Activist investor targeting Suncor has long track record

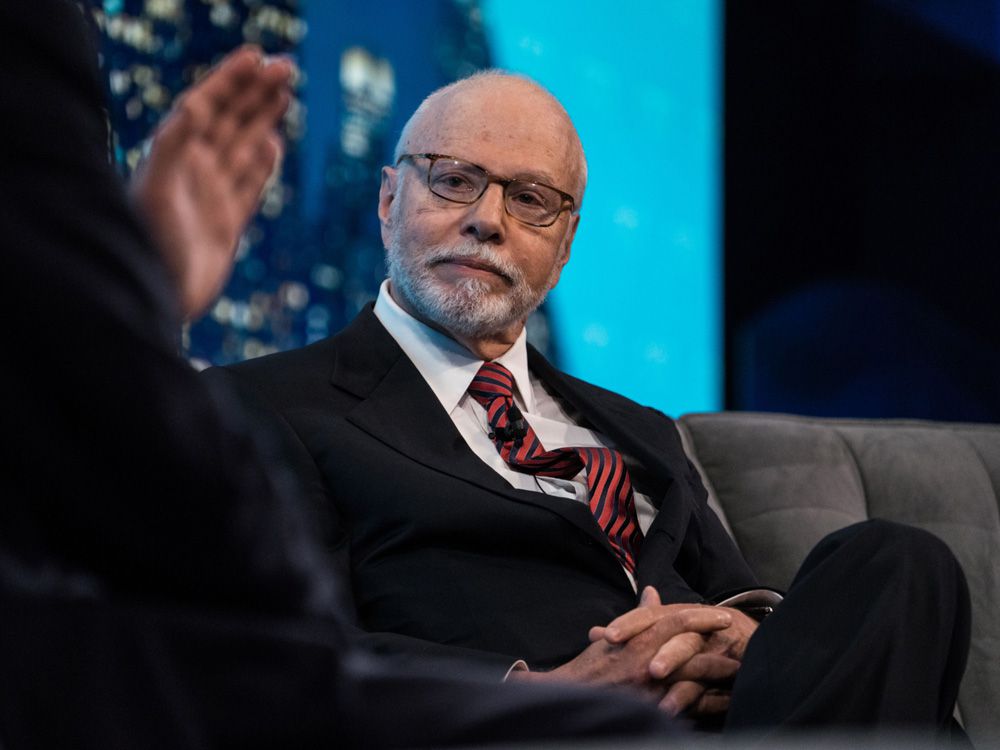

Paul Singer, founder and president of Elliott Management Corp., during the Bloomberg Invest Summit in New York, U.S., on June 7, 2017. Photo by Misha Friedman/Bloomberg files Before targeting Calgary-based oil producer and refiner Suncor this week, billionaire Paul Singer tangled with world leaders to extract debt repayments, pushed to oust Jack Dorsey as CEO of Twitter and was dubbed “the world’s most feared investor” by Bloomberg for his aggressive and litigious tactics as an activist investor.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

Though the 77-year-old is not as flashy or public as activists such as Bill Ackman and Carl Icahn, his hedge fund, Elliott Investment Management LP, has a reputation for seeking out and successfully exploiting weakness. His corporate targets have spanned sectors from technology and telecommunications to entertainment and energy and helped him amass a US$4.3 billion fortune and a spot on the Forbes rich list.

“The team at Elliott Management is very sophisticated,” said Andrew MacDougall, a partner at law firm Osler, Hoskin & Harcourt LLP in Toronto, who specializes in corporate governance and shareholder activism. “They have a track record of success.”

In the 1990s, for example, Singer’s firm bought up troubled sovereign debt from countries including Peru and Argentina that brought in multi-million-dollar repayments, sometimes after years of litigation. Such tactics, which also included corporate debt plays in firms such as Caesars Entertainment Corp., earned him the title of “doomsday investor” in a 2018 article in The New Yorker magazine.

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

His firm, which managed US$51.5 billion in assets as of Dec. 31 and is in its 45th year of operations, had an annualized return of around 13 per cent as of the middle of last year. It has lost money in only two of those years.

They have a track record of success

Andrew MacDougall

Elliott launched 17 activist campaigns last year in the United States, according to a 2021 review of shareholder activism by Lazard’s Capital Markets Advisory Group, leading the pack and representing the New York-based firm’s most active year since 2018.

Notable campaigns included a showdown overboard composition and a push for a strategic review at Charlotte, N.C.-based Duke Energy, and a management challenge at pharmaceutical giant GlaxoSmithKline PLC.

Software company Citrix Systems, which was also targeted by Singer’s firm, agreed in January to be taken private by affiliates of Vista Equity Partners and Elliott Investment Management L.P, in an all-cash transaction valued at $16.5 billion, including the assumption of Citrix debt.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

Singer doesn’t always win, though. His battle with Twitter ended in a compromise in 2020, for example, with board changes and Dorsey still at the helm. By the following year, though, Dorsey had stepped down.

A Suncor Energy Inc. oil refinery near the Enbridge Line 5 pipeline in Sarnia, Ont. Photo by Cole Burston/Bloomberg files This week, Elliott set its sights on Suncor, criticizing the oilsands laggard for “repeated operational challenges” and safety issues.

Elliott Investment Management has built up a 3.4 per cent economic stake in Suncor, and is using it to push for a review of management and the firm’s assets, and calling for changes to the board — including installing five new directors.

In a letter to Suncor, Elliott partner partner John Pike and portfolio manager Mike Tomkins complained of “missed production goals, high costs, and, tragically, a number of employee fatalities and other safety incidents” at the oil company.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

Investors responded to the activist firm’s arrival by pushing Suncor shares as high as $47.80 on Friday morning, up from $42.15 on Wednesday, before pulling back slightly to close at $46.18.

Singer, who was raised in New Jersey and studied psychology at the University of Rochester before getting a law degree from Harvard, has been credited among those who correctly predicted the 2008 Financial Crisis — profiting handsomely from credit default swaps that bet leveraged companies would run aground. He also presciently warned staff in February 2020 to prepare for a long quarantine period, Bloomberg reported. Although COVID-19 had begun to show up outside China, the declaration of the global pandemic was still more than a month away.

Advertisement 6 This advertisement has not loaded yet, but your article continues below.

He grants few interviews and even when he spoke to Euromoney in 2004, he declined to be photographed, telling the reporter he preferred the story to be about his firm. Singer does, however, reveal in that article that his “risk consciousness” was forged a series of unpredicted events and a bear market in the 1970s.

The Euromoney article also includes an oft-repeated anecdote about how Singer lost a lot of money the first time he tried his hand at stock market investing. In all tellings, the young man tried stock picking with his family’s money, though some say the money belonged to just him and his father.

After law school, he worked in the real estate division of Donaldson, Lufkin & Jenrette, an investment bank that was subsequently bought by Credit Suisse. In his early 30s, he left investment banking to start his own firm with around $1 million in capital.

Advertisement 7 This advertisement has not loaded yet, but your article continues below.

More On This Topic David Rosenberg: The Fed is tightening and that usually means recession, no matter what they say Why stock market forecasters are in need of a reality check FP Answers: Am I paying too much in portfolio management fees? One of his two sons, Gordon, now works with him.

Despite keeping a relatively low profile for many years outside of his activist campaigns, Singer gained some public exposure in 2018 when he acquired AC Milan, a European football club once owned by former Italian Prime Minister Silvio Berlusconi. In keeping with his investing philosophy, he picked up the 119-year-old team when its owner, Li Yonghong, defaulted on a loan payment owed to the hedge fund.

But while the Republican billionaire is reportedly a soccer fan, Reuters reported this week that Elliott is on the verge of selling the team, with Bahrain-based asset manager Ivestcorp the frontrunner.

Singer appeared to view the club as he does the firms he targets through activist campaigns: as a fixer-upper.

“Elliott looks forward to the challenge of realizing the club’s potential and returning the club to the pantheon of top European football clubs where it rightly belongs,” he said in a statement when he acquired the team a few years ago.

• Email: bshecter@nationalpost.com | Twitter: BatPost

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300