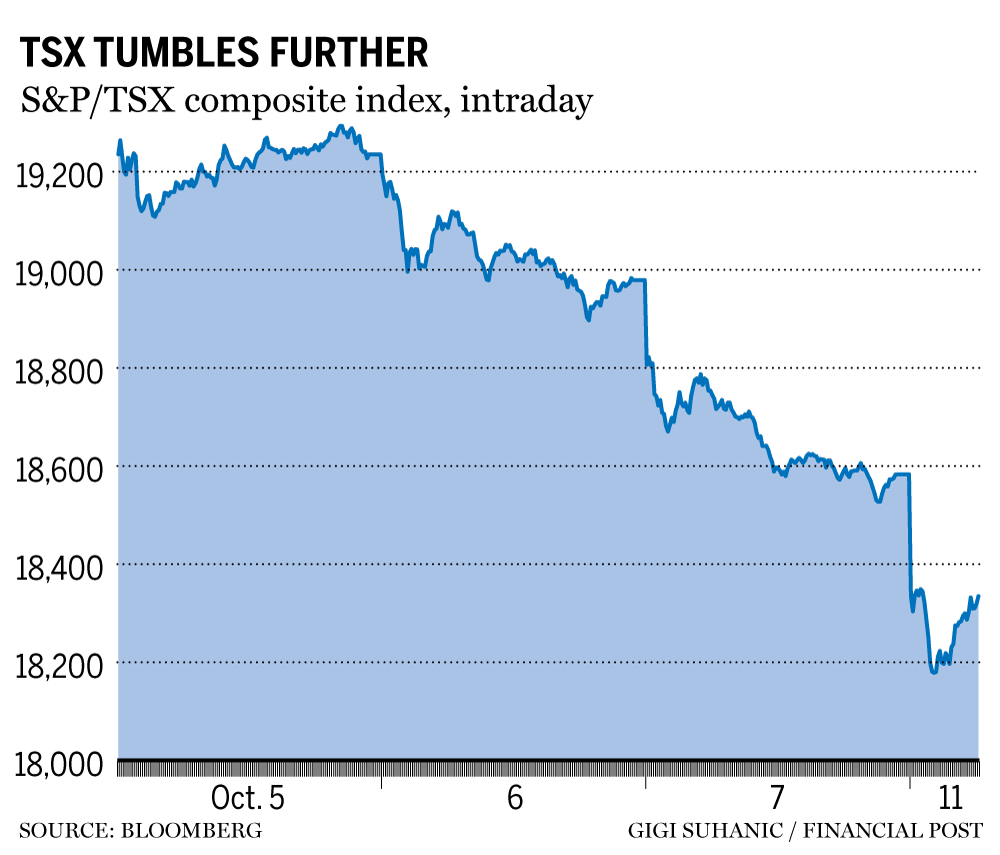

S&P/TSX composite index ended down 366.45 points, or nearly 2%, at 18,216.68

Author of the article:

The S&P/TSX composite index fell Tuesday, as worries about a global recession unnerved investors returning from a long weekend, with commodity-linked energy and material stocks among big losers. Photo by REUTERS/Mark Blinch/File Photo Canada’s main stock index fell on Tuesday to a 19-month low, tracking a fall in world markets, as worries about a global recession unnerved investors returning from a long weekend, with resource, technology and financial stocks among the big losers.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

The Toronto Stock Exchange’s S&P/TSX composite index ended down 366.45 points, or nearly two per cent, at 18,216.68, its fourth straight day of declines and the lowest closing level since March 2021.

FP Investor By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

The index was closed on Monday for the Thanksgiving Day holiday.

The S&P 500 and Nasdaq also ended lower on Tuesday, with indications from the Bank of England that it would support the country’s bond market for just three more days adding to market jitters.

Investors were already on edge ahead of a key U.S. inflation report this week that could cement additional interest rate hikes by the Federal Reserve.

“I think we are seeing the rate hikes really in full effect now,” said Allan Small, senior investment adviser at the Allan Small Financial Group with iA Private Wealth.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

“The fear is that because the rate hikes have a lagging effect on the economy, we will not feel the full effect of these rate hikes until perhaps three to six months down the road.”

The International Monetary Fund on Tuesday cut its global growth forecast for 2023, warning that conditions could worsen significantly next year.

China, the world’s largest consumer, stepped up COVID-19 restrictions after a flare-up in infections, pushing oil, gold and other metals prices lower on worries about the hit to demand.

The energy sector dropped nearly four per cent as oil prices settled down US$1.78 at US$89.35 a barrel, while the materials sector, which includes precious and base metals miners and fertilizer companies, ended 1.4 per cent lower.

Heavily-weighted financials lost 2.3 per cent and technology was down nearly three per cent.

© Thomson Reuters 2022