Stock Market Today

The Nasdaq had its best day since November 2020, while the S&P 500 posted its biggest one-day advance in almost two years.The markets staged a robust relief rally that saw all but two sectors – energy (-3.1%) and utilities (-0.7%) – finish in the green.

Boosting investor sentiment were headlines indicating that foreign ministers from Ukraine and Russia will meet in Turkey on Thursday – the first cabinet-level talks to be held between the two countries since the conflict began.

This follows reports Ukraine President Volodymyr Zelensky on Monday said he is open to a dialogue with Moscow.

“Within equity markets, all the areas of the market that have been hit the hardest recently are snapping back sharply,” says Michael Reinking, senior market strategist for the New York Stock Exchange. This included financials, which rose 3.7% after “a few more European banks overnight provided updates on Russian exposure which were not as bad as some had feared,” as Reinking explained.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

However, it was technology (+4.0%) that led the charge, with chip stocks Nvidia (NVDA, +7.0%) and Advanced Micro Devices (AMD, +5.2%) among the biggest gainers.

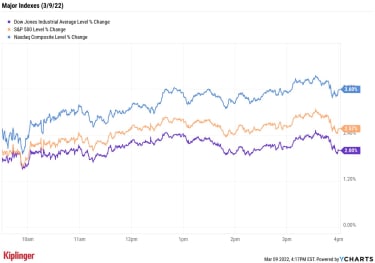

At the close, all three major benchmarks had snapped their four-day losing streak, with the Nasdaq Composite up 3.6% at 13,255, the S&P 500 Index 2.6% higher at 4,277 and the Dow Jones Industrial Average up 2% to 33,286.

It was the Nasdaq’s best day since November 2020 and was enough to pull the tech-heavy index out of a bear market. The S&P 500, meanwhile, had its biggest one-day gain since June 2020, while the Dow’s advance moved it out of correction of correction territory.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 popped 2.7% to 2,016.U.S. crude futures retreated sharply from Tuesday’s 13-year high, sinking 12.1% to settle at $108.70 per barrel. Gold futures slid 2.7% to end at $1,988.20 an ounce, snapping a four-day winning streak.Bumble (BMBL) shot up 41.9% after BMO Research analyst Daniel Salmon upgraded the dating app shares to Outperform. “Catalysts should be driven by the Bumble app and include international expansion milestones and new bundle launches, while new advertising/sponsorship opportunities will be tested over the near term (likely on BFF first) supporting multiple re-expansion,” the analyst says. Raymond James analyst Andrew Marok (Outperform) also chimed in on BMBL, saying last night’s earnings report came in “better-than-feared.” Marok added that while Bumble’s decision to pull operations out of Russia will create roughly $20 million in headwinds in fiscal 2022, its full-year guidance is still “ahead of expectations.”Declining oil prices lit a fire under travel stocks. Carnival (CCL, +8.8%), Royal Caribbean (RCL, +5.5%), American Airlines (AAL, +5.9%) and United Airlines (UAL, +8.3%) were some of the day’s biggest winners.A Big Boom in Bitcoin PricesAnother big winner on Wall Street today: Bitcoin. The cryptocurrency jumped 11.3% to $41,807 (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) after President Biden signed an executive order aimed at regulating digital-asset transactions.

The administration outlined several objectives as part of an effort to assess digital assets at the federal level, which include financial inclusion and responsible innovation. The goal of the order is to help the U.S. “maintain technological leadership in this rapidly growing space,” while “mitigating the risks for consumers, businesses, the broader financial system and the climate.”

This regulation could continue to give cryptocurrencies a boost, says Anthony Denier, CEO of trading platform Webull. Digital assets have “definitely been at reputational risk for buying an asset class that is so volatile and derided. Oversight gives them a firmer ground to stand on.”

There are plenty of ways for investors to gain exposure to the top cryptocurrencies too. In addition to stocks that are connected to crypto in some way, Wall Street is now flush with Bitcoin ETFs and other cryptocurrency funds. Read on as we highlight 17 funds focused on riding the crypto wave.

124 Companies That Have Pulled Out of Russia

stocks

124 Companies That Have Pulled Out of RussiaThe list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

March 9, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

5 Superb Stocks to Shield Against Stagflation

stocks

5 Superb Stocks to Shield Against StagflationSoaring inflation and slowing economic growth have many investors seeking out stocks that will tamp down stagflation risk. Here are five top-rated nam…

March 7, 2022

Amazon Stock Split Puts It in Play to Join the Dow

stocks

Amazon Stock Split Puts It in Play to Join the DowAmazon.com’s four-digit price tag is coming down as the e-tailer announces a 20-for-1 AMZN stock split effective in June.

March 10, 2022

124 Companies That Have Pulled Out of Russia

stocks

124 Companies That Have Pulled Out of RussiaThe list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

March 9, 2022

Stock Market Today (3/8/22): Stocks Suffer Whiplash After Russian Energy Ban

Stock Market Today

Stock Market Today (3/8/22): Stocks Suffer Whiplash After Russian Energy BanThe market went round-trip on Tuesday, bouncing from modest losses to significant gains before slipping back into the red.

March 8, 2022

Stock Market Today (3/7/22): Nasdaq Falls Into Bear-Market Territory

Stock Market Today

Stock Market Today (3/7/22): Nasdaq Falls Into Bear-Market TerritoryThe Nasdaq Composite is now off more than 20% from its November highs after progress toward more Russia sanctions sent stocks even lower Monday.

March 7, 2022