ETFs

Investors will likely benefit from a “flight to quality” in 2022 and this Fidelity fund offers higher rewards and lower risk than its peers.When the market gets rough, you hear a lot about a “flight to quality.”

In the stock market, that means companies that have a lower risk profile thanks to traits such as dependable earnings, strong balance sheets, plump dividends or lower-than-average trading volatility, for example.

“Given the likely slowing industrywide for earnings growth in 2022, we think investors will benefit from a diversified basket of higher-quality companies,” says Todd Rosenbluth, head of ETF and mutual fund research at CFRA.

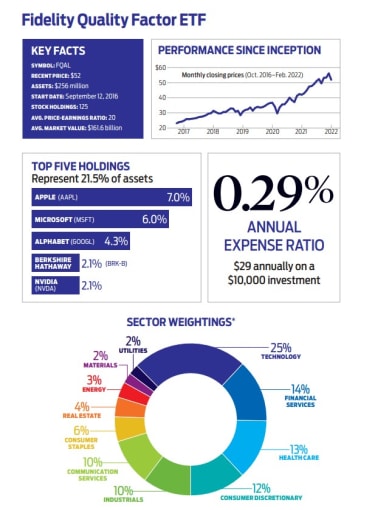

Fidelity Quality Factor ETF (FQAL) tracks a proprietary index designed to home in on stocks with a higher-quality profile than the broad market.

The index measures how efficient a company is at converting sales to cash, how much profit it generates with the assets invested by stock and bond holders, and how consistently it can generate positive free cash flow (cash profits left after investing to maintain and expand the business). The approach differs from that of funds that overweight a particular sector, say, or focus mostly on debt levels.

The exchange-traded fund has a higher expense ratio than many of its peers, but its returns are competitive.

With just under $260 million in assets – compared with billions for similar offerings iShares MSCI USA Quality Factor ETF (QUAL) and Invesco S&P 500 Quality ETF (SPHQ), for example – the Fidelity fund “is an under-the-radar quality ETF,” says Rosenbluth, with a “higher reward potential and less risk than its high-quality peers and the broader U.S. market.”