Canadian asset owners and managers score well below their U.K. peers and slightly below the global average

Author of the article:

The Logic

Catherine McIntyre

Published Apr 16, 2021 • 4 minute read

Beyond voting, stewardship can include meeting with a firm’s executives to try and influence change, issuing open letters signed by co-investors, suing a firm over its practices and nominating board members who champion sustainability. Photo by Getty Images/iStockphoto Data from close to 100 Canadian investors and money managers shows many firms committed to responsible investing aren’t doing enough to press publicly listed portfolio companies to improve their practices around environment, social and governance (ESG) issues.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. REGISTER TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account. Share your thoughts and join the conversation in the comments. Enjoy additional articles per month. Get email updates from your favourite authors. A report from the Canadian chapter of the UN Principles for Responsible Investment (PRI) presented to signatories in a webinar and viewed by The Logic shows that Canadian asset owners and managers score well below their U.K. peers and slightly below the global average when it comes to consulting public companies they manage in both their active and passive portfolios.

The results are based on annual transparency reports PRI signatories are required to submit to the body. PRI is a global network of more than 3,000 signatories who commit to making business decisions through an ESG lens, and to tracking and disclosing their progress on the issues. The organization has 189 Canadian signatories, including most of Canada’s largest banks and pension funds. Firms are asked to disclose details about how they track ESG factors in all of their asset classes and what steps they’re taking to improve their sustainability. Questions address what they’re doing to reduce their carbon footprints, whether and how they’re monitoring investees’ ESG progress and if they’re discussing the issues with people responsible for creating ESG policies and standards.

FP Investor Canada’s best source for investing news, analysis, and insight on investment strategies, stocks and more.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Article content This advertisement has not loaded yet, but your article continues below.

Article content “While most signatories engage in [proxy] voting, the active ownership often stops there,” reads the report.

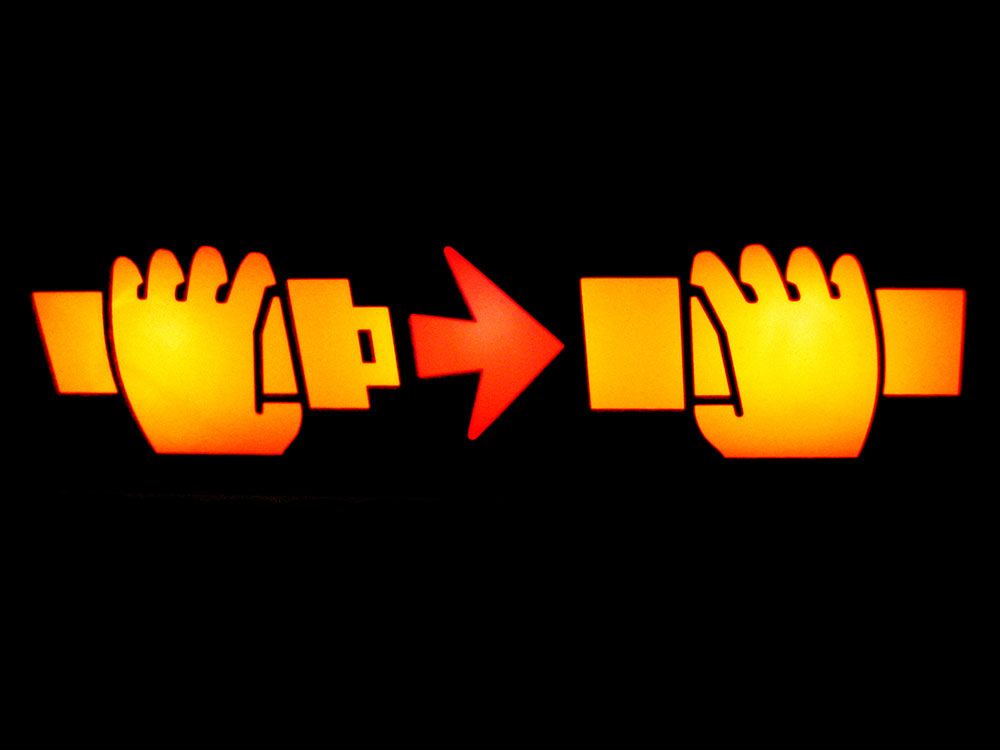

Beyond voting, stewardship can include meeting with a firm’s executives to try and influence change, issuing open letters signed by co-investors, suing a firm over its practices and nominating board members who champion sustainability.

PRI breaks down companies’ stewardship (or engagement) performance in three categories: how a signatory directly engages portfolio companies; how an outsourced service provider — like ISS or Glass Lewis — engages companies on a signatory’s behalf; and how a signatory collaborates with other asset owners and managers to influence ESG improvements. PRI then scores signatories’ answers in each category on a scale from zero to three.

This advertisement has not loaded yet, but your article continues below.

Article content According to the data from 2020, nearly 35 per cent of Canadian signatories scored zero out of three on all questions of how they engage firms through outsourced service providers; over 20 per cent scored zero on how their individual firms engage directly with portfolio companies; and almost 25 per cent scored zero on collaborating with other firms to press for change in portfolio companies.

In the U.K., less than 10 per cent of signatories scored zero on collaborative and individual engagement, and 20 per cent scored zero on engagement with service providers.

Canadian firms, however, scored well above the global average and their U.K. peers on using their voting powers to influence change at portfolio firms. Less than five per cent of signatories scored zero on questions of voting, compared to 10 per cent in the U.K. and 15 per cent globally that scored zero.

This advertisement has not loaded yet, but your article continues below.

Article content Scores of asset owners and managers now tout ESG principles in their investing criteria. Global ESG assets are expected to exceed US$53 trillion by 2025, up from an estimated US$37.8 trillion this year, representing about a third of all assets under management. The mainstreaming of ESG follows pressure from consumers and regulators demanding more socially and environmentally responsible business practices. However, the industry is rife with accusations of greenwashing — concerns that companies take credit for responsible investing without doing the heavy lifting to clean up their portfolios.

Investors often cite engagement with companies as an alternative to divestment to entice them to change behaviours around climate change or board governance, for example. Lindsey Walton, PRI’s head of Canada, agreed that asset owners should use divestment only as a last resort, but that other stewardship practices have to improve if they want to influence companies to make meaningful changes on social and environmental issues. “You have to make sure you’ve done absolutely everything in your power before you say, ‘This isn’t working, we’re going to have to divest,’” said Walton. “When you just divest from a company, the emissions don’t go away; they’re just not in your portfolio. It’s much more powerful if you go through a series of escalation steps.”

This advertisement has not loaded yet, but your article continues below.

Article content U.S. oil drillers ‘dying on the vine’ as private equity flight prompts funding drought As Canadian Pacific Railway bulks up, rival Canadian National takes a few attention-grabbing measures of its own Canadian banks tie CEO pay to ESG, setting them apart from the crowd Voting in favour of shareholder proposals or against chairs that are reluctant to improve ESG is just one aspect of that stewardship, said Walton. Those votes also tend to be non-binding, making them more symbolic than mechanisms for affecting change. “You need different levers on your escalation plan if an investee isn’t doing what you want them to do, she said.

Ryan Riordan, director of research at the Institute for Sustainable Finance at Queen’s University, said he isn’t surprised that Canada lags the U.K., or even the global average, on its engagement practices. “The average Canadian asset owner or asset manager is smaller than the average U.K. or global one,” said Riordan. “I’m also not surprised, given our extractive economy. A country like the U.K. started to decarbonize in the ‘90s, so it makes sense that their asset managers are also much more aware of that sort of thing.”

Still, he said the results strike him as a problem. “It highlights that Canada needs to push for more decarbonization at a firm level and an investor level. We’re wrestling with the transition to a green economy more [than some peers] because so much of our economy is tied up in extraction,” said Riordan, adding that shareholder activism could be an effective tool in that transition. “Investors need to decide what they want and what’s doable and coordinate their activism to get it done.”

The Logic