Over 20 analysts cut their targets after the stock plunged 17 per cent in Toronto on Wednesday, its biggest drop ever

Author of the article:

Bloomberg News

Stefanie Marotta

A monitor displays Shopify Inc.. signage on the floor of the New York Stock Exchange. Photo by Michael Nagle/Bloomberg files Canadian e-commerce company Shopify Inc. had the average price target on its shares slashed to the lowest level since January 2021 after it signalled slower sales growth.

Advertisement This advertisement has not loaded yet, but your article continues below.

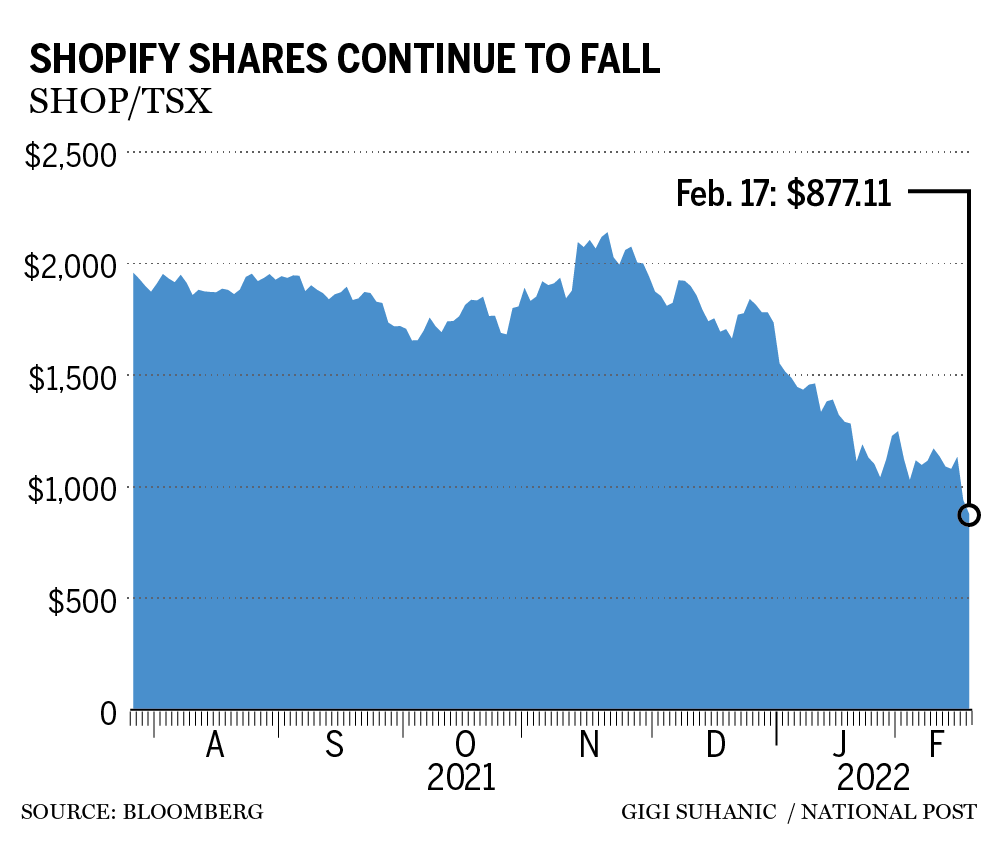

More than 20 analysts cut their targets after the stock plunged 17 per cent in Toronto on Wednesday, its biggest drop ever, following a company statement that full-year revenue growth will be lower than the 57 per cent increase in 2021. Shares extended their slump Thursday.

Shopify’s business surged during the pandemic, with sales jumping 86 per cent in 2020 as shoppers moved online. It became Canada’s most valuable company by market capitalization, overtaking Royal Bank of Canada. It surrendered that position in December amid a broader tech selloff, and as shoppers returned to brick-and-mortar stores.

More On This Topic Shopify shares plummet on slower growth outlook Coinbase adds Shopify founder Lütke to board amid e-commerce push Shopify plunges in 2022 tech wreck, losing title as Canada’s biggest publicly traded company This advertisement has not loaded yet, but your article continues below.

Article content Last month, Shopify said it had canceled warehouse and fulfilment-centre contracts, pushing shares to a 16-month low. The company has tumbled almost 50 per cent this year, losing about $100 billion in market value.

“The reality is that the above ‘in-line’ results combined with no firm outlook guidance was not enough,” National Bank analyst Richard Tse said in a note to clients. “If the above wasn’t enough to cause pause, a further notable fly in the ointment was a shift in the company’s SFN (fulfilment) strategy to own or run more of the major fulfilment hubs.”

Even as targets were gutted, analysts are largely positive on the stock: Shopify has only one sell rating, with 27 buys and 19 holds.

Bloomberg.com

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300