Hike tomorrow could put prime rate at 7.2 per cent, the highest in 22 years

Published Jul 11, 2023 • 5 minute read

Canada’s housing market is expected to slow if the Bank of Canada hikes interest rates again. Photo by Postmedia Article content Good morning!

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. REGISTER TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account. Share your thoughts and join the conversation in the comments. Enjoy additional articles per month. Get email updates from your favourite authors. As the Bank of Canada interest rate decision approaches this week, Canadians are bracing for another hike amid the highest lending rates in 22 years.

Another 25 basis point hike Wednesday, as many predict, would put the central bank’s policy rate at 5 per cent and the prime rate at 7.2 per cent. The last time rates were this high was March of 2001.

After raising rates rapidly to 4.5 per cent over the past year, the Bank of Canada paused in March and April before adding another 25 basis points in June.

The rate pause appeared to breath new life into Canada’s spring housing market, with the speed of the recovery surprising economists. Nationally sales rose 5.1 per cent in May and average prices increased in almost every major market.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

A survey by online realtor Zoocasa done in the spring appears to back this notion up with the majority of respondents saying the Bank of Canada’s decision to hold rates had a positive impact on their interest in real estate.

Early numbers for June, however, are telling a different story. After the Bank’s interest rate hike, buyers retreated in Toronto, Hamilton, Ottawa and Vancouver, said RBC assistant chief economist Robert Hogue.

Toronto home sales that soared 32 per cent in April and May, fell 6.9 per cent in June from the month before, he said.

The decline came despite more properties coming on the market when in the previous two months a rise in listings had stimulated activity, he said. For now prices continue to rise, with the MLS HPI composite benchmark price up 2.5 per cent in June from the month before.

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

“But more balanced conditions point to a slower pace of appreciation in the months ahead,” said Hogue. “Higher interest rates are poised to keep homeownership affordability extremely challenging for buyers.”

The Zoocasa poll suggests buyers are planning to wait it out.

More than 70 per cent of those polled said another interest rate increase by the Bank of Canada would negatively impact their interest in real estate.

More than 63 per cent did not expect housing to become more affordable within the next year, and for now they are prepared to wait.

Most said they were planning to wait more than seven months before buying a home, with 63 per cent saying they would wait a year or longer, “suggesting there is some hesitancy among buyers to enter the market now,” said Zoocasa’s MacKenzie Scibetta.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

Sellers are showing the same hesitancy. More than 73 per cent said they were planning to wait a year or longer before selling their home.

Mortgage experts also expect the housing market to slow. “A hike will put downward pressure on home prices, which have rebounded since the beginning of the year, and cause transactions to slow over the summer,” said James Laird, co-CEO of Ratehub.ca and president of CanWise mortgage lender.

A Bank of Canada hike tomorrow will not only raise variable-rate mortgages but fixed-rate as well as the bond market reacts, he said. Laird suggests people looking to buy a home or renew their mortgage get pre-approval to hold today’s fixed rate for up to 120 days.

“If your mortgage is up for renewal within the next year, it’s a good idea to hold a rate with a new lender now. If rates jump up further in the future, it should make sense to break your existing mortgage and switch to that new lender before your rate hold expires to lock-in the lower rate.”

Advertisement 6 This advertisement has not loaded yet, but your article continues below.

The hit to variable-rate borrowers since the central bank began hiking has been substantial.

For every 25-basis-point increase, a homeowner on a variable rate can expect to pay about $15 more per month for every $100,000 of the mortgage, says RATESDOTCA.

A homeowner now paying $3,145 a month with a variable rate of 5.75 per cent on a $500,000 mortgage will see their rate rise to 6 per cent and payments to $3,220 a month, an increase of $75.

Since the Bank of Canada began hiking rates in March of 2022, this variable rate borrower will have seen a total increase of about $1,425 per month in mortgage payments.

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

Advertisement 7 This advertisement has not loaded yet, but your article continues below.

BMO Another worrying sign on Canada’s economic front. Business insolvencies have climbed back above pre-pandemic levels in an economy that appears to be in fairly good shape.

BMO senior economist Sal Guatieri, who brings us today’s chart, says the May data showed stress building for both consumers and businesses, but especially the latter. Consumer insolvencies are already back to the levels seen before the pandemic and are likely to go higher if interest rates stay high and the unemployment rate rises.

“Of greater concern is that business insolvencies have already overshot 2019 levels at a time of reasonably healthy economic activity,” said Guatieri. “As shown in the chart, businesses showed amazing resiliency during the Great Recession. But they are already under stress even before an expected mild economic slump.”

Advertisement 8 This advertisement has not loaded yet, but your article continues below.

LNG conference in Vancouver brings together members of the international gas industry Earnings: New Gold, MTY Food, Aritzia

_______________________________________________________

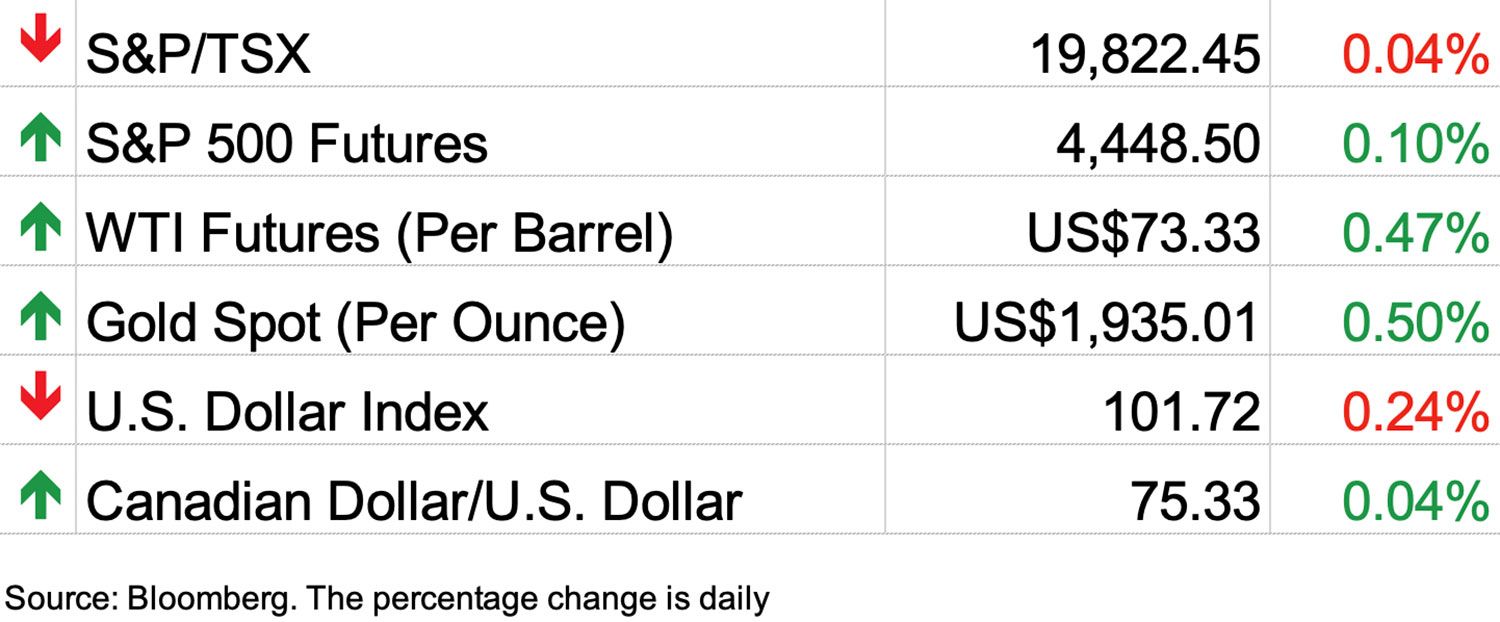

The markets so far this year have been a one-trick pony with investors herding into U.S. megacap tech stocks and not much else. In one week last month retail investors bought a record US$1.5-billion worth of single stocks, and most of that went to Nvidia, Tesla Inc. and Apple. Large swaths of the market are being completely ignored and Martin Pelletier has some suggestions for buying opportunities beyond the pricey tech giants. Like Canadian equities, which are offering the biggest payout ever relative to the S&P 500. Read more

Recommended from Editorial Bank of Canada will hike interest rates one more time: CIBC Canadians reporting insolvency hits record high ____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.