Companies that pay sustainable dividends have provided the best returns over time

A specialist trader working on the floor of the New York Stock Exchange. Photo by Brendan McDermid/Reuters files Companies that pay sustainable dividends have provided the best returns over time, including during periods of elevated inflation.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

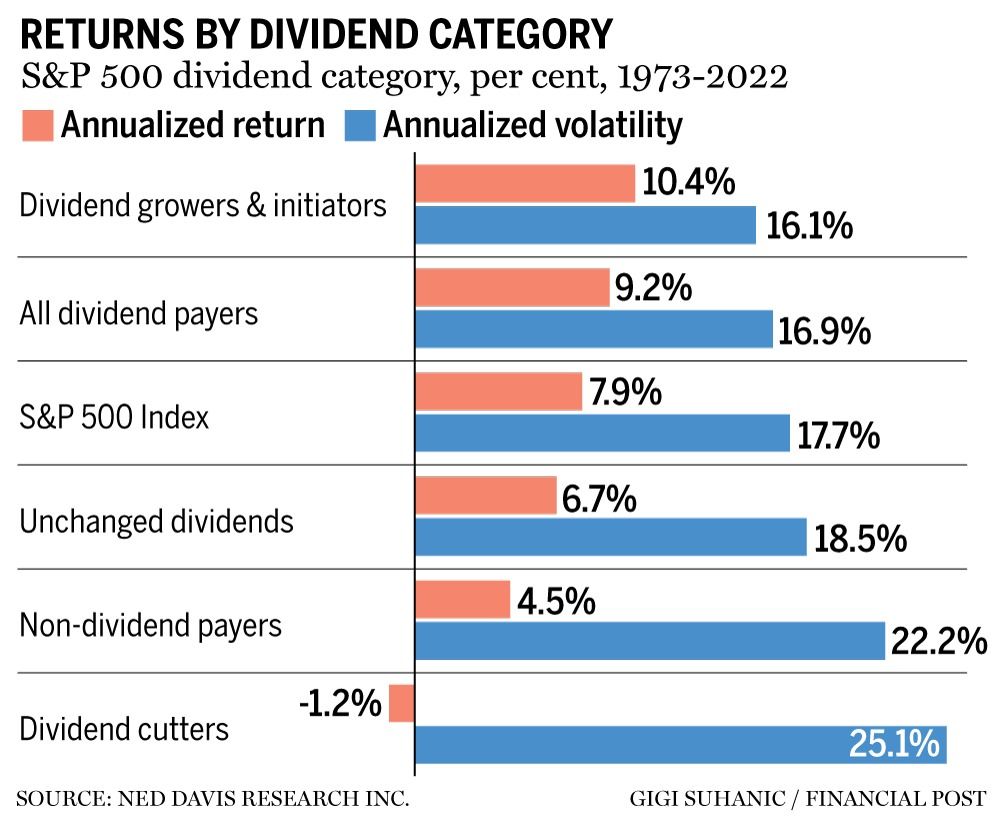

Over the past 48 years, dividend-paying stocks have outperformed their non-dividend paying counterparts by 4.7 per cent on an annualized basis, according to Ned Davis Research Inc. (NDR), which studied the relative performance of S&P 500 stocks from 1973-2020.

FP Investor By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

This difference is nothing short of astronomical when coupled with the power of compounding. A $1-million investment in dividend payers over this period would have been valued at $68,341,836 as of the end of 2020, which is $60,070,380 more than the same amount invested in non-dividend-paying stocks would be worth.

Within the dividend-paying complex, dividend growers and initiators have been the clear champions, with an annualized return of 10.4 per cent compared to 9.2 per cent for all dividend-paying stocks. A $1-million investment in dividend growers and initiators would have been valued at $115,482,326, which is $47,140,940 more than the same amount if the original sum had been invested in all dividend payers.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

Furthermore, dividend-paying companies have outperformed their non-dividend-paying counterparts while exhibiting lower volatility.

NDR’s study also examined the relative performance of dividend payers versus non-payers in various macroeconomic environments, specifically the impact of inflation, economic growth and interest rates.

Dividend-paying stocks have on average outperformed their non-dividend-paying counterparts regardless of whether inflation has been low, moderate or high. Unsurprisingly, dividend growers and initiators outperformed other dividend-paying companies during periods of moderate to high inflation.

During recessions, dividend-paying stocks have underperformed non-payers by 2.5 per cent on an annualized basis. This shortfall pales in comparison to their 4.8 per cent outperformance during economic expansions, especially considering that economies spend far more time expanding than contracting.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

Once again, dividend growers and initiators have exhibited particularly strong performance, underperforming non-dividend payers by only 0.9 per cent during recessions while outperforming them by 5.6 per cent during expansions.

As for interest rates, dividend payers underperformed non-payers by an annualized rate of 2.9 per cent during periods when 10-year rates were rising, but this shortfall pales in comparison to their blistering annual 9.4 per cent outperformance when rates were declining.

Once again, dividend growers and initiators stood out. They barely outperformed all dividend payers during periods of rising rates, but bested them by an annualized 1.8 per cent when rates were falling.

The ability to consistently pay dividends suggests a company is mature, and has cash flow and cash on hand. These features enable dividend-paying companies to have lower volatility and to hold up better than their non-dividend-paying counterparts during market meltdowns.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

On a year-to-date basis through the end of October, the S&P 500 Dividend Aristocrats index has declined 8.7 per cent compared to a 17.7 per cent loss for the S&P 500 index. This is because high-quality dividend-paying companies typically pay dividends regardless of share price movement, which can mitigate losses in down markets.

A company with a share price of $100 that pays $3 every year in dividends has a dividend yield of three per cent. If a bear market materializes and the stock price falls to $50 but the company maintains its annual payout of $3, then the stock’s dividend yield increases to six per cent.

Assuming the company is financially stable, the new six-per-cent yield will provide what is referred to as “yield support.” The increased yield entices opportunistic bargain hunters to step in and buy the company’s stock, which slows, halts or even reverses its downward trajectory.

Advertisement 6 This advertisement has not loaded yet, but your article continues below.

Of course, there is the old notion that “there is no such thing as a free lunch,” that is, it’s impossible to get something for nothing. Notwithstanding their strong long-term performance, investors who are prone to FOMO (fear of missing out) be warned: there have and will be times when dividend payers underperform.

Recommended from Editorial Three hall-of-fame investors share the lessons they learned along the way Cryptocurrency blowout shows disruption fuelled by easy money often only disrupts your portfolio David Rosenberg: Why that ‘remarkable’ stock market rally was just another head fake FOMO sufferers who were heavily invested in dividend payers in 2007 would have watched in horror as the S&P 500 Dividend Aristocrats index underperformed the S&P 500 by 7.6 per cent and the TSX Dividend Aristocrats index underperformed the TSX composite by 5.8 per cent.

This advertisement has not loaded yet, but your article continues below.

Article content They might have been similarly apoplectic in 2020-2021 as the liquidity-fuelled surge in growth stocks caused American and Canadian dividend payers to underperform their benchmarks by 15.5 per cent and 9.1 per cent, respectively.

However, the fact remains that dividend-paying stocks have produced meaningful outperformance over the long term. Yet most dividend-focused managers have been unable to pass on the magic of dividend-paying stocks to investors.

According to S&P Global Inc., 79.3 per cent of Canadian dividend-focused funds underperformed the TSX Dividend Aristocrats index over the 10 years ending June 30, 2022. The data over the past five years is even more daunting, with 88.1 per cent of managers underperforming.

This advertisement has not loaded yet, but your article continues below.

Article content Francis Galton, a famous English statistician, was obsessed with measurement. His motto: “Wherever you can, count.” I agree with his assertion, particularly with respect to investing. To this end, I strongly believe a disciplined, rules-based investment process based on data, statistical analysis and machine learning can reap the full potential of dividend-paying stocks for investors.

Noah Solomon is chief investment officer at Outcome Metric Asset Management LP.

_____________________________________________________________

If you liked this story, sign up for more in the FP Investor newsletter.

_____________________________________________________________