Greg Abel invests more skin in the game to the relief of shareholders

Author of the article:

Bloomberg News

Dan Reichl and Katherine Chiglinsky

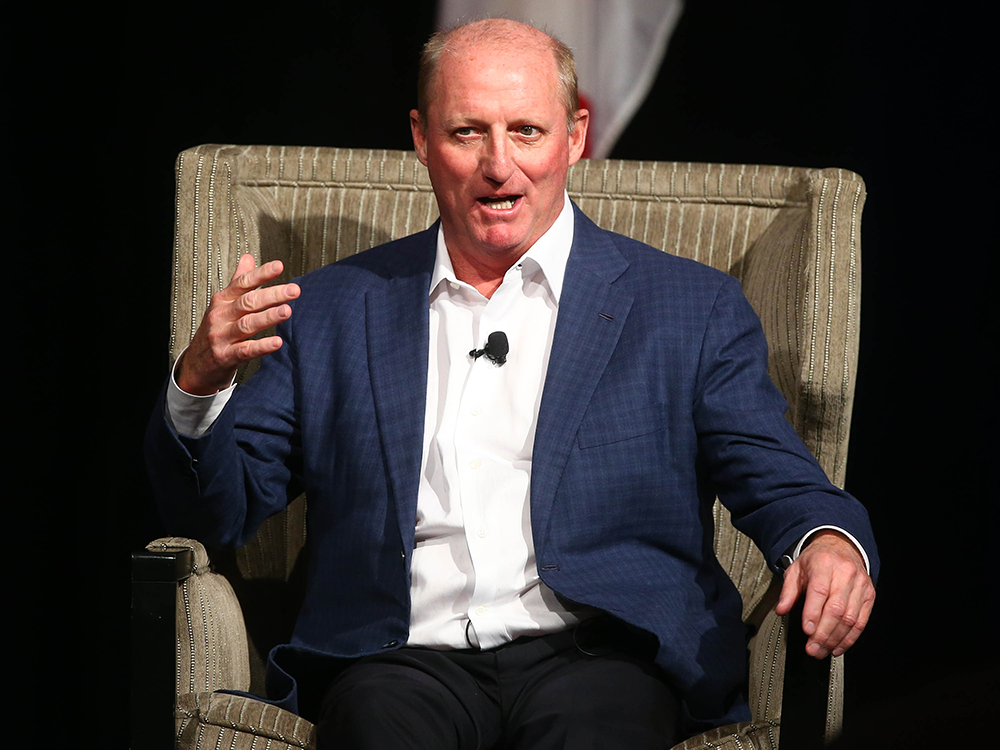

Canadian Greg Abel is the current heir-apparent to investing guru and head of Berkshire Hathaway Warren Buffett. Photo by Jim Wells /Postmedia Greg Abel, who is in line to eventually succeed Warren Buffett as chief executive officer of Berkshire Hathaway Inc., has been building his stake in the conglomerate he expects to oversee one day.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

Abel acquired about US$68 million of stock late last month, according to filings Monday. The Class A shares closed at US$413,300 Monday in New York.

FP Investor By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

The purchases may begin to address a concern raised by shareholders: Abel, who oversees Berkshire’s non-insurance businesses, hasn’t been a major holder of the stock, unlike the company’s long-time leader. The heightened ownership stake increases his skin in the game more than a year after being officially named as the most likely successor to replace the 92-year-old Buffett when he steps down.

“Abel’s buy helps align him more closely with Berkshire shareholders as he prepares to, at some point, take the reins of the company,” said Ben Silverman, director of research at VerityData. “It’s an important move by Abel because a nearly US$70-million stock purchase signals his seriousness, and the timing of the buy — on weakness, as the quarter is closing — sends a positive valuation message.”

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

The share purchases significantly ramp up Abel’s stake in Berkshire. He owned five Class A shares and more than 2,000 Class B shares as of March 2, according to a proxy filing earlier this year.

Recommended from Editorial Berkshire CEO-designate Abel sells stake in energy company he led for $870 million Buffett’s Berkshire Hathaway buys 5.99 mln more Occidental shares Buffett’s Berkshire trims stake in China’s BYD, a holding since 2008 Abel, who previously ran the company’s sprawling energy empire, received an influx of funds when the energy business bought back his small ownership stake for US$870 million in June. The move stoked speculation he might seek to redeploy some of those funds back into the company he’s slated to run.

Abel is among the most well-compensated executives at Berkshire, earning more than US$19 million in total compensation in 2021 from the conglomerate, according to its most recent proxy filing. That’s equivalent to earnings by his peer Ajit Jain, who oversees the insurance operation.

Bloomberg.com