This is what happened to the stock market after

Publishing date:

Mar 16, 2022 • March 16, 2022 • 3 minute read • 13 Comments

Food and energy inflation has been surging. Photo by Getty Images/ Reuters By David Rosenberg and Brendan Livingstone

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

Food and energy inflation — notoriously volatile but representing key expenditures for households that can’t easily be reduced — has been surging. At more than 15 per cent year over year (a threshold first breached last October), we are seeing a degree of price gains that have only occurred four other times in the past (1973, 1979, 2005 and 2008).

Note that three of these instances took place during economic downturns, a warning to investors that the spike in prices that has already transpired raises the odds of a recession. The recent decline in equities, as well as the widening in high-yield spreads, provide further confirmation of this rising risk on the horizon.

Keep in mind that this is before the sanctions on Russia have exerted their impact on food and energy prices. Thus far during March, agriculture prices are up 15 per cent and energy prices are 10 per cent higher. This will further exacerbate food and energy costs for households, leading to less disposable income for discretionary purchases.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

One can readily imagine how this will lead to an especially large pullback in demand for big-ticket durable goods, which were already poised to see a meaningful demand hit as purchases were pulled forward during the pandemic.

In light of our view that recession risks are rising, particularly given the moves in food and energy prices, we went back and looked at stock market performance in the year following a spike in food and energy CPI (above 15 per cent year over year).

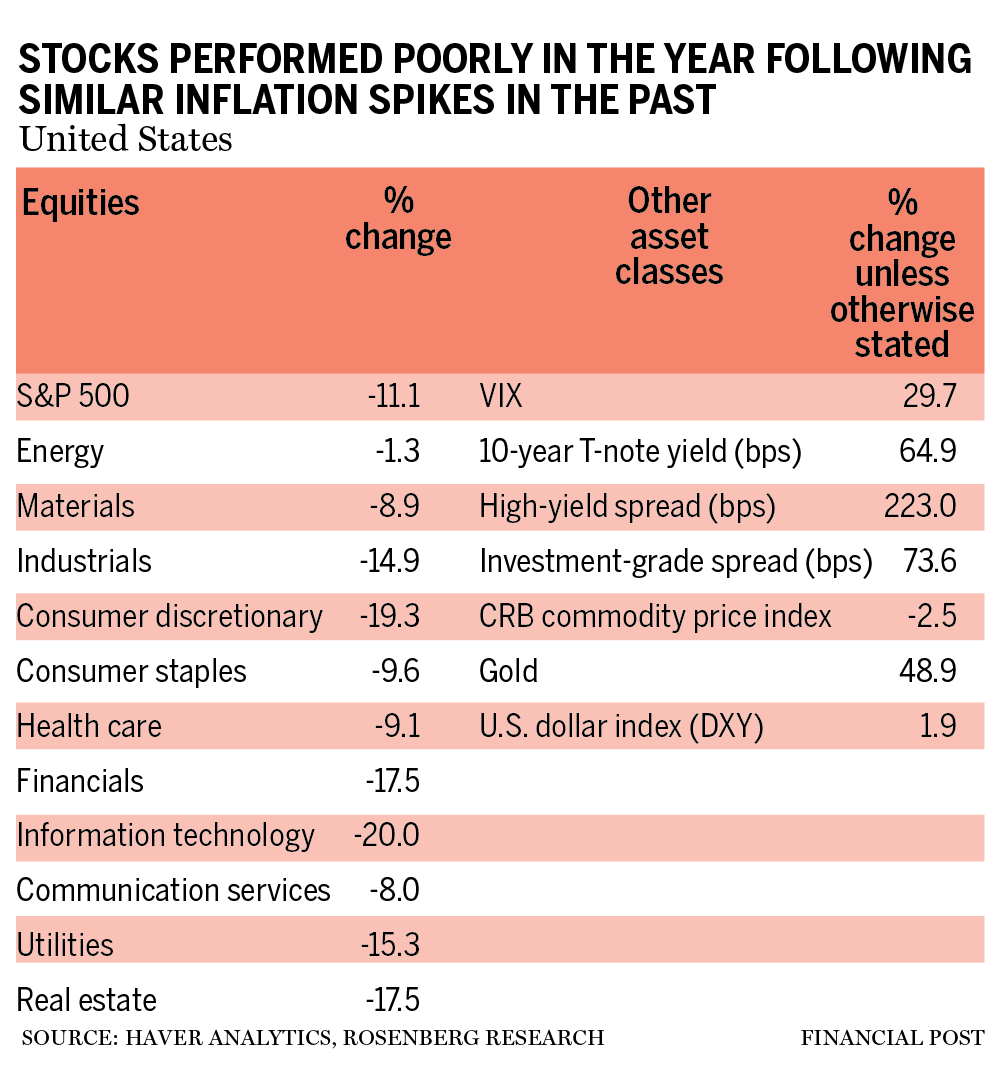

Perhaps unsurprisingly — since three of four occurrences took place during recessions — the S&P 500 did quite poorly in the following year, with an average decline of 11.1 per cent. All 11 S&P 500 sectors declined, although there is a pretty meaningful dispersion in performance. Indeed, on one hand, energy (-1.3 per cent) held up quite well, suggesting this sector has served as a good spot for investors to hide out. Conversely, technology (-20 per cent) was the worst performer, which is to be expected given its long duration status (making it particularly vulnerable to spikes in inflation).

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

Beyond equities, corporate bonds did quite poorly during these periods when GDP growth slows and the economy enters recession. High-yield spreads widen out 223 basis points on average, and investment-grade spreads were 74 basis points wider. Historically, the 10-year Treasury yield also increased (by 65 basis points) as inflation expectations remain elevated.

However, as far as the current period is concerned, note that the 10-year T-note yield has already increased 55 basis points since last October, representing most of an “average” up move. In other words, the spike in inflation today appears largely priced into the Treasury curve.

But the one asset class that investors should really focus on is gold, which was up a whopping 48.9 per cent during the periods under review. And this was with a stronger U.S. dollar (+1.9 per cent) and Treasury yields moving higher — a positive sign that indicates fundamental support. By way of comparison, the broader commodity complex fell slightly (by 2.5 per cent on average) over the next year due to the demand destruction caused by higher food and energy costs.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

More On This Topic David Rosenberg: The Russians aren’t coming, they’ve arrived — here’s what could happen next David Rosenberg: Looking for opportunities amidst the volatility David Rosenberg: Defensives over cyclicals as the knife falls on earnings estimates The bottom line is that recession risks are rising, particularly as food and energy prices, which were already spiking, are poised to move higher due to the Russia-Ukraine war. In the past, similarly high run rates have resulted in a recessionary outcome in three out of four instances. Against this backdrop, stocks have performed poorly, although the dispersion between the top-performing sector (energy) and worst performer (technology) is quite wide, suggesting good opportunities for active managers to add alpha.

This advertisement has not loaded yet, but your article continues below.

Article content In the corporate bond market, spreads are wider, with a particularly large move in lower-rated credit. Treasury yields also tend to increase, but the move that has already transpired suggests most of the inflation spike is priced in. However, gold has been, by far, the most attractive investment in these periods, suggesting investors should make this a point of emphasis within their portfolio.

David Rosenberg is founder of independent research firm Rosenberg Research & Associates Inc. Brendan Livingstone is a senior strategist there. You can sign up for a free, one-month trial on Rosenberg’s website.

_____________________________________________________________

For more stories like this one, sign up for the FP Investor newsletter.

______________________________________________________________

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300