Mortgage interest costs also surged again

Published Jul 18, 2023 • Last updated 3 hours ago • 3 minute read

The price of grapes jumped 30 per cent in June from May. Photo by Getty Images/iStockphoto The rise in consumer prices cooled to 2.8 per cent in June, Statistics Canada reported on July 18, slightly below consensus expectations and the slowest pace since March 2021. While within the Bank of Canada’s target range, some costs are still putting a strain on Canadians’ wallets. Here are five things in the inflation data that you should know about:

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. REGISTER TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience.

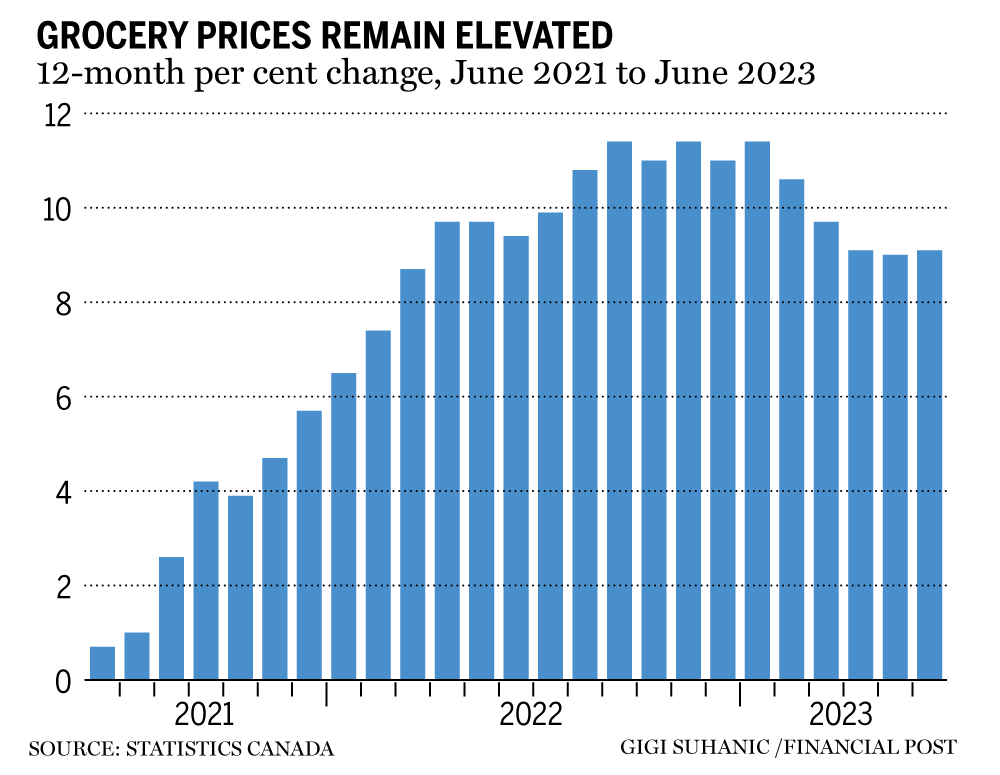

Access articles from across Canada with one account. Share your thoughts and join the conversation in the comments. Enjoy additional articles per month. Get email updates from your favourite authors. 1. Food prices up 9.1 per cent Grocery prices continue to put upward pressure on the consumer price index, remaining one of the largest contributors to the all-items CPI. The 9.1 per cent year-over-year jump in June, although nearly unchanged from the increase in May, leaves a tricky balancing challenge ahead for the Bank of Canada.

Statistics Canada said meat prices were up 6.9 per cent and were one of the main upward contributors to the 12-month change in CPI. Prices for bakery products were also up 12.9 per cent, dairy products were up 7.4 per cent and other food preparations were up 10.2 per cent.

The price of fresh fruit grew at an annual pace of 10.4 per cent in June, partly driven by a 30 per cent month-over-month jump in the price of grapes. Food purchased from restaurants remained an upward contributor to the headline CPI increase with a 6.6 per cent 12-month change.

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails or any newsletter. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content 2. Mortgage interest payments drive up shelter costs Mortgage interest costs surged 30.1 per cent in June, up slightly from last month’s 29.9 per cent increase, driving a large part of the headline CPI increase. This marks the 12th consecutive month of rising mortgage interest expenses, the sixth consecutive month where year-over-year increases have exceeded 20 per cent and the fourth consecutive record increase. Following Canada’s sharply rising policy interest rate over the past year, mortgage rates have reached their highest levels since early 2009. For prospective homebuyers, the surge in mortgage interest costs mean larger monthly payments and reduced purchasing power.

3. Gasoline led CPI slowdown Advertisement 4

This advertisement has not loaded yet, but your article continues below.

The transportation component fell 3.4 per cent on a year-over-year basis in June after a 2.4 per cent decline in May. While deceleration was fairly broad-based, Statistics Canada said the base-year effect in gasoline prices led the month’s slowdown in the CPI. Without the decline in gasoline prices, headline inflation would have been four per cent in June, following a 4.4 per cent increase in May.

The year-over-year prices for gasoline fell 21.6 per cent in June, due to elevated prices in June 2022 amid higher global demand for crude oil as China, the largest importer of crude oil, eased some COVID-19 public health restrictions. This follows an 18.3 per cent decline in May. On a month-to-month basis, however, consumers paid 1.9 per cent more at the pump in June compared to May.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content Gas prices were down more than 21 per cent in June compared to last year. Photo by Peter J. Thompson/Financial Post Improved supply chains and inventories coincided with a slower pace of increases in passenger vehicle prices in June to 2.4 per cent from 3.2 per cent in May. This year-over-year slowdown was the result of a base-year effect, with a 1.5 per cent month-over-month increase in June 2022 being replaced with a smaller 0.6 per cent month-over-month increase in June 2023.

Passenger vehicle insurance premiums rose 5.4 per cent in June after a 3.1 per cent increase in May, moderating deceleration in the transportation component.

Stephen Brown, an economist at Capital Economics, said the decline in energy inflation will soon be reversed and the bank “can’t get too excited about the decline in headline inflation.”

4. Telecom prices fell Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Consumers paid less for telecommunications services in June, thanks to lower prices and promotions. Cellular services cost 14.7 per cent less on a year-over-year basis in June, following an 8.2 per cent decline in May.

Prices for internet access services also fell 3.2 per cent year over year in June after a one per cent increase in May. Internet bills in June had the largest one-month decline since February 2019, with a five per cent decrease mostly due to promotions in Ontario and lower prices in Quebec.

Recommended from Editorial Inflation cools to 2.8% in June What economists are saying about inflation numbers Minimum-wage workers’ struggle to afford rent getting worse 5. Slower price growth in travel services Prices for travel tours rose at a slower pace year over year in June, putting downward pressure on the all-items CPI. Prices rose 6.8 per cent in June compared to 23.4 per cent in May. This was largely driven by an 11.5 per cent month-over-month decline, in line with normal seasonal patterns leading up to the peak travel season in July.

• Email: dpaglinawan@postmedia.com | Twitter: denisepglnwn