ETFs

Tech was the biggest payer of dividends among all S&P 500 sectors in 2021, according to CFRA.It may surprise you that in 2021, the technology sector was the largest payer of dividends among sectors in the S&P 500 Index, according to investment research firm CFRA.

Tech stocks contributed more than 17% of the overall income for the broad-market benchmark. That’s more than the contribution from healthcare (15%), financials (14%) and consumer staples (11%), notes CFRA.

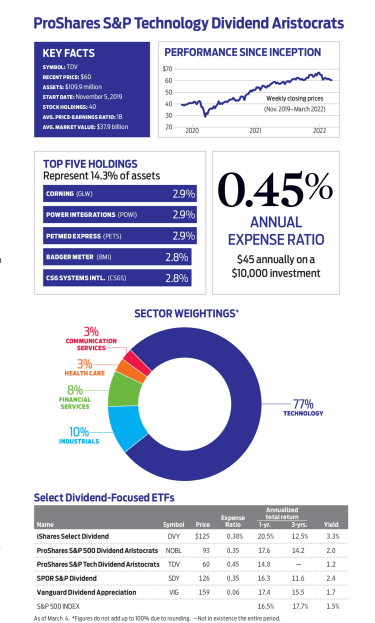

And yet, many exchange-traded funds that invest in companies with a track record of hiking dividends have relatively limited exposure to tech. The ProShares S&P 500 Dividend Aristocrats (NOBL), for example, which tracks an index requiring firms to have posted at least 25 consecutive years of dividend increases, holds 1.5% of assets in tech, compared with 22% in consumer staples.

The ProShares S&P Technology Dividend Aristocrats (TDV) holds 77% of assets in tech stocks. Tracking an index that requires a minimum of just seven years of dividend hikes allows the fund to home in on tech names with the wherewithal to consistently return cash to shareholders. Holdings are equally weighted, so behemoths with giant market values can’t dominate. The 40 stocks in the portfolio range from household names such as Apple (AAPL) and Broadcom (AVGO) to water-meter manufacturer Badger Meter (BMI) and pet pharmacy PetMed Express (PETS).

The ETF, yielding 1.2%, might be worth a look by dividend investors who want to balance out sector exposure or by tech investors who prefer the cushion of a dividend in an often-volatile sector.

SOURCES: CFRA, fund sponsors, Morningstar Direct, Yahoo Finance