A low-profile US hedge fund has probably made a $5 billion gain on Nvidia stock this year. Jennison Associates’ nearly 1% stake in the microchip maker is worth around $8.6 billion today. Nvidia shares have surged by about 160% this year as investors bet it will profit from the AI boom. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

A secretive US hedge fund has likely notched a $5 billion gain on Nvidia this year, making it one of the biggest winners from the microchip maker’s epic stock rally.

Jennison Associates owned roughly 23 million Nvidia shares at the end of last year and at the end of March this year, regulatory filings show. The position jumped in value from $3.4 billion to $6.3 billion in the first quarter as Nvidia’s stock price soared. It would be now worth an astounding $8.6 billion, based on Thursday’s closing price.

The investment firm’s nearly 1% stake in Nvidia ranks it among the company’s 10 largest shareholders, per CNN Business. Meanwhile, Jennison counts Nvidia among its largest holdings; the position accounted for 3.5% of its roughly $100 billion US stock portfolio at the end of December, and 5.8% at the end of March.

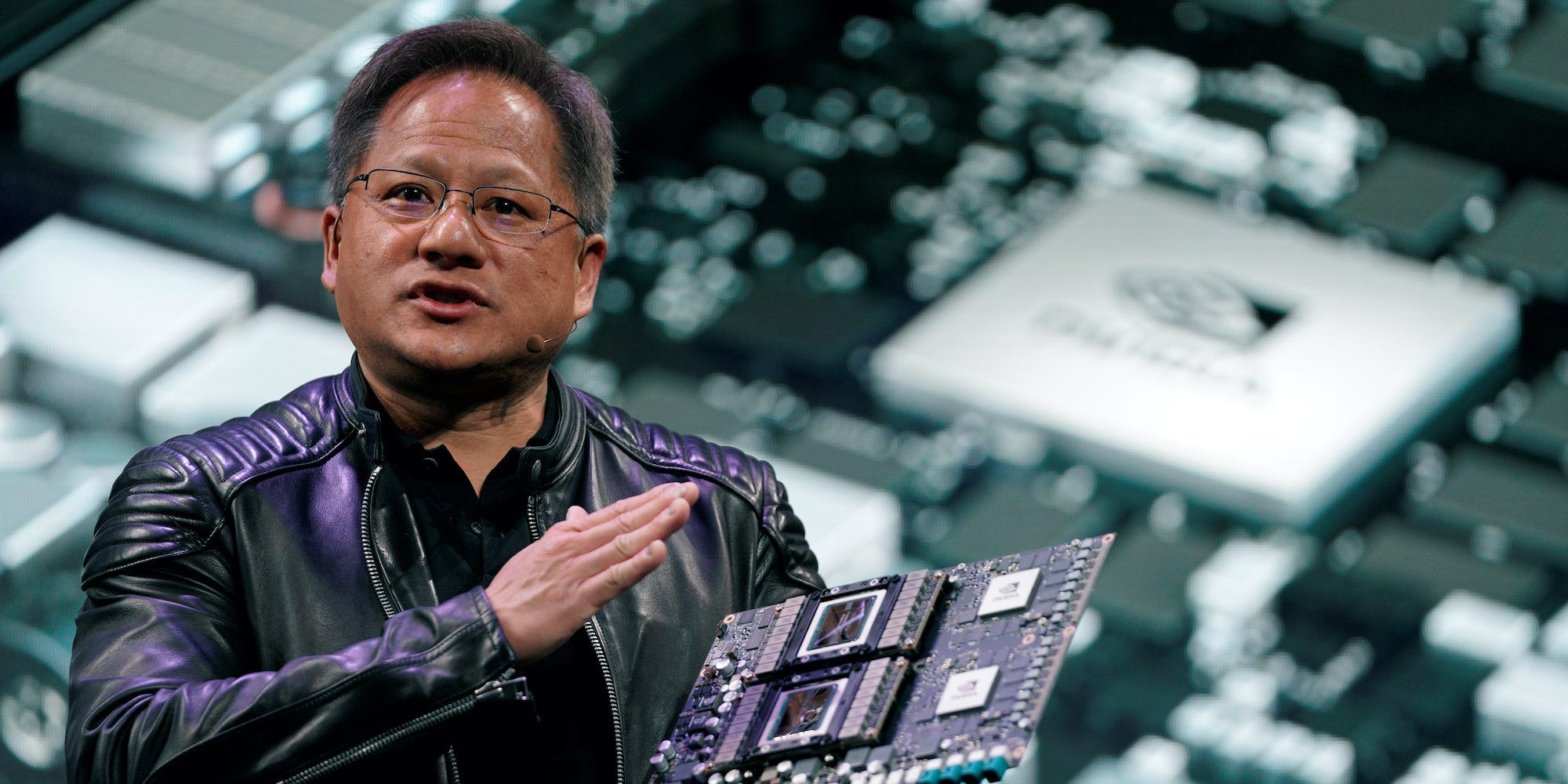

Jennison, which keeps a low profile and rarely engages with the media, has owned Nvidia shares on and off since at least the fourth quarter of 2001 – less than two years after Nvidia CEO Jensen Huang took his company public.

Nvidia’s stock price has skyrocketed by about 160% this year, as investors wager the semiconductor giant will play a pivotal role in the artificial-intelligence boom. The company’s shares surged 24% on Thursday, boosting its market capitalization to over $900 billion, after it issued a second-quarter sales forecast that smashed Wall Street’s expectations.

Jennison — which has offices in New York and Boston —has bet heavily on Big Tech. It owned over $7 billion of Microsoft stock at the end of March, nearly $7 billion of Apple, and more than $4 billion worth of both Amazon and Tesla. Together with Nvidia, those were its top five US stock holdings at the end of March.

It’s worth emphasizing that portfolio updates only provide a snapshot of a firm’s holdings on a particular day. They also exclude overseas-listed stocks, private investments, non-stock assets, and shares sold short.

Therefore, it’s possible that Jennison has significantly altered its Nvidia stake since the end of March, or its massive gain on paper has been offset by hedges or losses elsewhere in its portfolio.

Jennison didn’t immediately respond to a request for comment from Insider.