Half point hike in December now seen as more likely than three-quarter

Author of the article:

Bloomberg News

Stephen Kirkland

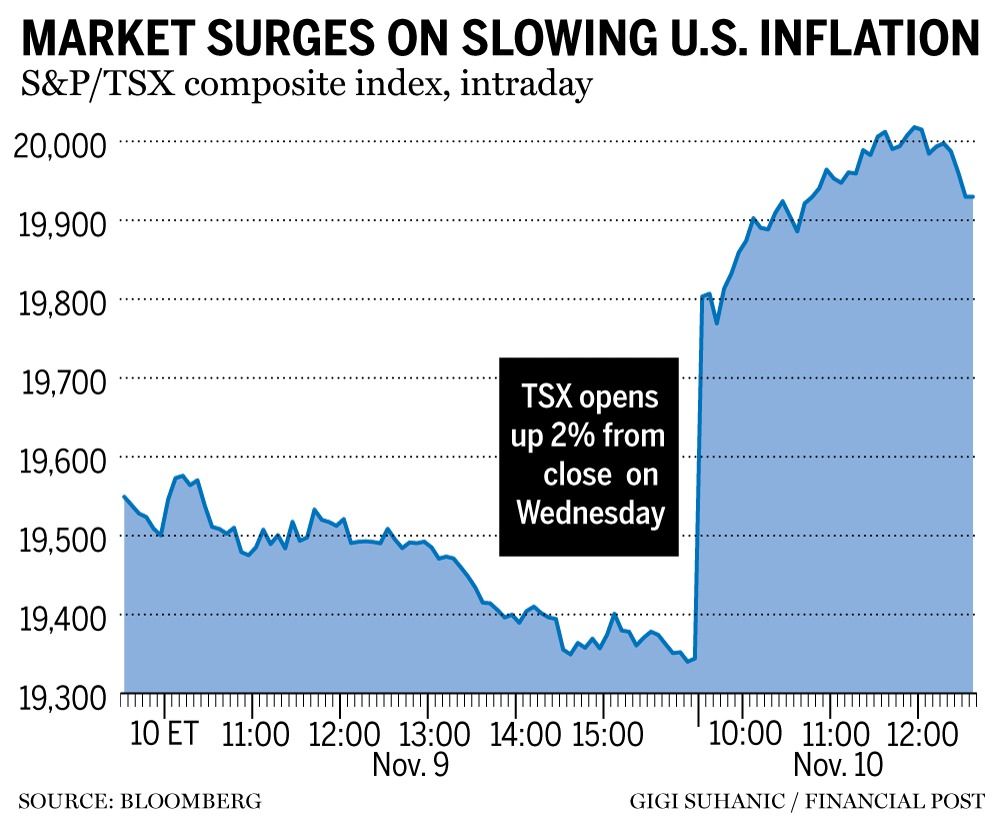

The S&P 500 rallied more than 3 per cent, poised for the best first-day reaction to a CPI report since 2008. Photo by Michael M. Santiago/Getty Images Stocks are headed for the best post-inflation day rally in more than a decade as slower-than-projected price growth sparked bets the Federal Reserve can downshift its aggressive rate-hike path.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

More than 90 per cent of stocks in the S&P 500 were swept up in the rally that left the benchmark poised for the best first-day reaction to a CPI report since 2008. The tech-heavy Nasdaq 100 surged the most intraday since April 2020. The relief rally helped crypto markets stabilize despite the turmoil surrounding crypto exchange FTX.

FP Investor By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

At 12:18 p.m. ET, the Dow Jones Industrial Average was up 959.59 points, or 2.95 per cent, at 33,473.53, the S&P 500 was up 172.53 points, or 4.60 per cent, at 3,921.10, and the Nasdaq Composite was up 631.19 points, or 6.10 per cent, at 10,984.36.

Treasuries soared across the board, sending the rate on two-year notes, more sensitive to monetary policy, down 28 basis points. Rates traders pared bets on Fed hikes, with swaps indicating now that a 50-basis-point increase in December is far more likely than a 75-basis-point move.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

Headline inflation came in at 7.7 per cent, the lowest since January, before Russia’s war in Ukraine pushed up commodity prices. More important for the Fed, the core measure that excludes food and energy slowed more anticipated.

“The first downside surprise in inflation in several months will inevitably be received by an equity market ovation,” Seema Shah, chief global strategist at Principal Asset Management, wrote. “A 0.5 per cent hike, rather than 0.75 per cent, in December is clearly on the cards but, until we have had a run of these types of CPI reports, a pause is still some way out.”

Fed officials appeared to back a downshift in rate hikes after a stretch of four jumbo-sized increases. They also stressed the need for policy to remain tight.

Dallas Fed President Lorie Logan said it may soon be appropriate to slow the pace to better assess economic conditions. San Francisco’s Mary Daly said the moderation was “good news,” but noted “one month of data does not a victory make.” She also said “pausing is not the discussion, the discussion is stepping down.”

Swaps markets pulled back bets on a peak rate to slightly less than 4.9 per cent in the first half of next year, from more 5 per cent before the CPI data.

Additional reporting by Reuters

Bloomberg.com