Microsoft most recent earnings results failed to impress investors, with the stock falling about 3%.But Wall Street analysts are bullish on the company’s heavy focus on artificial intelligence.”AI offerings are expected to contribute meaningfully for both Azure and Office,” Bank of America said. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

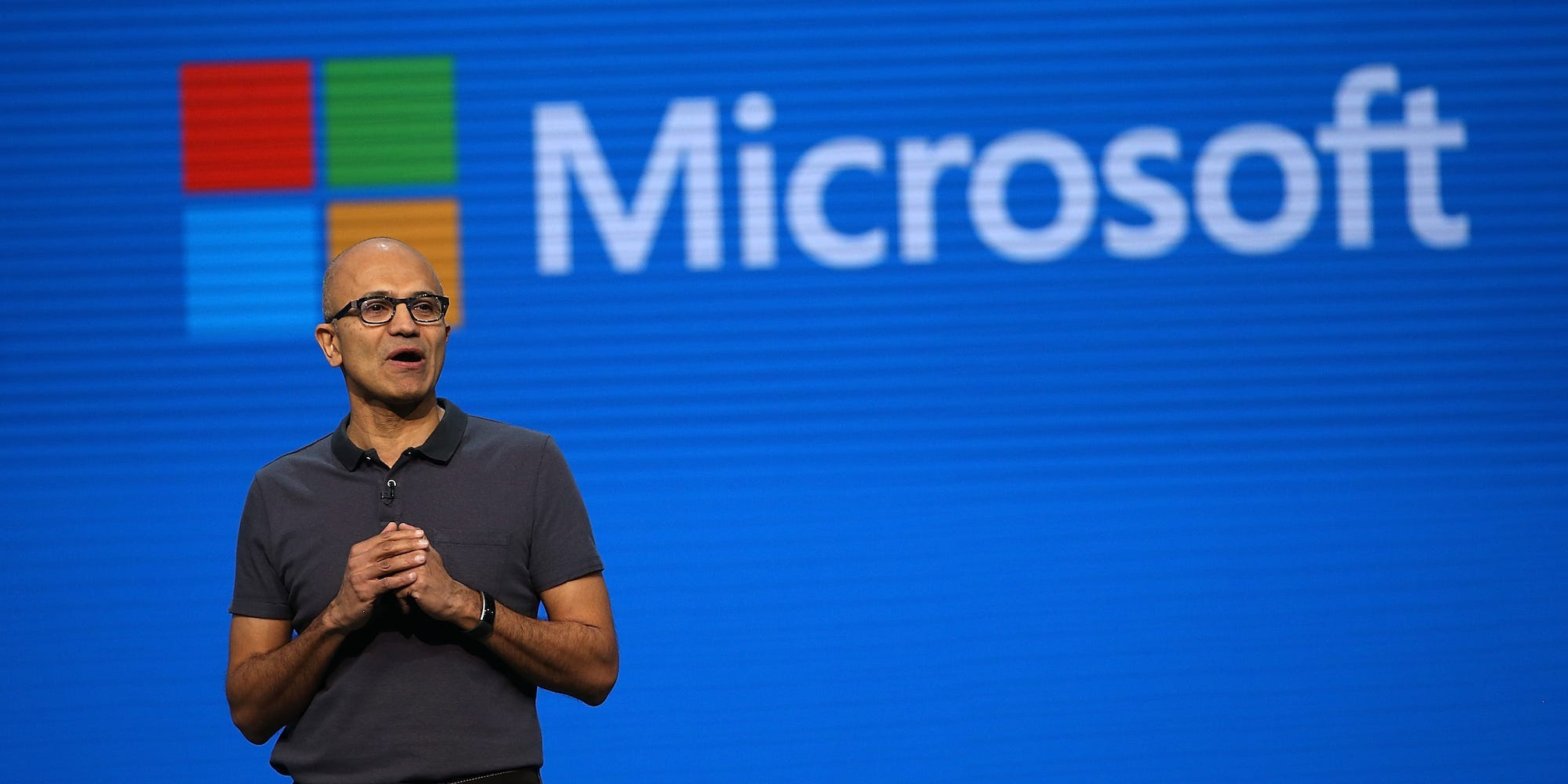

Microsoft’s fiscal fourth-quarter earnings report failed to jolt its stock price higher as investors come to terms with the gradual ramp-up of its new artificial intelligence offerings.

Shares of Microsoft fell about 3% on Wednesday despite it beating both revenues and profit estimates. The company saw revenue grow 8.3% year-over-year to $56.2 billion in the quarter, while its GAAP earnings per share of $2.69 beat analyst estimates by $0.14.

All eyes are on Microsoft’s cloud growth, as well as its rollout of AI technologies via Microsoft CoPilot, which will cost its Microsoft 365 users an additional $30 per month. While the rollout of Microsoft CoPilot could drive significant revenue growth for the company going forward, it will take some time for that opportunity to be fully realized.

Here’s how Wall Street is reacting to Microsoft’s most recent earnings report.

Wedbush: “AI Momentum building in Redmond.””The stock sold off modestly as Nadella and Co. commented that the AI ramp will be ‘gradual’ in FY24 which is not a surprise to the Street as FY25 remains the true inflection year of AI growth with pricing, beta customers, and use cases all being rolled out over the next three to six months,” Wedbush analyst Dan Ives said. “We believe Microsoft is in the early innings of a massive penetration of AI and cloud that could conservatively approach 50% of its global installed base over the next 3 year.

Ives reiterated his “Outperform” rating and raised his price target to $400 from $375.

Bank of America: “AI investment justified given opportunity.””Though Azure growth was below our upside case, we view the high end of the guidance as solid in an environment where optimization headwinds do not appear to be abating. While AI did not provide material upside to Q4 Azure growth (1% tailwind, consistent), guidance for a 2% tailwind in Q1 suggests workloads are ramping. Commentary for a more meaningful AI tailwind to H2 growth suggests that the AI-enabled M365 Copilot offering is likely to begin contributing in that time frame. In summary, AI offerings are expected to contribute meaningfully for both Azure and Office,” Bank of America said.

Bank of America reiterated its “Buy” rating $405 price target.

JPMorgan: “A multi-year trend rather than an instantaneous flip of a switch.””We have been consistent in our view that generative AI is the seminal technological breakthrough of our generation and one that will likely play out over years to come. To the latter point, we cautioned investors that that process of translating early demand to large-scale implementations and recognized revenue will be a multi-year trend rather than an instantaneous flip of a switch. The majority of Microsoft’s Copilot solutions are yet to be made generally available and may take some time to go live as Microsoft iterates on the product in the private preview phase,” JPMorgan said.

JPMorgan reiterated its “Overweight” rating and $385 price target.