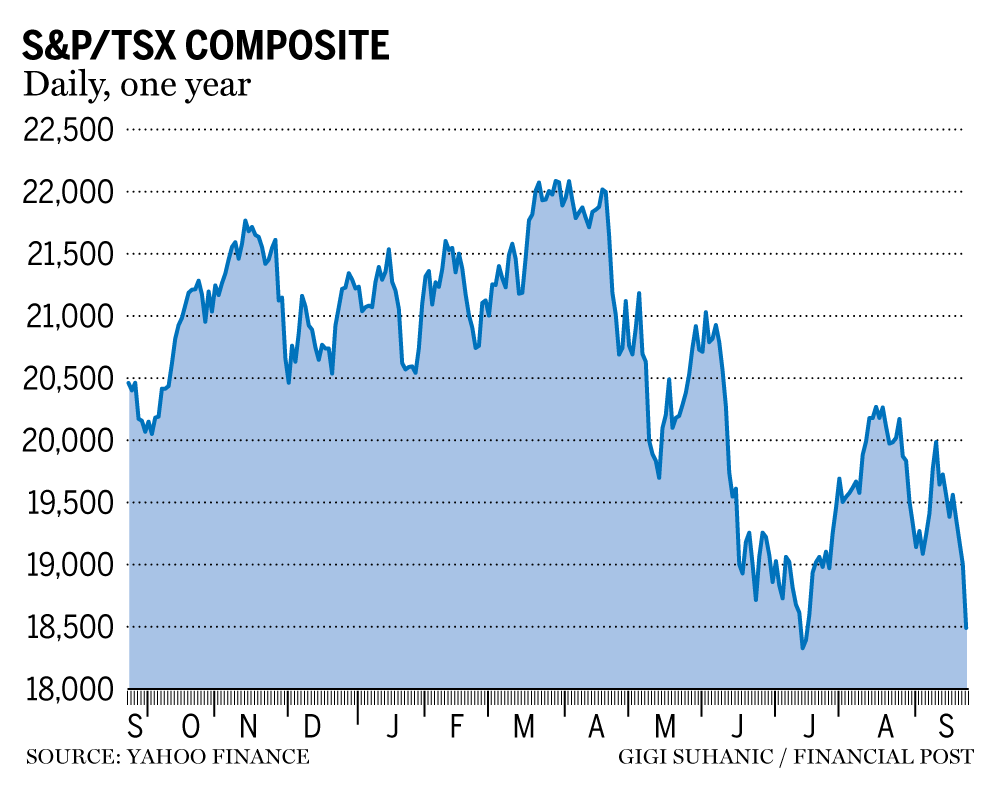

Canada’s main stock index plunged Friday, with losses led by energy stocks. Photo by REUTERS/Mark Blinch/File Photo A selloff in the riskier corners of the market deepened as the U.K.’s plan to lift the economy fuelled concerns about heightened inflation that could lead to tighter monetary policy, boosting the odds of a recession.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

It was a sea of red for equity trading desks around the globe, with the rout in the S&P 500 pushing the gauge within a striking distance of its June bottom — which stands less than 1 per cent below current levels. The lack of full-blown capitulation may be a sign that the carnage isn’t over yet. Big firms like Goldman Sachs Group Inc. are slashing their targets for stocks, warning that a dramatic upward shift in the outlook for rates will weigh on valuations.

FP Investor By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Canada’s main stock index plunged Friday, with losses led by energy stocks. Shortly after 10 a.m. ET, the Toronto Stock Exchange’s S&P/TSX composite index was down 512 points at 18,490.

The S&P 500 was down 60.56 points, the Dow 382,47 and Nasdaq down 207 points.

As the risk-off sentiment took hold, Treasuries reversed a slide that earlier sent 10-year yields above 3.8 per cent. The dollar hit a fresh record, sweeping aside other currencies. The euro slid to its weakest since 2002, while the pound touched its lowest in 37 years. Traders are focusing on the growing gap between interest rates in the U.S. and elsewhere.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

“It appears that traders and investors are going to throw in the towel on this week in what feels like ‘the sky is falling’ type of event,” said Kenny Polcari, chief strategist at SlateStone Wealth. “Once everyone stops saying that they ‘think a recession is coming’ and accepts the fact that it is here already – then the psyche will change.”

The greenback’s strength has been unrelenting and will exert a “meaningful drag” on corporate earnings, serving as a key headwind for stocks, said David Rosenberg, founder of his namesake research firm.

Investors are flocking to cash and shunning almost every other asset class as they turn the most pessimistic since the global financial crisis, according to Bank of America Corp. Investor sentiment is “unquestionably” the worst it’s been since the crisis of 2008, with losses in government bonds being the highest since 1920, strategists led by Michael Hartnett wrote in a note.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

Gloomy sentiment is often considered a contrarian indicator for the U.S. stock market, under the belief that extreme pessimism may signal brighter times ahead. But history suggests that equity losses may accelerate even further from here before the current bear market ends, according to Ned Davis Research.

Recommended from Editorial Structured notes can offer investors some protection when markets are volatile Global markets hunkering down for economic ‘hurricane’ Do this, don’t do that: Investors should read these 11 signs The firm’s Crowd Sentiment Poll has been in an extreme pessimism zone since April 11, or 112 consecutive trading days that mark the third-longest streak of gloom since the data began in 1995. Over the subsequent few months following those periods of extreme pessimistic sentiment, equity gains were fleeting, with negative median returns three and six months after the 100-day mark.

This advertisement has not loaded yet, but your article continues below.

Article content In another threat to stocks, different iterations of the so-called Fed model, which compares bond yields to stock earnings’ yields, show equities are least appealing relative to corporate bonds and Treasuries since 2009 and early 2010, respectively. This signal is getting attention among investors, who can now know look to other markets for similar or better returns.

The S&P 500’s breakdown since the August peaks solidifies the downtrend channel in place since the bull market apex in early January, according to Gina Martin Adams at Bloomberg Intelligence. “The breakdown beneath 3,900 support leaves little for the index to grasp at on its way to testing the June lows,” she wrote in a note.

Additional reporting by Thomson Reuters

Bloomberg.com