All eyes are on Apple as the iPhone maker reports its fiscal third-quarter earnings results on Thursday.The world’s largest company is expected to show continued resiliency in growth in its Services business.Here’s what Wall Street expects from Apple’s upcoming earnings report. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

The world’s largest company will report its fiscal third-quarter earnings report after the market close on Thursday, and it could set the direction for the broader stock market.

Apple is expected to show continued resiliency with its iPhone business, as well as continued growth in its Services business.

Analyst estimates suggest the company will deliver quarterly earnings per share of $1.09 and revenue of $74.2 billion, according to data from Yahoo Finance.

Top concerns among investors include how strong demand for Apple’s iPhone is in China, which has had a difficult economic reopening following the pandemic, as well as the company’s foray into India and other emerging markets.

Here’s what Wall Street expects to hear from Apple when it reports its quarterly earnings results tomorrow.

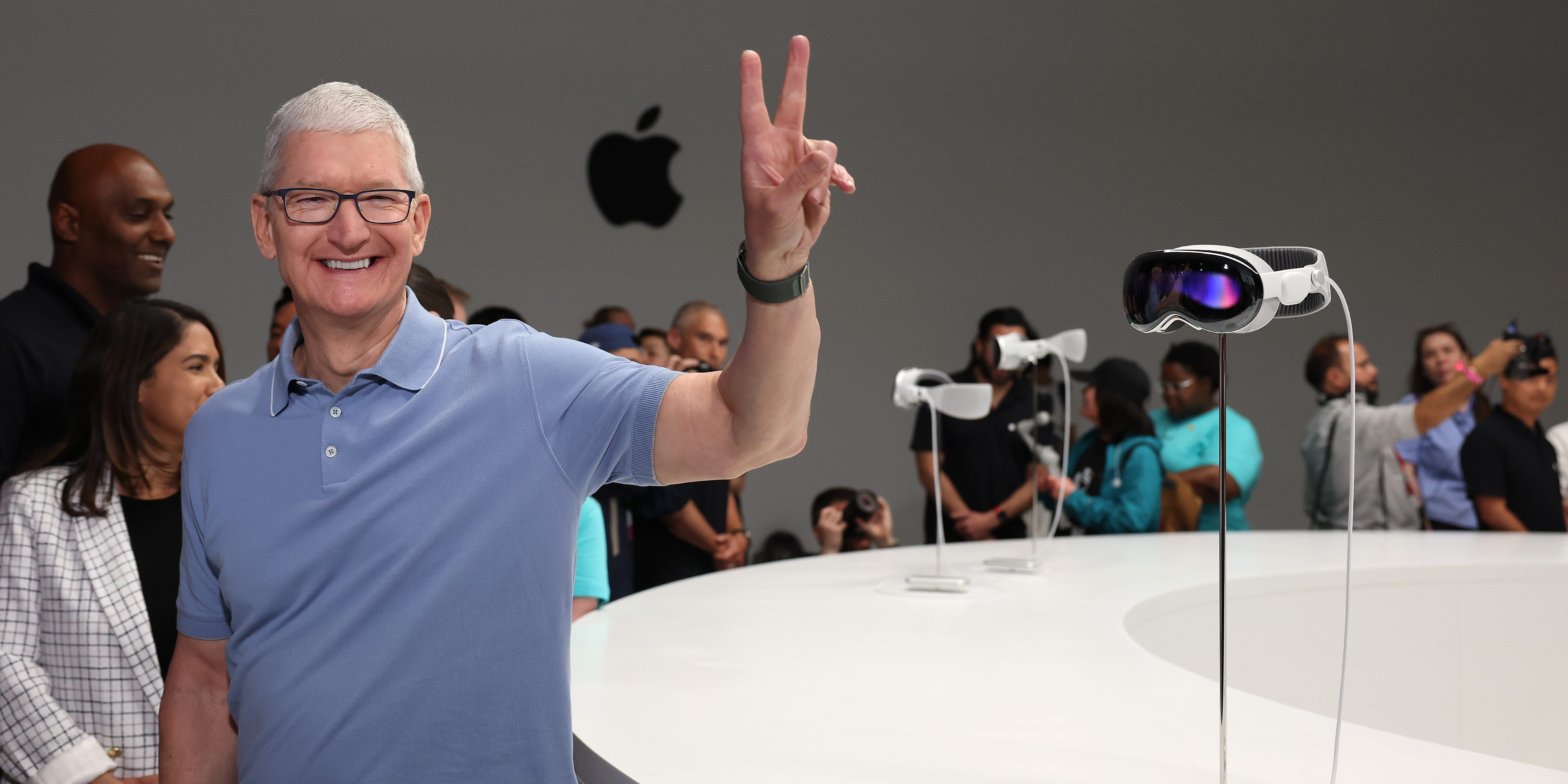

Wedbush: “Another flex the muscles moment from [Tim] Cook.””Based on our recent Asia supply chain checks we believe Apple should post at least in-line June quarter iPhone revenues with upside likely… We believe iPhone units based on a clear uptick in demand around the key China region this quarter could show some upside despite the choppy macro as higher average selling prices and overall upgrade activity on iPhone Pro 14 carry the day for Cook and Co,” Wedbush analyst Dan Ives said.

“We would expect relatively conservative September guidance as this is all about the drumroll to the main event with the anniversary iPhone 15 launch slated for the mid September timeframe… we estimate roughly 25% of the current iPhone installed base has not upgraded their iPhone in 4 years+… With the highly anticipated anniversary edition iPhone 15 set to be launched in the September timeframe the handoff from iPhone 14 to iPhone 15 looks to be a “steadier transition” than some other peak to valley iPhone cycles of the past,” Ives said.

Ives rates Apple at “Outperform” with a $220 price target.

JPMorgan: “Resilient earnings compounder rather than a product cycle company.””We see Apple well positioned to drive higher confidence from the upcoming earnings print as an ‘earnings compounder’ that continues to drive resilient performance. Even as Apple cycles past the period of revenue declines that started in F1Q23 (Dec-end), and returns to growth again in F4Q23 (Sep-end), we expect investors to be further convinced of the resilience of the replacement cycle drivers for the hardware products as well as the diversified growth drivers in Services,” JPMorgan’s Samik Chatterjee said.

“We expect the key highlight from the upcoming earnings print to be the return of revenue growth on a year-over-year basis in F4Q23 (Sep-end) with the help of typical seasonality in most parts of the business, but with an additional boost from moderating currency and improving Services growth rates as advertising rebounds,” Chatterjee said.

JPMorgan rates Apple at “Overweight” with a $235 price target.

Goldman Sachs: “Mac, Services, and forex to drive EPS beat.””With AAPL up 48% year-to-date, driven entirely by multiple expansion, we recognize investor concerns around valuation and downside risks, but continue to believe that Apple’s growing iPhone installed base serves as the foundation for growing monetization per user driven by ASP increases, a greater number of Apple devices were iPhone user, and secular industry tailwinds & share gain opportunities in several of Apple’s Services categories. Accordingly, we view AAPL as a long-term earnings & free cash flow compounder with strong visibility into that growth that supports a premium valuation,” Goldman Sachs’ Michael Ng said.

Goldman Sachs rates Apple at “Buy” with a $220 price target.