Stock Market Today

The major indexes appeared ready to plumb new 2022 depths Monday, but an afternoon bounce-back gave investors much-needed relief.The stock market’s 2022 washout, which included an uncharacteristically awful April for equities, looked like it was about to bleed into May, but a late relief rally helped the major indexes finish in positive territory for the month’s first session.

Monday’s early selling might have in part been triggered by a weak Institute for Supply Management manufacturing purchasing managers’ index, which showed activity declining 1.7 points in April to 55.4 (still expanding, but at a slower pace, and below expectations).

“Headwinds from [supply pressures and softer external demand] have intensified in March and April in the wake of geopolitical developments despite strong domestic final demand,” says Barclays economist Jonathan Millar.

Nerves also might be frayed ahead of what will prove a busy week. In addition to another full earnings slate and Friday’s April jobs report, the next chapter of Federal Reserve monetary tightening is expected to come Wednesday, when the Federal Open Market Committee makes its latest policy statement.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Wall Street is overwhelmingly betting on a 50-basis-point increase to the central bank’s benchmark interest rate, and some strategists see Fed Chair Jerome Powell stuck between a rock and a hard place.

“The question becomes ‘How many more [rate hikes] does Powell signal?'” says Tom Porcelli, chief U.S. economist for RBC Capital Markets. “The market expects we’ll also see [50-basis-point hikes] at the June and July meetings. The next meeting is September, and it’s not quite fully priced for a 50.

“And there is part of the challenge for Powell. If he relents at all on his hawkish position, the market will begin to remove this aggressive stance and we’ll see an easing in financial conditions and that is exactly what he does not want to happen, not at the moment anyway.”

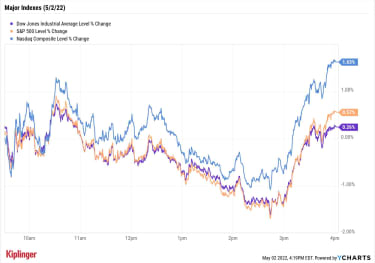

The major indexes, which looked primed to plumb new year-to-date lows early on, flipped into green during the session’s final hour. The Nasdaq Composite (+1.6% to 12,536) led the way, followed by the S&P 500 (+0.6% to 4,155) and Dow Jones Industrial Average (+0.3% to 33,061).

YCharts

Other news in the stock market today:

The small-cap Russell 2000 joined in on the afternoon rally, improving by 1.0% to 1,882.U.S. crude oil futures edged up 0.5% to $105.17 per barrel.Gold futures suffered their worst daily decline since early March, sliding 2.6% to $1,863.60 an ounce.Bitcoin gained a little bit of ground, improving 0.6% to $38,567.40. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Global Payments (GPN) sank 9.2% after the payments technology firm reported earnings. In its first quarter, GPN reported higher-than-expected adjusted earnings of $2.07 per share on in-line revenue of $1.95 billion, while also maintaining its full-year outlook. As for today’s slide, Oppenheimer analyst Dominick Gabriele suggests Wall Street might have been looking for “more top-line growth” following solid results from Visa (V) and Fiserv (FISV).Align Technology (ALGN) gained 6.5% after the Invisalign maker said it kicked off a $200 million accelerated stock buyback program. Shares plummeted to a new 52-week low of $270.37 late last week after the company’s earnings report reflected “the quarter’s underperformance, lower visibility causing ALGN to revoke revenue guidance, and the negative management tone around global headwinds which will likely impact earnings per share growth,” says CFRA Research analyst Paige Meyer (Hold).Investors More Bearish Than They’ve Been in DecadesMonday’s higher close belies investors’ deep gloom.

The American Association of Individual Investors has, since 1987, run a weekly survey that gauges investors’ sentiment by asking “Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)?” In the most weekly survey, optimists are in short supply.

“There haven’t been so few “bullish” investors in 30 years,” says Ross Mayfield, investment strategy analyst at Baird. “Just as a refresher, that stretch includes the dot-com crash, the 2008 Financial Crisis, and the COVID-19 pandemic.”

But before you gnash your teeth or rend your garments, consider that the stock market is often darkest right before its dawn.

“Equity returns from periods of elevated bearishness tend to be outstanding,” Mayfield continues. “The average 12-month return from these periods is double the all-period average, and perhaps more importantly, the hit rate for a positive return is nearly 100%. You might not always get the 20% return over 12 months, but you almost never lose money – and that’s half the battle. As it turns out, a great time to be bullish is when everyone is bearish. Or, as the saying goes, ‘Be greedy when others are fearful.'”

Indeed, rather than “sell in May and go away,” investors might consider a springtime spree of dip buys on downtrodden stocks that are potentially poised to ride secular trends higher over the coming year.

Electric vehicle shares, for instance, now trade at far better valuations than they have over the past year-plus.

Another place to look is big data – as companies gather ever-growing troves of data, they’re also finding this information increasingly difficult to sift through. But big data firms can help corporate America gain valuable insights from this information, and could become staples of doing business in the future.

Here are five big data names worth a closer look.

Keeping Property in the Family with LLCs and Partnerships

estate planning

Keeping Property in the Family with LLCs and PartnershipsPassing a farm, vacation home or other property down for generation after generation has its challenges. LLCs and partnerships can help.

April 29, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Should I Buy Bonds?

bonds

Should I Buy Bonds?Investors’ personal motives for buying bonds should inform what they do next.

April 27, 2022

Pfizer (PFE) COVID, Cancer Drugs Key to Top-Line Growth

stocks

Pfizer (PFE) COVID, Cancer Drugs Key to Top-Line GrowthOur preview of the upcoming week’s earnings reports include Pfizer (PFE), Advanced Micro Devices (AMD) and DraftKings (DKNG).

May 2, 2022

Stock Market Today (4/29/22): Stocks Close Out Worst April in Years

Stock Market Today

Stock Market Today (4/29/22): Stocks Close Out Worst April in YearsNegative earnings reactions for mega-caps Amazon.com and Apple weighed on broader markets today.

April 29, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

April 29, 2022

Sell in May and Go Away? Here We Go Again …

Investor Psychology

Sell in May and Go Away? Here We Go Again …Every year, “sell in May and go away” is dragged out for show like Punxsutawney Phil. Should you follow this advice in 2022? As always, it depends.

April 29, 2022