Canada’s economy is firing on all cylinders; unfortunately so is inflation

Publishing date:

Apr 13, 2022 • 9 hours ago • 5 minute read • 56 Comments

Bank of Canada governor Tiff Macklem speaks during a news conference in Ottawa Wednesday. Photo by Justin Tang/Bloomberg The Bank of Canada intentionally overdid it on the way into the COVID-19 recession. So perhaps it shouldn’t be a surprise that policy-makers are scrambling to keep up with an economy that heated up faster than they anticipated.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

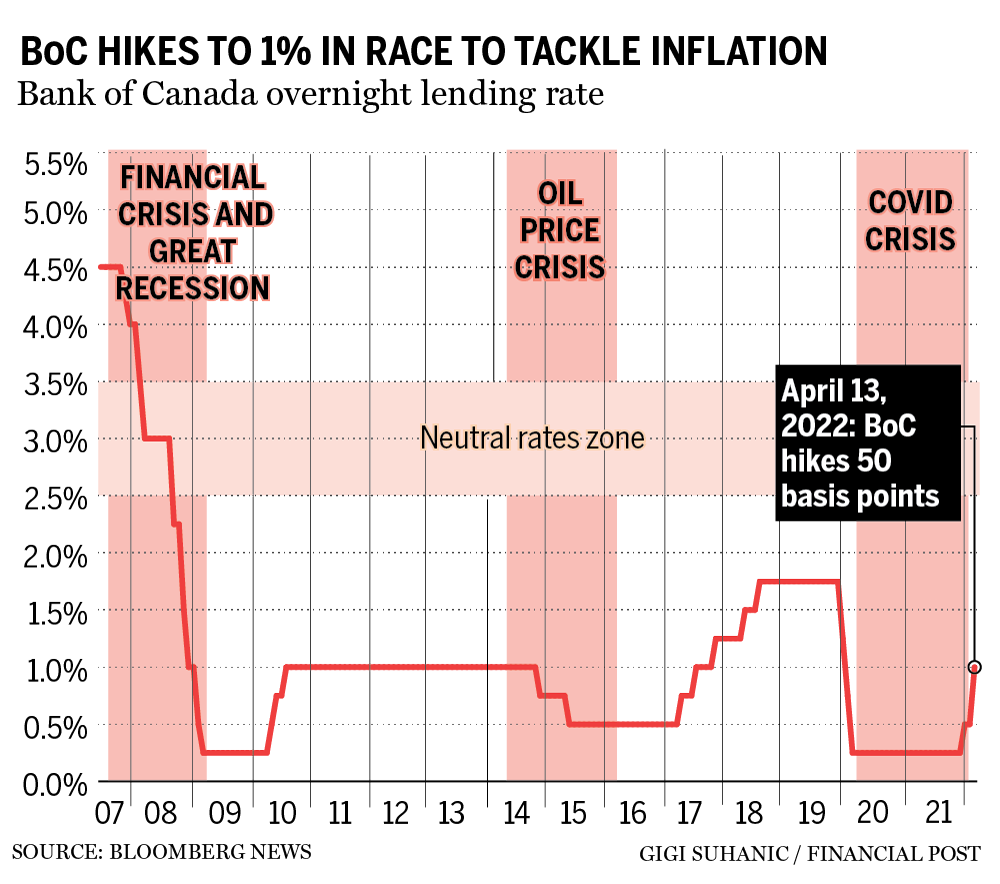

Governor Tiff Macklem and his deputies raised the benchmark interest rate by half a percentage point on April 13, an aggressive move since central banks generally prefer to move in quarter-point increments.

Policy-makers also said they would initiate “quantitative tightening,” which means the central bank will remove itself as an active participant in the bond market. The Bank of Canada purchased hundreds of billions of dollars of bonds during the recession to put additional downward pressure on interest rates, and had been reinvesting what it earned when those assets matured. The reinvesting will now stop.

The outsized increase in borrowing costs, which took the benchmark interest rate to one per cent, was widely anticipated; the central bank had telegraphed that stronger-than-forecast inflation would force it to accelerate its march to a more normal interest-rate setting.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

Less anticipated, perhaps, was the extent to which the economy is straining on the central bank’s reins. Macklem’s new quarterly economic forecast has gross domestic product increasing at an annual rate of six per cent in the second quarter, which is a rate of growth you would expect in the earliest days of a recovery, not when the recovery is over and the jobless rate at a modern low.

“The Canadian economy is strong,” he said in the opening statement at his quarterly press conference. “The economy has fully recovered from the pandemic, and it is now moving into excess demand.”

By “excess demand,” Macklem meant the central bank’s forecast suggests the economy is now growing faster than its capacity to generate goods and services without stoking inflation. The Bank of Canada revised its estimate of the “output gap,” an important concept in central banking, if mostly meaningless to the rest of us, to between -0.25 per cent and 0.75 per cent, compared with an estimate of -0.75 per cent and 0.25 per cent in January.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

All that growth would be something to cheer if it wasn’t paired with equally strong inflation. The Bank of Canada acknowledged it underestimated how much the consumer price index would increase in the first quarter, and now predicts an average monthly gain of 5.6 per cent, compared with the 5.1 per cent it forecasted in January.

Policy-makers expect average headline inflation of 5.8 per cent in the second quarter, and forecast that price increases will remain well above the high end of their comfort zone — one per cent to three per cent — for the rest of the year.

“Today’s decision suggests the BoC is going on offence,” Charles St.-Arnaud, chief economist at Alberta Central and a former Bank of Canada staffer, said in a note to clients. “The door remains open to further (half-point) hikes.”

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

The Bank of Canada said the war in Ukraine was the primary reason it underestimated inflation. Russia and Ukraine are big exporters of oil, natural gas, wheat and other commodities, and prices for those important inputs have soared since Russian President Vladimir Putin’s invasion of Ukraine on Feb. 24.

More On This Topic Bank of Canada raises interest rate: Read the official statement Bank of Canada survey shows most businesses think it will take at least two years to get inflation under control The Bank of Canada will almost certainly take the steeper path to higher rates next month Inflation surges to 5.7%, adding pressure on Bank of Canada to accelerate rate hikes It’s hard to criticize the Bank of Canada governor for failing to foresee a war in Europe. But that’s what happened, and now he must contend with an emergency stimulus program that worked so well that little of the scarring that typically occurs during a recession happened this time.

This advertisement has not loaded yet, but your article continues below.

Article content As a result, the economy came out of the downturn firing on all cylinders. That’s creating more demand than there is supply, putting extra pressure on prices amid a war, drought, COVID-19 lockdowns and sundry other disruptions that have already put upward pressure on prices.

The Bank of Canada emphasized it is far from finished. Its new forecast discovered the economy is probably now operating at a level that exceeds estimates of what it can produce without stoking inflation. And yet the benchmark rate is still below its pre-pandemic level.

A second half-point increase when the central bank next updates its policy rate on June 1 would surprise no one.

Policy-makers said they are worried households and businesses will absorb current inflation as the new normal. The Bank of Canada is relying on its credibility with the public to keep expectations anchored.

This advertisement has not loaded yet, but your article continues below.

Article content The thing about expectations is that you have to back up your words with actions every once in a while. For Canada’s central bank, this is probably one of those times. The central bank has confronted bursts of inflation before during the three decades it has used the consumer price index to guide interest rates, but nothing like the threat it is facing now.

“Inflation is too high,” Macklem said. “We need higher interest rates.”

How much higher? The central bank isn’t sure, but the governor was unusually clear about what companies and households should expect. The “neutral” rate of inflation is another concept that is important to central bankers and essentially meaningless to everyone else because it doesn’t exist. However, policy-makers use it as a guide to help them get close to an interest rate that neither helps nor hurts growth.

This advertisement has not loaded yet, but your article continues below.

Article content The Bank of Canada updated its estimate of the neutral rate to a range of two per cent to three per cent. There is some distance to travel to get to the lower end of that range, and Macklem acknowledged it’s possible he will have to push the benchmark rate above the high end to bring inflation under control.

“We have an inflation target, not an interest rate target,” he said. “This means Governing Council is not on autopilot to a pre-set destination for the policy interest rate.”

Still, it’s a safe bet the Bank of Canada is on autopilot for the next little while. The benchmark rate was 1.75 per cent in February 2020, and the economy is arguably stronger now than it was then. There’s a reason St-Arnaud and others predict another outsized increase in June. Macklem is in chase mode.

• Email: kcarmichael@postmedia.com | Twitter: CarmichaelKevin

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300