Martin Pelletier: Canadian investors with too much tech exposure and not enough energy could seriously compound their risks

Martin Pelletier looks at the ongoing battle between tech and energy sectors. Photo by Getty Images/Reuters What a roller coaster ride the market is on, especially the ongoing battle between the commodity and tech sectors, with investors choosing their horses by betting on whether the economy is strong enough to finally cause the United States Federal Reserve to accelerate its tightening and start raising interest rates.

Advertisement This advertisement has not loaded yet, but your article continues below.

On the commodity side, WTI oil prices fell from more than US$84 per barrel in mid-November to US$64 per barrel at the beginning of December over Omicron fears and U.S. President Joe Biden’s threats to restrict exports. But prices have since recovered to over US$81 as the latest variant isn’t impacting economies nearly as much as expected and market participants called Biden’s terrible bluff.

The tech sector and especially the five Big Tech stocks have also had some volatility, but investors are buying the dip and performance-chasing indexes such as the S&P 500, which has a whopping 28-per-cent weighting to the sector.

Overall, a hawkish Fed is terrible news for this long-duration, highly capital-dependent sector, which requires low interest rates to support current valuations.

Advertisement This advertisement has not loaded yet, but your article continues below.

Specifically, growth stocks, as represented by the S&P 500 Growth Index, are valued at an average P/E ratio of 27, which compares to only 17.5 times for the S&P 500 Value Index, according to financial reporter Holger Zschaepitz. This is the widest gap since the turn of the millennium.

Many forget Edward Greenspan’s tightening was one of the core catalysts that burst the 2000 tech bubble

For those wondering when and if this gap will ever narrow, simply ask yourself when the Fed is going to close the candy store or at least reduce its hours? Many forget Edward Greenspan’s tightening was one of the core catalysts that burst the 2000 tech bubble.

On the other side of that trade is the oil sector, with demand recovering while supply remains constrained, which could possibly lead to a repeat of the incredible commodity run post-2000 through to 2014.

Advertisement This advertisement has not loaded yet, but your article continues below.

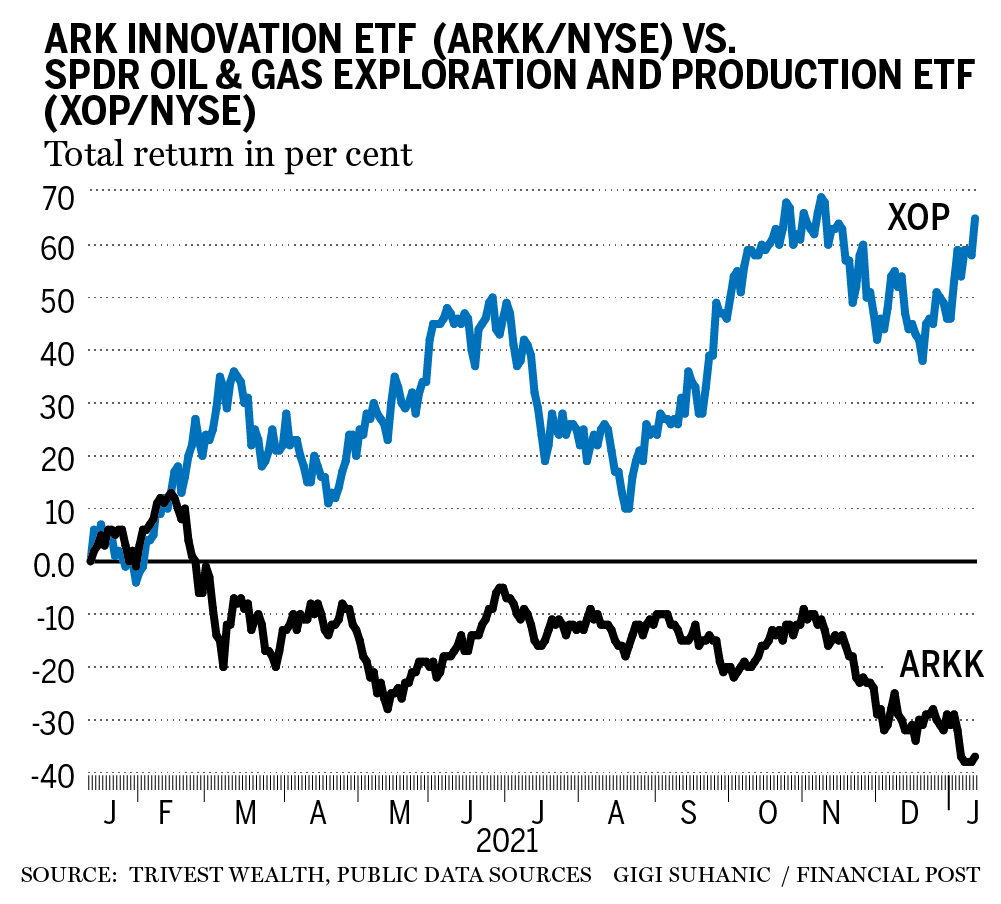

A great example of this epic battle is to compare the Ark Innovation ETF (Nasdaq:ARRK) versus the SPDR S&P Oil & Gas Exploration & Production ETF (Nasdaq:XOP) over the past 12-months. While at extremes, both make for a fair representation of this unfolding situation, with ARKK down 37 per cent and XOP up 65 per cent. There could be plenty of room for this trade to continue playing out and narrow as ARKK is up 294 per cent during the past five years while XOP is down 33 per cent.

We’ve been living on quantitative easing for so long now that the big question is when is enough, enough? The answer may not be as binary as this, but perhaps all it will take to wreak havoc on the highly torqued tech sector is a return to anywhere near where monetary policy was pre-COVID-19. There is also still a lot of room here, with U.S. 10-year yields at 1.77 per cent versus the 3.2 per cent high in October 2008.

Advertisement This advertisement has not loaded yet, but your article continues below.

On the other hand, take a look at XOP’s correlation to the U.S. 10-year Treasury yield over the past few months: higher yields, higher oil prices and higher XOP prices. Should this continue to play out, imagine the tremendous sector upside that remains, especially if there is a rotation out of tech for icing on the cake.

In the meantime, oil companies are generating so much cash flow that many Canadian exploration and production companies (E&Ps) will be able to buy back all their stock and debt within the next five to seven years under current oil prices.

This could be a real possibility since we don’t expect them to put much cash flow back into the ground, beyond maintenance capex, given the market’s appetite is moving over to those waving the environmental, social and corporate governance (ESG) banner.

Advertisement This advertisement has not loaded yet, but your article continues below.

More On This Topic How to prepare your portfolio for what could be a very volatile year Looking for opportunities amidst the Omicron noise and policy-makers’ nosiness Martin Pelletier: Inflation volatility, central bank policy error are the two biggest risks facing markets — so buckle up Making it even more difficult is that capital is highly restrictive at the moment, because financial institutions are under a lot of pressure to no longer provide financing to the sector.

Don’t expect much help from our federal government. Prime Minister Justin Trudeau wrote a mandate letter in December to Environment Minister Steven Guilbeault instructing him “to accelerate our G20 commitment to eliminate fossil fuel subsidies from 2025 to 2023, and develop a plan to phase out public financing of the fossil fuel sector, including by federal Crown corporations.”

This advertisement has not loaded yet, but your article continues below.

Article content Therefore, we see a real chance of an energy crisis unfolding within this country, especially eastern Canada, not unlike what is currently happening in Europe, paired with the potential for higher interest rates required to support a weakening Canadian dollar. Don’t look for oil prices to come to the rescue this time; simply look at how the currency has recently decoupled from recovering oil prices.

Canadian investors with too much tech exposure and not enough energy could seriously compound the consequences of this risk. For the contrarians, now may be as good a time as ever to change horses, or consider rebalancing at the very least.

Financial Post

Martin Pelletier, CFA, is a senior portfolio manager at Wellington-Altus Private Counsel Inc, operating as TriVest Wealth Counsel, a private client and institutional investment firm specializing in discretionary risk-managed portfolios, investment audit/oversight and advanced tax, estate and wealth planning.

_____________________________________________________________

For more stories like this one, sign up for the FP Investor newsletter.

______________________________________________________________

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300