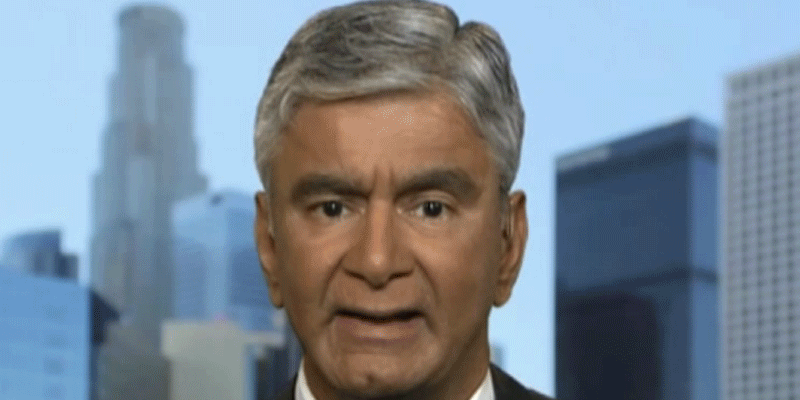

Inflation and bond yields are close to peaking, according to top economist Komal Sri-Kumar. He also told CNBC that he expects a severe recession in the wake of monetary tightening and inflation. “I think we are reaching the point where demand destruction is going to dominate over supply uncertainties, and that’s what is happening.” Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Both bond yields and inflation are close to peaking, and demand destruction is becoming the main focus, according to economist Komal Sri-Kumar.

As the September inflation report, which showed an annual rate of 8.1%, jolted markets on Thursday, he also told CNBC that he sees the 10-year Treasury yield maxing out at around 4%. It’s currently hovering around 3.95% after topping 4% earlier in the session.

“I think we are reaching the point where demand destruction is going to dominate over supply uncertainties, and that’s what is happening,” Sri-Kumar said, adding that he expects both a severe recession and stagflation as “both part of the script.”

“The only thing unknown is, what is the top for inflation and what is the top for the bond yield? And I think we may be reaching both of them at this point,” he continued.

Sri-Kumar, who is president of macroeconomic consulting firm Sri-Kumar Global Strategies, also pointed to the Bank of England and highlighted its plan to stop buying gilts after Friday as a useful roadmap for Fed Chair Jerome Powell, although he expressed doubt that Powell would follow London’s lead.

“The question now in terms of controlling inflation [and] keeping bond yields under manageable levels is if Jerome Powell can do that, and I doubt it very much,” Sri-Kumar said. “In London we have independence of monetary and fiscal policy. In Washington, DC, we do not.”