Stock Market Today

A few Street-beating blue-chip earnings helped lift stocks to modest gains as Wall Street prepared for another rise in benchmark interest rates.Stocks wobbled their way to a second consecutive session of gains Tuesday as investors looked ahead to tomorrow’s pivotal Federal Reserve announcement.

Not that Tuesday was entirely without its own developments.

U.S. job openings unexpectedly increased in March, by 205,000 to a record 11.55 million, though 4.5 million U.S. workers quit the labor force to widen the labor gap to 5.6 million workers – also a new high.

“This increased tightness suggests that strong wage growth will persist until improvements in labor supply and normalization of job openings bring the labor market back into balance,” says a Goldman Sachs economic research team. Also, March factory orders improved by a better-than-expected 2.2%.

The first-quarter earnings calendar kept on churning, too.

Pfizer (PFE, +2.0%) lowered its full-year earnings forecasts, but Wall Street nonetheless reacted positively to a solid Q1 report. Strong sales of both its COVID-19 vaccine and oral antiviral helped the Big Pharma outfit to solid top- and bottom-line beats.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

Clorox (CLX, +3.0%) also beat Street estimates, though the company also announced it would continue raising prices after profit margins took a sharp hit in its most recent three-month period. It also lowered its full-year earnings forecast for the second consecutive quarter.

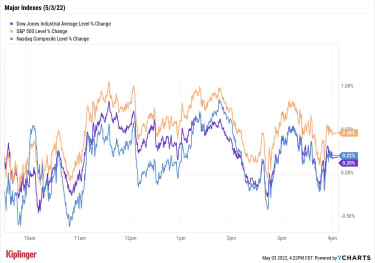

All that was enough to help the broader markets to another small up day. The S&P 500 (+0.5% to 4,175) led the way, with the Dow (+0.2% to 33,128) and Nasdaq (+0.2% to 12,563) also producing modest gains.

It’s also a peculiar lead-up into tomorrow’s Federal Open Market Committee policy announcement, where Kiplinger (and just about everyone else) expects the Fed to declare a 50-basis-point increase to its benchmark interest rate. Much of the market’s recent issues have been tied to rate jitters, though it could be that the market has finally priced in the central bank’s expected moves.

“We may very well have seen ‘peak hawkishness,’ meaning that the market’s expectations for Fed policy could stabilize or moderate somewhat,” says Lauren Goodwin, economist and portfolio strategist at New York Life Investments. Though she adds “it’s too early to be sure that ‘peak hawkishness’ has passed.”

YCharts

Other news in the stock market today:

The small-cap Russell 2000 jumped 0.9% to 1,898.U.S. crude oil futures fell 2.6% to settle at $102.41 per barrel.Gold futures gained 0.4% to end at $1,870.60 an ounce.Bitcoin didn’t partake in Tuesday’s recovery, dropping 2.2% to $37,701.91. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Carvana (CVNA) slid 5.2% after Wells Fargo analyst Zachary Fadem downgraded the used car retailer to Equalweight from Overweight, the equivalents of Hold and Buy, respectively. “Recent evidence suggests that macro headwinds are building, access to capital is dwindling, and appetite for high-growth, free cash flow-negative companies is becoming increasingly scarce,” Fadem says. The analyst also downgraded Vroom (VRM, -4.3%) and Shift Technologies (SFT, -5.0%).Nutrien (NTR) climbed 6.5% after the fertilizer firm reported higher-than-expected adjusted first-quarter earnings of $2.70 per share. The company also said it raised its full-year forecast as prices for key crops like corn, soybean and wheat are up 50% to 90% above their 10-year average. “We think NTR’s retail segment will continue to experience strong top-line growth across most of its products, given solid demand and price increases,” says CFRA Research analyst Richard Wolfe (Hold). “NTR’s Q1 results and guidance capture the benefits of being a crop input provider amid strong agriculture fundamentals and investors may view this as a safe haven in the inflationary environment.” Other materials stocks like Mosaic (MOS, +8.7%) and CF Industries (CF, +4.4%) posted solid gains today, too.Let’s Go, IPOs! Let’s Go!A return to market stability, even if for a short while, would be welcome news to two Wall Street groups: investment bankers, and retail investors needing to scratch an itch for “something new.”

A downturn in equities and high volatility have put the pinch on initial public offerings (IPOs), in which privately held companies list on the public markets. According to IPO-focused registered investment adviser Renaissance Capital, just 26 U.S. initial public offerings have priced so far in 2022 – down a little more than 80% from the same date last year.

But it’s possible this week could help kick-start some IPO activity. In just a couple of days, consumer eye care name Bausch + Lomb will hit the public markets in a spinoff from Bausch Health Companies (BHC). A warm reception to this offering – and no nasty surprises from the Fed – could help coax a few more anticipated offerings on the market, such as Steinway, which recently announced its plans to list on the New York Stock Exchange.

Investors curious about which new stocks could be hitting the markets this year need look no farther than our list of highly anticipated potential offerings.

37 Ways to Earn Up to 9% Yields on Your Money

Becoming an Investor

37 Ways to Earn Up to 9% Yields on Your MoneyOur field guide to income investments of varying dividend yields and interest rates identifies opportunities ranging from ordinary to downright exotic…

April 28, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Keeping Property in the Family with LLCs and Partnerships

estate planning

Keeping Property in the Family with LLCs and PartnershipsPassing a farm, vacation home or other property down for generation after generation has its challenges. LLCs and partnerships can help.

April 29, 2022

Stock Market Today (5/2/22): Late Rally Gives Stocks a Sunnier Start to May

Stock Market Today

Stock Market Today (5/2/22): Late Rally Gives Stocks a Sunnier Start to MayThe major indexes appeared ready to plumb new 2022 depths Monday, but an afternoon bounce-back gave investors much-needed relief.

May 2, 2022

Pfizer (PFE) COVID, Cancer Drugs Key to Top-Line Growth

stocks

Pfizer (PFE) COVID, Cancer Drugs Key to Top-Line GrowthOur preview of the upcoming week’s earnings reports include Pfizer (PFE), Advanced Micro Devices (AMD) and DraftKings (DKNG).

May 2, 2022

Stock Market Today (4/29/22): Stocks Close Out Worst April in Years

Stock Market Today

Stock Market Today (4/29/22): Stocks Close Out Worst April in YearsNegative earnings reactions for mega-caps Amazon.com and Apple weighed on broader markets today.

April 29, 2022

Kiplinger’s Weekly Earnings Calendar

stocks

Kiplinger’s Weekly Earnings CalendarCheck out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

April 29, 2022