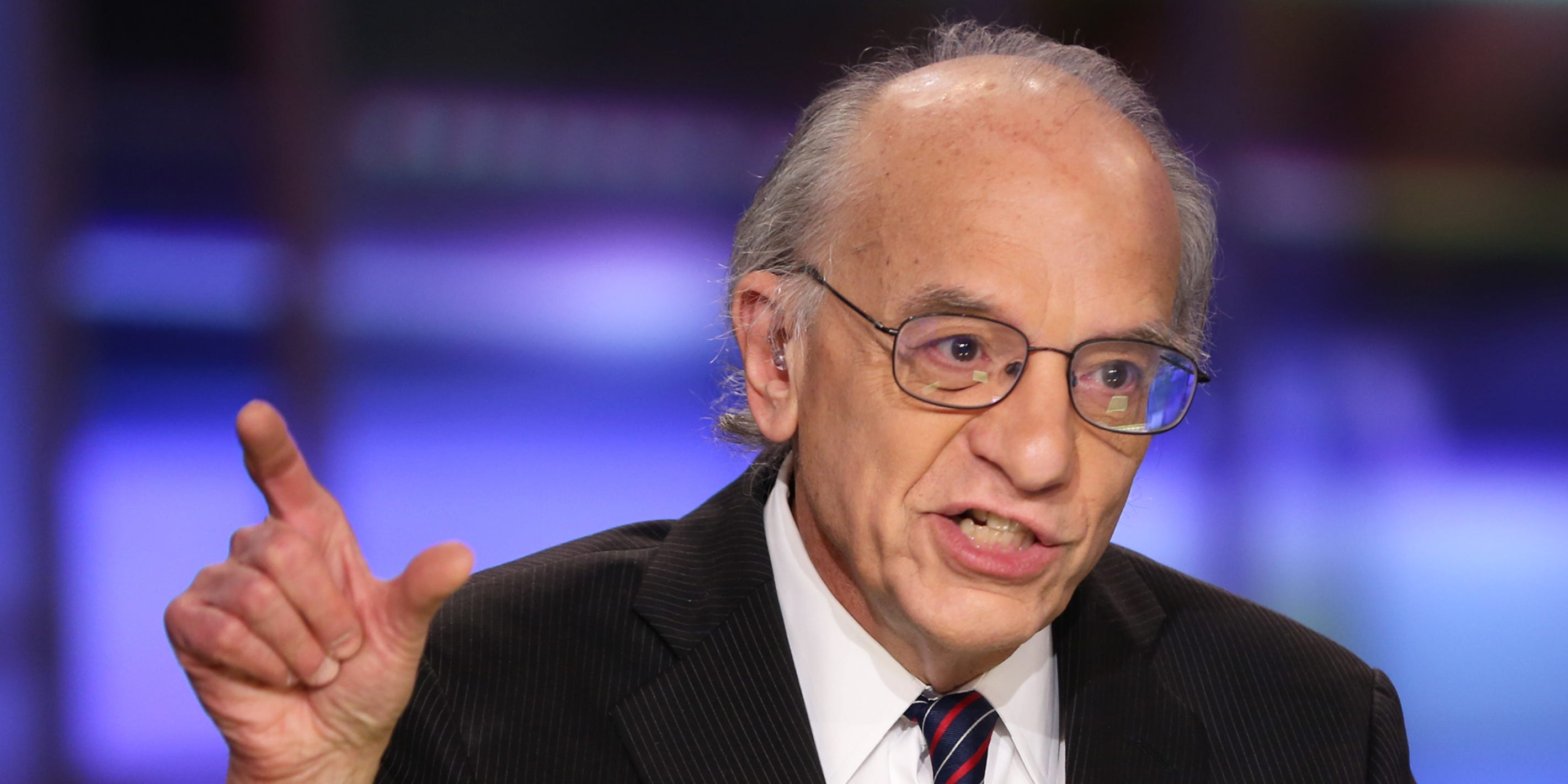

Home prices may fall as recent gains and higher borrowing costs restrain demand, Jeremy Siegel says. The retired Wharton professor noted mortgage rates have ticked up to about 7% in recent days. Siegel welcomed a “truly Goldilocks situation” for stocks as the threat of further rate hikes fades. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

US house prices are at risk of dropping, as their recent gains combine with steeper borrowing costs to price out prospective homebuyers, Jeremy Siegel has warned.

“The higher interest rates and 40% increase in home prices more than doubled the cost of homes for buyers,” the retired Wharton finance professor said in his weekly commentary for WisdomTree on Monday.

He was likely referring to the surge in house prices over the past couple of years — including a second straight monthly increase in March — and the Federal Reserve hiking rates from nearly zero to upwards of 5% since last spring.

“Mortgage rates had ticked down to 6% a few months ago before rising back above 7% now — so perhaps we see some renewed softness in housing prices,” Siegel added.

Higher interest rates translate into larger monthly mortgage payments, which mean banks are willing to lend significantly less money to homeowners today than they were a few years ago. Americans’ finances are also being squeezed by historic inflation and the increased cost of car loans, credit cards, and other types of debt.

A flurry of bank runs, failures, and emergency takeovers in recent months have also spooked lenders. Some have pulled back from making loans so they can weather a sudden wave of withdrawals, or survive a surge in late payments and defaults if recession strikes.

On the other hand, Siegel hailed a “truly Goldilocks situation for equities” in his commentary. He suggested that signs of a cooling labor market, coupled with hints from Fed officials that the central bank could skip a rate hike this month, were good news for stocks.

Still, the markets guru predicted that joblessness would likely jump later this year as the Fed’s previous hikes temper demand for workers. He also described the current rate level as a threat to the economy.

Siegel struck an even more negative tone in his commentary last week. He cautioned that lifting rates any higher might spur depositors to yank their cash from their bank accounts, and pile it into higher-yielding Treasuries and money-market funds instead. He also noted that regional banks, and the smaller businesses they serve, would likely suffer the most from those deposit outflows.

Experts are divided on the outlook for the housing market. “Shark Tank” investor Barbara Corcoran has argued there’s a load of pent-up demand, and called for home prices to surge 20% once interest rates fall by two percentage points.

Meanwhile, real estate billionaire Jeff Greene has warned of a “very frightening time in the entire real-estate industry” as households and businesses fall behind on their rent and mortgages, and struggle to obtain fresh financing as banks shy away from lending.