Tax and energy windfalls and federal health-care transfers flip the script

Published Mar 28, 2023 • Last updated 21 hours ago • 5 minute read

The government of Ontario Premier Doug Ford is projecting a deficit of $2.2 billion in fiscal 2022-2023, down dramatically from Budget 2022’s expected near-$20 billion deficit. Photo by Nathan Denette/The Canadian Press The struggle to bring provincial budgets into balance has never been easy and as the pandemic waned, the expectation was for a continued sea of red. But tax and energy windfalls and federal health transfers have flipped the script — notwithstanding certain exceptions. With provincial budget season completed, the Financial Post’s Stephanie Hughes breaks down what you need to know. (Provincial surplus/deficit figures are for fiscal 2023-2024.)

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to read the latest news in your city and across Canada.

Unlimited online access to articles from across Canada with one account Get exclusive access to the National Post ePaper, an electronic replica of the print edition that you can share, download and comment on Enjoy insights and behind-the-scenes analysis from our award-winning journalists Support local journalists and the next generation of journalists Daily puzzles including the New York Times Crossword SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to read the latest news in your city and across Canada.

Unlimited online access to articles from across Canada with one account Get exclusive access to the National Post ePaper, an electronic replica of the print edition that you can share, download and comment on Enjoy insights and behind-the-scenes analysis from our award-winning journalists Support local journalists and the next generation of journalists Daily puzzles including the New York Times Crossword REGISTER TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account Share your thoughts and join the conversation in the comments Enjoy additional articles per month Get email updates from your favourite authors Tax windfall or tax cuts? Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Ontario: $1.3 billion deficit

Quebec: $4 billion deficit

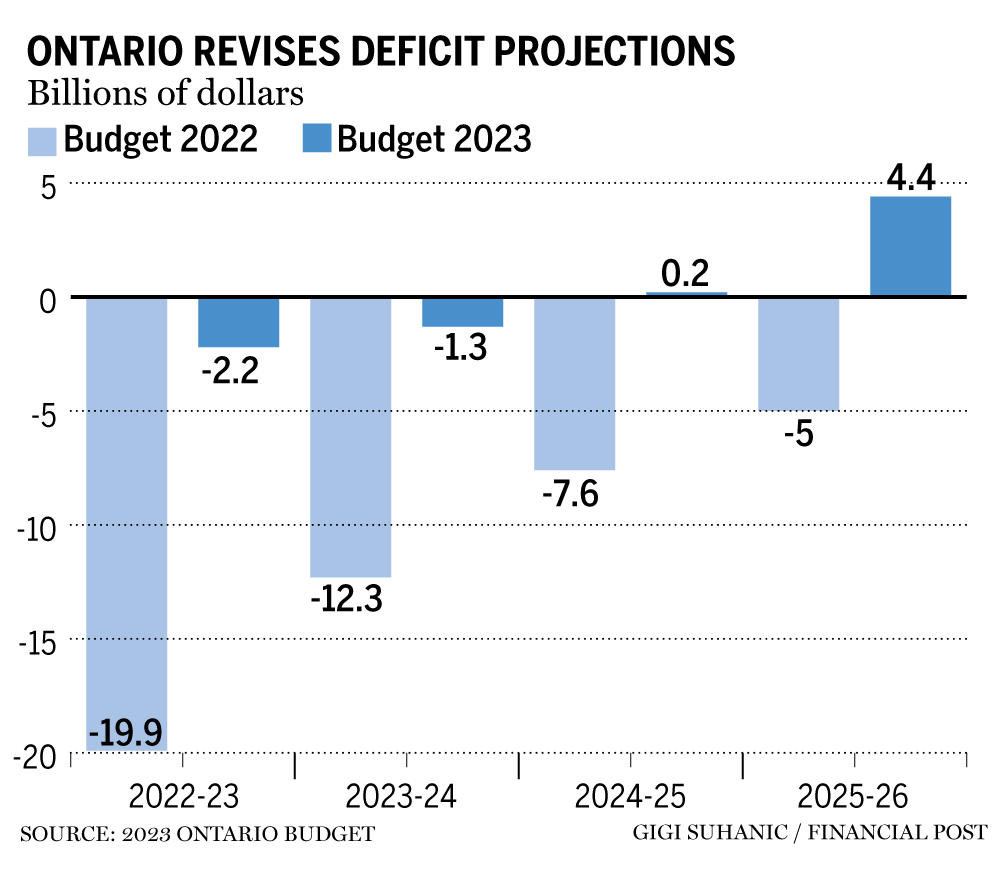

Ontario’s finances are shaping up to be stronger than expected despite a slowing economy. The country’s largest province now projects its outgoing fiscal 2022-2023 deficit to fall to $2.2 billion (down significantly from the $19.9 billion in Budget 2022) and expects the deficit to decline to $1.3 billion in 2023-2024. Ontario also says it will balance the budget three years ahead of schedule, returning to the black by 2024-2025.

The province’s finances are ahead of schedule in part because of a surge in revenue, which surpassed the $200 billion mark in fiscal 2022-2023, largely due to a tax revenue windfall and larger federal transfers. Ontario’s interim 2022-2023 total tax revenue came in at $144.7 billion, up from a realized $131.7 billion in 2021-2022 and $110.9 billion in 2020-2021. Though the $204.7 billion in spending for fiscal 2023-2024 would be the province’s largest-ever budget, the economics team at the Royal Bank of Canada characterized it as being more conservative than the spending plans in its 2022 pre-election budget.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

“Save for a $6.1 billion increase to the health-care sector, Ontarians can expect much of the same from their government in the year ahead,” RBC economist Rachel Battaglia wrote in a March 24 note to clients, adding that this fiscal prudence could leave some stakeholders hanging. “Municipalities, for instance, didn’t get the funding commitment they sought to fill the gap from government-imposed cuts on real estate development charges.

Quebec was less conservative in its approach, rolling out new spending and tax cuts, and now expects a deficit of $4 billion in 2023-2024 that will gradually be eliminated by 2027-2028. The $24 billion earmarked for new spending over the next six years included the province’s plan to put $9.2 billion toward cutting taxes.

Article content This advertisement has not loaded yet, but your article continues below.

Article content The government flagged five key priorities in Budget 2023, including growing provincial wealth, improving the health-care system, supporting Quebecers, aiding youth development and environmental measures.

Riding the resource wave Alberta: $2.4 billion surplus

Saskatchewan: $1 billion surplus

Surging resource revenues help two western provinces project surpluses for the upcoming year. Alberta ended its 2022-2023 fiscal year with a forecasted $10.4 billion surplus and is expecting a $2.4 billion surplus for 2023-2024. The province is forecasting a $27.5 billion in non-renewable resource revenue for 2022-2023, which would be its highest ever level. For 2023-2024, that figure is expected to ease to $18.4 billion, the second-highest on record.

This advertisement has not loaded yet, but your article continues below.

Article content The government promised to keep its books in balance with a new fiscal framework that includes offsetting risks tied to volatile resource revenues, according to RBC Economics. Growing expenditures and shrinking revenue growth from the oil patch, however, are expected weigh on the province’s next budget, economists noted.

Saskatchewan, meanwhile, is projecting its second billion-dollar surplus in a row for fiscal 2023-2024 after finishing $1.1 billion in the black in fiscal 2022-2023 when it had initially projected a $463 million deficit. The province’s projected $1 billion surplus for next fiscal year will be driven in part by non-renewable resource revenue (although that is expected to slip by more than $1 billion from this fiscal year) and fiscal restraint.

This advertisement has not loaded yet, but your article continues below.

Article content Deficit cutting delayed British Columbia: $4.2 billion deficit

Manitoba: $363 million deficit

A projected $5.8 billion surge in spending is pushing British Columbia into the red for 2023-2024, with the province projecting a deficit of $4.2 billion. That would reverse the $3.6 billion surplus it expects for 2022-2023. In total, expenditures are expected to hit $81.2 billion in 2023, mostly toward health care, education and social services.

RBC Economics warned that the financial outlook for the province could deteriorate as the economy slows and commodities revenue growth eases. The bank pointed to a housing downturn and lower lumber prices as added downside risks, on top of a potential recession.

Manitoba, meanwhile, forecast a $363 million deficit for fiscal 2023-2024, down slightly from $378 million in 2022-2023, as it focuses on investing in more relief measures such as tax cuts.

This advertisement has not loaded yet, but your article continues below.

Article content Raising the basic personal amount from $10,145 to $15,000, took 47,000 taxpayers off the tax roll, RBC Economics said . The province’s expenses are also expected to rise by more than $900 million in fiscal 2023-2024.

Mixed bag on the East Coast Nova Scotia: $279 million deficit

New Brunswick: $40.3 million surplus

Newfoundland & Labrador: $160 million deficit

Nova Scotia’s plan to overhaul its strained health-care system will expand its 2023-2024 deficit to $279 million from $259 million the year prior. Health-care investments will add $100 million to the province’s expenses, bringing the total to $4.8 billion. Health care is the single largest line item on the province’s balance sheet, accounting for one-third of total spending.

This advertisement has not loaded yet, but your article continues below.

Article content New Brunswick can look forward to a modest surplus of $40.3 million in fiscal 2023-2024 due to a growing taxable population as more people move east. Some headwinds the province could face include tax cuts that would shrink revenues next fiscal year and the $1 billion in capital spending in 2023 to accommodate a growing population.

Industry lining up for carrots as green transition set to speed up Chrystia Freeland desperately needs a ‘soft landing’ from inflation Striving for compromise on who pays for decarbonization will disappoint everyone Newfoundland & Labrador expects its 2022-2023 tax revenue windfall to partially reverse and lend to a projected $160 million deficit in 2023-2024. This came after an unexpected 2022-2023 surplus of $784 million in Budget 2023, revised from the initially estimated $351 million deficit in Budget 2022. Declining offshore resource royalties are also expected to contribute to the deficit, falling by $97 million. The province expects to swing back to a surplus of $297 million by 2024-2025.

Prince Edward Island dissolved its legislature on March 6 for an election before its budget could be tabled.

• Email: shughes@postmedia.com | Twitter: StephHughes95