US Markets Loading… H M S

Premium

Morgan Stanley can help investors searching for stocks that will maintain margins even as wage pressure rises. Leon Neal/Getty Images This story is available exclusively to Insider subscribers. Become an Insider and start reading now. Morgan Stanley says labor markets could stay tight for years, continually pushing wages higher. Right now, companies are concerned about what that will do to their profits. The firm named 10 stocks that face minimal wage pressure, which will help margins and performance. Amazon has its first unionized warehouse, and it’s just the latest sign among many that the power of labor is on the rise.

This week Morgan Stanley published a report that found that labor held onto a steady share of corporate profits for years up until the turn of the millennium. At that time, its share dropped precipitously thanks in part to declining unionization and falling real minimum wages. But the tide turned around 2014 and 2015.

Morgan Stanley says that now workers are starting to take a larger share of corporate profits, a trend that only sped up after the pandemic hit. And while companies still keep a much larger share of profits than they did before 2000, the turn in favor of workers might keep going for a long time because of worker shortages and a lack of population growth.

“The record-breaking pace of the economic recovery has come with very fast wage growth. If we are right, monetary and fiscal policy will henceforth create persistently tight labor markets, meaning that the case for a structural uptrend in wages — and therefore the labor share of income — is strong,” wrote a group including Economist Julian Richers, Chief Investment Officer Mike Wilson, and Chief US Economist Ellen Zentner.

That has wide-ranging implications for the economy and stock markets. One outcome that matters a lot to investors is that it’s going to put pressure on company profit margins.

“In our top-down economic model, the full convergence of real wages with productivity implies that the economy-wide pretax profit margin declines to 10.7% from 17.8% today,” wrote the Morgan Stanley team. If that happens over the next five years, pretax profits would go back to their 1990’s average.

Companies are very concerned about rising wages and about other rising costs — many of which affect profit margins more immediately than higher wages do. Morgan Stanley says that companies have raised prices to keep their margins strong, but in a period of rapid inflation, that strategy may not work for much longer.

“Price increases to offset higher wages may soon lose steam as demand destruction is emerging in consumer end markets, including household durables, autos, and homes,” the firm wrote.

With fewer tools at firms’ disposal, it could be important for investors to find the companies that are less vulnerable to the effects that rising prices could have on their profit margins and their earnings. Morgan Stanley’s analysts concluded that the following 10 companies have notably low levels of wage-related risk.

The reasons these stocks are relatively protected vary based on the companies’ business models and the sectors they operate in. The companies are ranked below from lowest to highest based on how much upside they have relative to Morgan Stanley’s price targets.

Those upside figures were calculated based on Thursday’s closing prices. At that time, nine of the 10 stocks had double-digit upside.

10. Costco

Costco Markets Insider Ticker: COST

Sector: Consumer staples

Thesis: “COST has been a long-time leader on wages and was the first in our coverage to reach a $15/hour minimum wage. … While wage pressure is widespread, COST is so far ahead of the rest of the market that it can get away with not substantially lifting hourly rates, or potentially not raising them at all.” — Simeon Gutman

Price target: $560

Upside to target: -2.8%

Source: Morgan Stanley

9. Realty Income

Realty Income Markets Insider Ticker: O

Sector: Real estate

Thesis: “Triple Net REITs are arguably the REIT subsector that would be the most insulated from higher wages. … the burden of insurance, property taxes and operating expenses on the property is borne by the tenant. Indeed, the NOI margins are the highest in the REITs space at over 95% as nearly all of rents flow through to the bottom line.” — Ron Kamdem

Price target: $78

Upside to target: 12.6%

Source: Morgan Stanley

8. National Retail Properties

National Retail Properties Markets Insider Ticker: NNN

Sector: Real estate

Thesis: “Triple Net REITs are arguably the REIT subsector that would be the most insulated from higher wages. … the burden of insurance, property taxes and operating expenses on the property is borne by the tenant. Indeed, the NOI margins are the highest in the REITs space at over 95% as nearly all of rents flow through to the bottom line.” — Ron Kamdem

Price target: $51

Upside to target: 13.5%

Source: Morgan Stanley

7. McDonald’s

McDonald’s Markets Insider Ticker: MCD

Sector: Consumer discretionary

Thesis: “Franchised restaurants avoid most direct labor cost exposure. MCD, which is 93% franchised and internationally diversified (wage pressures are more of an issue in the US), is a classic defensive stock gaining market share with sales drivers in place for ’22. Franchisee profitability reached record levels last year, providing some cushion to absorb greater inflation.” — John Glass

Price target: $287

Upside to target: 16.1%

Source: Morgan Stanley

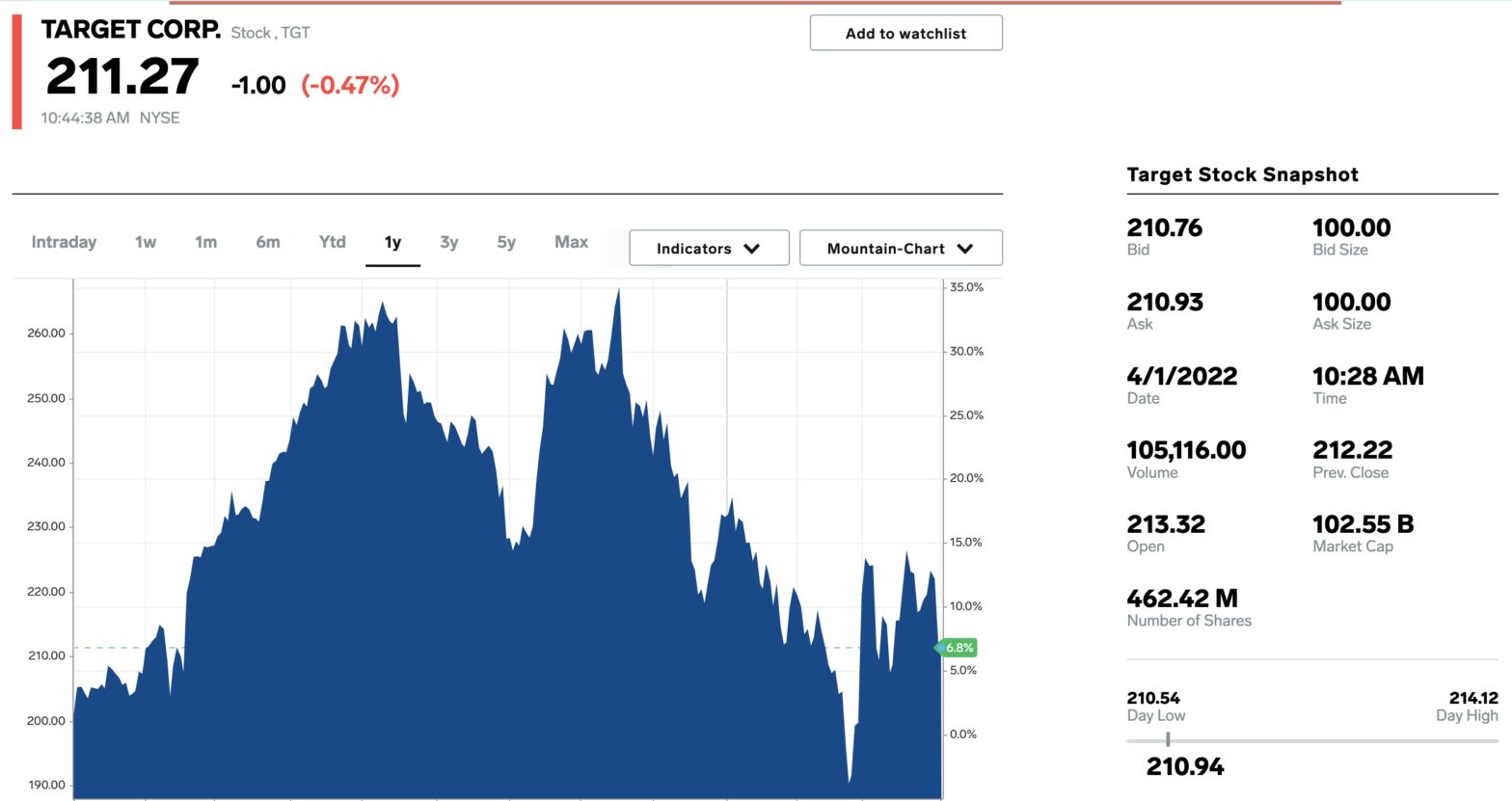

6. Target

Target Markets Insider Ticker: TGT

Sector: Consumer discretionary

Thesis: “On a relative basis TGT’s wages likely don’t need to move up as much as others’. We do expect SG&A to delever on slowing sales, even with solid expense management, and wage increases are a driver. ” — Simeon Gutman

Price target: $255

Upside to target: 20.2%

Source: Morgan Stanley

5. Willscott Mobile Mini Holding

WillScot Mobile Mini Markets Insider Ticker: WSC

Sector: Industrials

Thesis: “WSC has one of the strongest pricing narratives within our machinery coverage … We expect another year of ‘double digit’ pricing in FY22 — well in excess of labor inflation as well as other variable costs including delivery & installation, which should lead to more than 200bps of margin expansion.” — Courtney Yakavonis

Price target: $48

Upside to target: 22.7%

Source: Morgan Stanley

4. Boyd Gaming

Boyd Gaming Markets Insider Ticker: BYD

Sector: Consumer discretionary

Thesis: “We believe that Gaming operators are more immune from wage pressure because: 1) dealers were already relatively well-paying jobs (>$60k/ year); and 2) given the broad rationalization of casino workers across the industry, Las Vegas has the highest unemployment rate of any MSA in the US, creating a looser labor market.” — Thomas Allen

Price target: $82

Upside to target: 24.7%

Source: Morgan Stanley

3. Rockwell Automation

Rockwell Automation Markets Insider Ticker: ROK

Sector: Industrials

Thesis: “We view Rockwell as a prime beneficiary of secular investments driven by multitude of catalysts converging (supply chain constraints, labor shortages, near-shoring) as technology is improving and paybacks are shortening. … ROK’s focus on factory automation keeps the stock fairly insulated from higher wages given the ability to increase automation in its own factories.” — Josh Pokrzywinski

Price target: $395

Upside to target: 41.1%

Source: Morgan Stanley

2. Nike

Nike Markets Insider Ticker: NKE

Sector: Consumer discretionary

Thesis: “We expect Global Brands to be relatively insulated from wage inflation given lower store counts and high revenue penetration in the wholesale & eComm channels. Additionally, revenue exposure to international geographies could help alleviate pressures from US wage inflation.” — Kimberly Greenberger

Price target: $192

Upside to target: 42.7%

Source: Morgan Stanley

1. Knight-Swift Transportation

Knight-Swift Transportation Marketwatch Ticker: KNX

Sector: Industrials

Thesis: “While TL driver wages have seen some of the sharpest increases over the last two years, KNX’s relatively low exposure to wage-driven costs as a % of revenues and remarkable pricing power (evidenced by EBIT growth 2x the group average) should position them well to navigate wage inflation. We believe scale and exposure can make them the biggest beneficiary of any additional upside from the cycle.” — Ravi Shanker

Price target: $85

Upside to target: 68.5%

Source: Morgan Stanley

Deal icon An icon in the shape of a lightning bolt. Keep reading

Receive a selection of our best stories daily based on your reading preferences.

Loading Something is loading.

More: Features Investing Stocks Chevron icon It indicates an expandable section or menu, or sometimes previous / next navigation options.

Deal icon An icon in the shape of a lightning bolt. For you