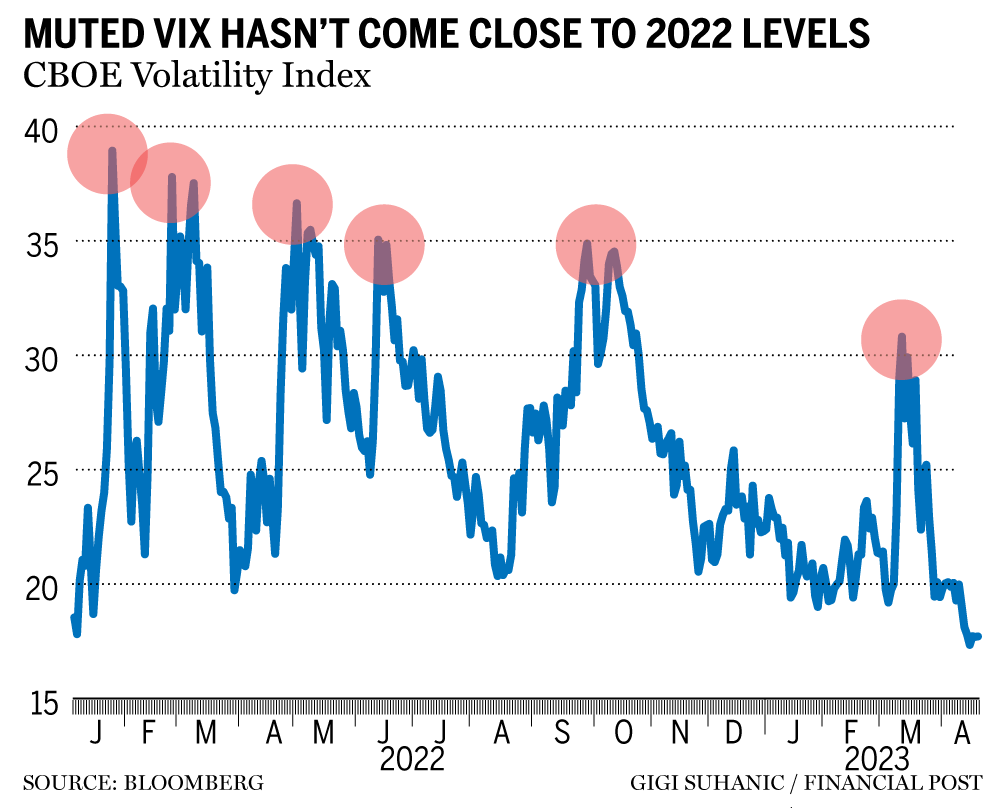

Most-watched gauge of market volatility hasn’t done much lately

Author of the article:

Bloomberg News

Lu Wang and Sam Potter

Published Apr 24, 2023 • Last updated 1 day ago • 3 minute read

The Chicago Board Options Exchange announced a new one-day version of its flagship volatility index — the VIX. Photo by Jim Young/Bloomberg About a month ago, as Wall Street stared down the barrel of an incipient banking crisis, the investment world’s most-watched gauge of market volatility did a funny thing: It didn’t do much.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to read the latest news in your city and across Canada.

Unlimited online access to articles from across Canada with one account. Get exclusive access to the National Post ePaper, an electronic replica of the print edition that you can share, download and comment on. Enjoy insights and behind-the-scenes analysis from our award-winning journalists. Support local journalists and the next generation of journalists. Daily puzzles including the New York Times Crossword. SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to read the latest news in your city and across Canada.

Unlimited online access to articles from across Canada with one account. Get exclusive access to the National Post ePaper, an electronic replica of the print edition that you can share, download and comment on. Enjoy insights and behind-the-scenes analysis from our award-winning journalists. Support local journalists and the next generation of journalists. Daily puzzles including the New York Times Crossword. REGISTER TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account. Share your thoughts and join the conversation in the comments. Enjoy additional articles per month. Get email updates from your favourite authors. Sure, the CBOE Volatility Index — a measure of expected swings in the S&P 500 Index also known as the VIX — climbed. But even at its intraday peak, it didn’t come close to levels seen multiple times just a year ago.

FP Investor Canada’s best source for investing news, analysis, and insight on investment strategies, stocks and more.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Many theories abound for why this once-reliable indicator of sentiment — famously known as Wall Street’s fear gauge — seems to be losing its edge. But one in particular keeps coming up: traders hedging against — or betting on — turmoil are piling into options with zero-days-to-expiration (0DTE).

Since the VIX is calculated using derivatives that expire 23 to 37 days into the future, the thinking is that it has been struggling to capture this near-term sentiment, which largely emerged last year when the introduction of new expiration days fomented the boom.

Article content This advertisement has not loaded yet, but your article continues below.

Article content Put simply: In the age of 0DTE, Wall Street may need a new fear gauge.

Enter the one-day VIX.

CBOE Global Markets Inc., the Chicago-based exchange operator behind the VIX, has announced that a new one-day version of its flagship volatility index is poised to launch. The CBOE 1-Day Volatility Index is scheduled to start on April 24, according to a notice on the company’s website.

If it succeeds in capturing the sentiment embedded in 0DTE options, it could mark a significant moment for investors and traders across the spectrum.

“This makes sense because so much of the volume has moved to shorter tenors,” Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets, said. “I’ve been joking that the VIX is going through a mid-life crisis, being replaced by someone younger (shorter dates).”

This advertisement has not loaded yet, but your article continues below.

Article content There is already some evidence that nearer-term options have been flashing more stress than the VIX. CBOE offers a nine-day version of the gauge (VIX9D), which has regularly traded at higher levels than the VIX this year.

Zero-day options have spiked in popularity since May, when CBOE expanded existing short-term derivatives to include Tuesday and Thursday expirations, blanketing each weekday.

By the third quarter of last year, 0DTE contracts accounted for more than 40 per cent of the S&P 500’s total options volume, almost doubling the percentage from six months earlier, according to data compiled by Goldman Sachs Group Inc.

CBOE is benefiting from the trading boom. 0DTE options are likely contributing to about 15 per cent of the exchange’s revenue, according to an estimate from Bloomberg Intelligence analysts including Paul Gulberg and Jackson Gutenplan.

This advertisement has not loaded yet, but your article continues below.

Article content “I’m not sure that it will bring a new level of clarity to the markets, but I fully understand why the CBOE is doing it,” Steve Sosnick, the chief strategist at Interactive Brokers, said. “The VIX complex is a well-deserved cash cow for them, so why not try to extract a little more milk while they can.”

CBOE didn’t respond to a request for comment.

Concerns over the VIX’s effectiveness as a sentiment barometer have been growing for months. Its highest close in 2022 was in March, even though a selloff gripped the stock market for much of the remainder of the year.

Confusing market information means it’s better to go your own way An inverted yield curve with a side order of (possible) recession Bearish investors most underweight stocks vs. bonds since 2009: BofA The gauge is trading near the lowest in more than a year, despite softening economic data, looming fears over the United States debt ceiling and a mixed earnings season so far.

Bloomberg.com