Wall Street searched for stability Tuesday, with a couple of the major indexes able to muster some gains ahead of a vital inflation reading tomorrow.

The 10-year Treasury note, after touching 3.2% yesterday, pulled back below the 3% threshold to as low as 2.94%. This retreat in interest rates removed some pressure from growthier stocks (which had been pummeled Monday), with technology (+1.5%) firms leading the session’s relief rally. Semiconductor stocks such as Nvidia (NVDA, +3.8%), Broadcom (AVGO, +3.3%) and NXP Semiconductor (NXPI, +3.2%) were among the day’s notable risers.

It wasn’t all roses, though. Investors continued to punish once-hot companies showing any signs of weakness.

For instance, artificial-intelligence lending-platform maker Upstart Holdings (UPST) plunged 56.4% to trade around all-time lows. While it beat Street estimates for first-quarter earnings, the company reduced full-year revenue forecasts to $1.25 billion from $1.4 billion previously.

Work-from-home darling Peloton Interactive (PTON, -8.7%) continued its fall from grace after reporting a 15% year-over-year decline in sales, a $757 million net loss and a dwindling cash pile that CEO Barry McCarthy said left the company “thinly capitalized.”

Even AMC Entertainment (AMC, -5.4%) was knocked lower despite a pretty encouraging report in which Batman and Spider-Man films helped the theater company to report a narrower-than-expected quarterly loss.

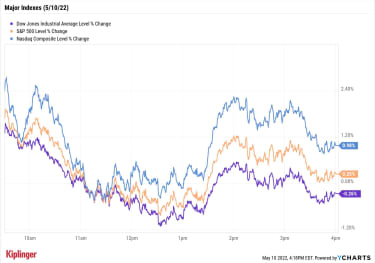

Still, the major indexes showed some strength. The Nasdaq Composite rebounded 1.0% to 11,737, while the S&P 500 improved 0.3% to 4,001. The Dow Jones Industrial Average brought up the rear, declining 0.3% to 32,160.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

“Markets are clearly confused about what the Fed will do this year and just how aggressive it will get. That can be seen in the volatility in expectations for where the Fed funds rate will be at the end of 2022, as seen in Fed funds futures,” says Invesco Chief Global Market Strategist Kristina Hooper. “And it is reflected in stock market volatility, with the VIX above 30.”

The big story to watch tomorrow is the Bureau of Labor Statistics’ consumer price index (CPI) report for April. BlackRock, for one, expects 8.1% headline CPI growth and 6.0% core growth following 8.5% and 6.5% increases in March.

“A weaker-than-expected CPI report later this week could help turn the tide and see investors embrace risk assets once again,” says Brian Price, head of investment management for independent broker-dealer Commonwealth Financial Network.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 slipped marginally to 1,761.U.S. crude futures slipped below the $100 per-barrel mark, ending the day down 3.2% at $99.76 per barrel. Gold futures fell 0.9% to settle at $1,841 an ounce.Bitcoin clawed out a 0.5% gain to $31,315.54. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Groupon (GRPN) slid 12.5% after the e-commerce marketplace swung to an adjusted loss of 80 cents per share in its first quarter, compared to a per-share profit of 25 cents in Q1 2021. GRPN also said revenue slid 41% year-over-year to $153.3 million, while global units sold slumped 29% to 12.7 million. The company gave soft current-quarter and full-year revenue guidance, as well. “The underperformance was driven by a weaker rebound in local following omicron impacts in January and February,” says Credit Suisse analyst Stephen Ju, who maintained a Neutral (Hold) rating on GRPN. “As merchants found themselves in a high demand/low capacity environment, they were not incentivized to leverage discounting. Furthermore, April local billings continue to trend at Q1 2022 (as a percentage of 2019) levels and latest trends suggest an elongated recovery path.”Vroom’s (VRM) narrower-than-expected first-quarter loss sent shares up 32.4% today. In its first quarter, the online used auto dealer reported a per-share loss of 71 cents per share vs. a consensus estimate for a loss of $1.07 per share. Revenue of $923.8 million also came in higher than analysts had expected. VRM also announced a new business realignment plan for long-term growth that it anticipates will result in up to $165 million in cost savings through the rest of 2022. “Vroom is shifting to survival mode, understandably, swapping out more aggressive growth plans for a leaner, and potentially more profitable business model,” says Baird Equity Research analyst Colin Sebastian (Outperform). “Given the current market environment, and challenges in scaling up an ‘asset light’ online sales platform, we think this pivot makes sense.”Stick to (Most Of) Your Guns”More than anything, volatility is a test of investor mettle.” So says Ross Mayfield, investment strategy analyst at research firm Baird, who notes that while we’re often told volatility is the price to pay in the stock market’s long-term gains, this glosses over the fact that volatility can take many forms.

“March 2020 featured a gut-wrenching drop, but also a relatively quick rebound. On the other end of the spectrum, markets are occasionally plagued by periods of high volatility that churn sideways relentlessly,” he says. “Each is challenging in its own way; holding through a big drop requires a steel stomach, but longer periods of frustrating volatility require real fortitude.”

While staying the course isn’t easy, you can at least make it less difficult on yourself by homing in on higher-quality investments with a longer-term focus. Stock investors might look to the Dow Jones’ top-rated components; fund investors should stick to well-managed products, such as these Vanguard funds commonly found in 401(k) plans.

But remember: Keeping a calm head doesn’t mean you shouldn’t ever sell in a downturn – on the contrary, the only thing worse than suffering losses in the first place is holding on to weak positions that will slather you in more red ink down the road.

With that in mind, we’ve taken a look at some of Wall Street’s least favorite names at the moment. Remember: Sell calls are typically rare among the analyst community, so the fact that the pros are calling for more downside in these names, rather than saying to buy the dips, is noteworthy.

Check out Wall Street analysts’ list of stocks to sell right now.

Kyle Woodley was long NVDA as of this writing.