Stock Market Today

Powell commentary made a 50-basis-point interest-rate increase in May appear even more certain, throwing stocks for a loop Thursday.Stocks flipped sharply from green to red Thursday as interest-rate fears swelled again across Wall Street.

Federal Reserve Chair Jerome Powell sent the latest signal that the central bank’s next rate hike might be soon, and bigger than usual. Powell told an International Monetary Fund panel that it’s “appropriate in my view to be moving a little more quickly” to raise interest rates, adding, “I would say 50 basis points will be on the table for the May meeting.”

The yield on the 10-year Treasury popped in response, from 2.836% to as high as 2.954%.

Initial jobless claims for the week ended April 16 came in at 184,000 – a bit higher for estimates for 182,000, but still historically low and under the previous week’s revised 186,000.

“That said, employment metrics have taken a back seat to inflation and interest rate hikes, so the read today is unlikely to move the needle for the market,” says Mike Loewengart, managing director of investment strategy for E*Trade.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Corporate earnings didn’t do much to turn the tide. Tesla (TSLA, +3.2%) popped after it reported a record $3.3 billion overall profit and easily beat analysts’ consensus earnings estimates. So too did AT&T (T, +4.0%) despite missing on overall revenues; that said, core revenues related to its wireless business improved 2.5% in Q1.

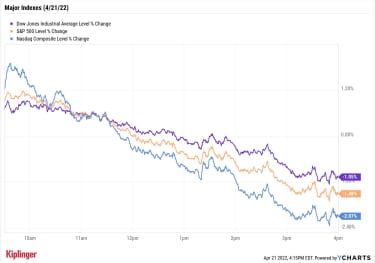

But the major indexes didn’t follow suit. Dips in communication services (-2.8%) and technology (-1.8%) weighed most on the Nasdaq Composite (-2.1% to 13,174), though the S&P 500 (-1.5% to 4,393) and Dow Jones Industrial Average (-1.1% to 34,792) sustained sizable declines, too.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 slumped 2.3% to 1,991.U.S. crude oil futures finished off their highs but still improved by 1.6% to $103.79 per barrel.Gold futures slipped by 0.4%, settling at $1,948.20 per ounce.Bitcoin also shed more than all of its morning gains, declining marginally to $41,207.81. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.Carvana (CVNA) plummeted 10.1% after the online used car dealer reported a loss of $2.89 per share in its first quarter, wider than the $1.58 per-share loss analysts were expecting. The company beat on the top line, however, bringing in $3.5 billion versus a $3.4 billion consensus estimate. “Carvana is facing several industry-wide and company-specific headwinds that are impacting unit volumes and margins,” says Stifel analyst Scott Devitt, who reiterated a Buy rating on CVNA stock. “While near-term trends are challenged, we believe the long-term thesis remains intact as the company continues to capture market share and develop the assets needed to realize significant leverage at scale.”Airline stocks got a lift after positive earnings from United Airlines Holdings (UAL, +9.3%) and American Airlines Group (AAL, +3.8%). While United missed on both the top and bottom lines in its first quarter, the company said it expects to report its highest quarterly revenue and return to a profit in the second quarter. American also reported a wider per-share loss than analysts were expecting in its first quarter, but it beat on revenue and said it expects to post a pre-tax profit in the second quarter. CFRA Research analyst Colin Scarola maintained a Strong Buy rating on UAL, saying its shares are “materially undervalued.” The analyst also kept a Hold rating on AAL. “Low efficiency, much higher debt, and a history of negative free cash flow in 2017-2019 leave us preferring AAL’s peers to invest in the post-pandemic travel recovery,” Scarola writes in a note.The Market’s Latest Ideas Are in Wall Street’s Newest ETFsEver find yourself in an investment rut? Well, if you’re looking for fresh investment strategies to tickle your brain cells, turn your eyes toward the exchange-traded fund (ETF) industry, where there’s always something new.

Indeed, more than 100 ETFs have launched so far in 2022 as the industry sucks up an ever-growing gob of cash – globally, ETFs drew in $305.6 billion in net inflows during the first quarter, marking the second-highest total behind only Q1 2021’s record $361.1 billion. That tally also follows 2021’s record-breaking annual intake.

“Given back-to-back record-breaking calendar years of net inflows, it is less of a surprise that the supply of ETFs has expanded,” says Todd Rosenbluth, head of research at ETF Trends.

Our core ETF recommendations, such as the Kip ETF 20 and the Best ETFs for 2022, are primarily built around established funds and seasoned with the occasional newcomer. But spanking-new ETFs, while unproven, are also worth keeping an eye on given that many of them tend to feature novel investment strategies, emerging industries or cheaper ways to accomplish traditional portfolio goals.

Read on as we highlight nine noteworthy new ETFs that have hit the market in 2022.

17 Worst Things to Buy at Dollar Stores (Dollar Tree Included)

spending

17 Worst Things to Buy at Dollar Stores (Dollar Tree Included)These discount retailers stock plenty of bargains, but not all of the merchandise is worth the buck, especially since Dollar Tree’s price increase.

April 19, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Retirees: Here’s How to Pay for 5 Common Expenses and Cut Your Taxes While Doing It

tax planning

Retirees: Here’s How to Pay for 5 Common Expenses and Cut Your Taxes While Doing ItWith tax planning still fresh on the minds of many retirees following the tax deadline, here are five tax-savvy ways to pay for expenses throughout th…

April 19, 2022

10 Facts You Must Know About Recessions

Markets

10 Facts You Must Know About RecessionsFears of an economic downturn are once again on the rise, but what is a recession, exactly? We tackle this and other questions here.

April 21, 2022

Stock Market Today (4/20/22): Netflix’s Epic Crash Clips Nasdaq

Stock Market Today

Stock Market Today (4/20/22): Netflix’s Epic Crash Clips NasdaqRare subscriber loss hacks Netflix’s value and weighs on its streaming rivals; Tesla reports Q1 beat after hours.

April 20, 2022

11 Emerging Market Stocks That Analysts Love

stocks

11 Emerging Market Stocks That Analysts LoveIt’s been a rough stretch for the global equities market, but Wall Street’s pros think these emerging market stocks are top plays going forward.

April 20, 2022

Stock Market Today (4/19/22): Stocks Rise Despite Rate Concerns, Mixed Earnings

Stock Market Today

Stock Market Today (4/19/22): Stocks Rise Despite Rate Concerns, Mixed EarningsJohnson & Johnson, Lockheed Martin Q1 reports underwhelm; Netflix severely disappoints after the bell with a Q1 subscriber loss.

April 19, 2022