Bond market vigilantes could come into force as fears over the deficit rise, Ed Yardeni said. That refers to investors who seek to rein in government spending by sending Treasury yields soaring. Yields on the 10-year Treasury this week notched their highest level since 2007. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

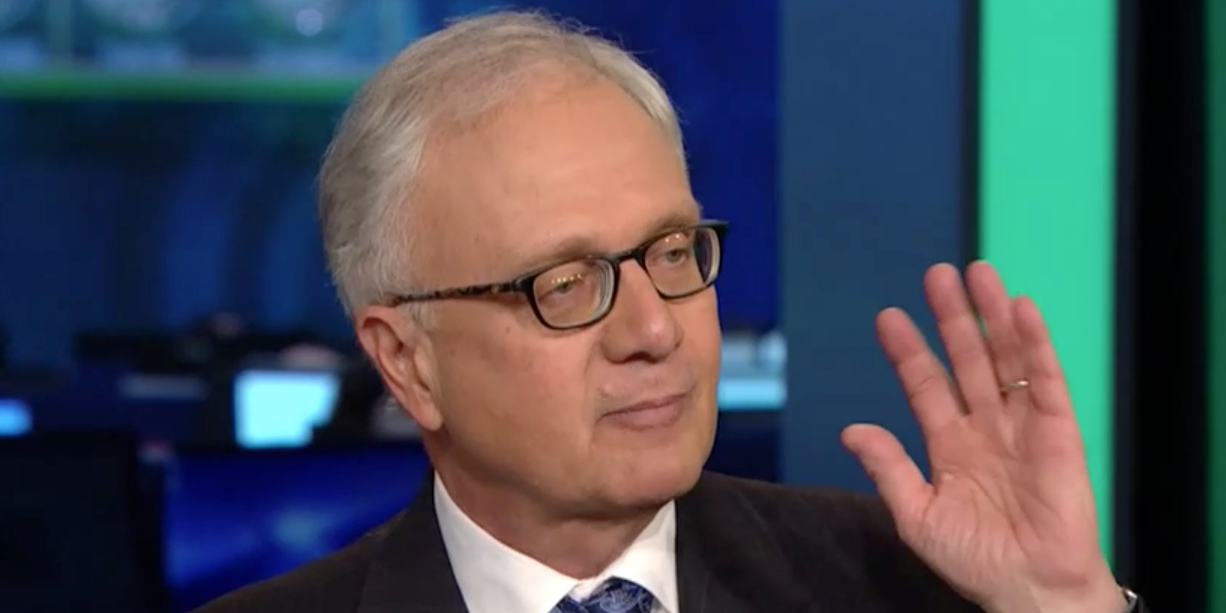

Bond market vigilantes could be making a comeback in the US amid fears over the ballooning government deficit and too-stubborn inflation, according to market veteran Ed Yardeni.

The Yardeni Research president pointed to the slew of economic risks facing the US, with inflation still well-above the Fed’s 2% target. Prices accelerated 3.7% in August, rising at a faster pace than the prior month.

According to Yardeni, sticky inflation is his top worry for the US economy, especially within the context of the ballooning government debt balance. The federal debt load just topped $33 trillion for the first time ever this month, reflecting a rapid pace of spending that has worried economists for years.

That spells trouble for the bond market, where investors’ perceived risk over the long-term has already begun to spike. And bond market vigilantes could be coming back, Yardeni warned, using a term he coined in the 80s, which refers to investors seeking to rein in government spending by orchestrating a sell-off in US Treasuries.

“Ever since the government debt was downgraded on August 1, people have been focusing on the deficit issue,” he said in an interview with CNBC on Wednesday. “If inflation kind of stays sticky here, I think we’re going to have a real problem, and my friends, the bond vigilantes, may need to come into force to convince politicians we’ve got to do something more fundamental about reducing the long-term outlook for the deficit.”

US investors famously dumped Treasurys in the early 90s over concerns on the national debt balance, causing yields to spike – an event later known as the Great Bond Massacre.

Last year, British investors did major damage to the UK bond market after former Prime Minister Liz Truss proposed hefty tax cuts, causing yields to jump and the sterling to plunge.

“The bond vigilantes have been sleepy for a long time here, but they’re waking up, and that’s a danger for the economy and that’s a danger for the stock market,” Yardeni said.

Stocks have reacted poorly in September to the surge in bond yields, with the S&P 500 down about 6% for the month, it’s worst monthly loss of the year.

Treasury yields in the US have surged in recent weeks as investors adjust to the higher for longer interest rate outlook. Shortly after Fed Chair Jerome Powell warned that interest rates in the economy could remain elevated, yields on the 10-year Treasury notched their highest level since 2007, while yields on the two-year Treasury notched their highest level since 2006.