Stock Market Today

U.S. inflation eased slightly on an annual basis in April, but it wasn’t enough to keep stocks in positive territory.It was a choppy day for stocks as investors unpacked the latest consumer price index (CPI). Data released by the Labor Department this morning showed that prices consumers paid for goods and services in April rose at an annual rate of 8.3% – down from March’s 8.5% pace to mark the first drop in inflation in eight months. While encouraging at first glimpse, there were concerning signs deeper inside the report.

For instance, the decline in CPI last month reflected a drop in gas prices, which have since rebounded. Food prices remained elevated, while airfare and restaurant bills increased ahead of the key summer travel season. And core CPI, which excludes the volatile energy and food categories, rose 0.6% on a sequential basis – double what it was in March.

“While this report appears to mark the first that shows some moderation from the ever-rising pace of inflation since September of last year, one data point does not necessarily make a trend; and the rise in core CPI should lead to some consideration that the moderation in inflation will not be quick,” says Jason Pride, chief investment officer of private wealth at wealth management firm Glenmede.

With prices already high, Pride said, it should be harder for the CPI to continue to rise at the same pace, especially with the Federal Reserve also hiking interest rates to combat higher prices. “However, it will likely take multiple reports for such a trend [of moderating inflation] to clearly establish itself,” he says.

Sign up for Kiplinger’s FREE Investing Weekly e-letter for stock, ETF and mutual fund recommendations, and other investing advice.

This sentiment is echoed by Mike Loewengart, managing director of Investment Strategy at E*Trade. “Today’s read is a stark reminder that the journey to pre-pandemic levels of inflation will be a long one,” Loewengart says. “Although inflation slowed from March, the market’s reaction suggests that record high prices continue to weigh heavy on investors psyches. And with inflation persistently hot, the Fed has more fodder for increased rate hikes, which the market doesn’t often welcome with open arms.”

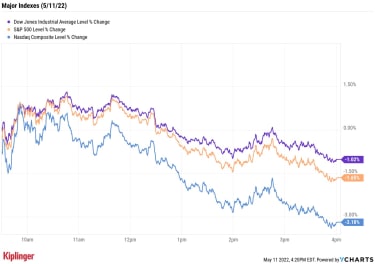

After bouncing between gains and losses in early trading, markets took a decisive turn lower this afternoon. At the close, the Nasdaq Composite was down 3.2% at 11,364, the S&P 500 Index was off 1.7% at 3,935 and the Dow Jones Industrial Average was 1.0% lower at 31,834.

YCharts

Other news in the stock market today:

The small-cap Russell 2000 retreated 2.5% to 1,718.U.S. crude futures surged 6% to end at $105.71 per barrel.Gold futures gained 0.7% to settle at $1,853.70 an ounce.Bitcoin slid below the $30,000 for the first time since July 2021, down 5.9% at $29,477.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)Roblox (RBLX) was down as much as 10% in after-hours trading Tuesday after the video game developer reported a first-quarter loss of 27 cents per share, wider than the 21 cents per share Wall Street was expecting. The company’s revenue of $631.2 million also fell short of the consensus estimate, as did bookings of 54.1 million. Still, the metaverse stock managed to finish today up 3.4% after Chief Financial Officer Michael Guthrie said on the company’s earnings call that year-over-year growth may have bottomed in March, sooner than anticipated. Coinbase Global (COIN) shares plunged 26.4% on Wednesday after delivering a pretty disappointing quarterly report. Q1 revenues were off 27% year-over-year to $1.17 billion, widely missing analysts’ expectations for $1.50 billion. Meanwhile, the company swung to a $430 million loss after earning $388 million in the year-ago period. Monthly users were down 19% YoY, too. Also raising eyebrows in the cryptocurrency community was an update to the Risk Factors section in its Form 10-Q, warning that users could potentially lose access to their assets in the event Coinbase ever had to go through bankruptcy proceedings.Inflation Remains a Top Concern for InvestorsInflation remains top of mind for investors. This is according to the latest Charles Schwab Trader Sentiment Survey, which reviews the outlooks, expectations and trading patterns of 845 Charles Schwab and TDAmeritrade clients. Inflation was the main concern for those surveyed in the report (20% of respondents), followed by geopolitics (15%) and recession/domestic politics (12% apiece). And nearly half of participants (45%) do not believe inflation will begin to ease until 2023.

“Overall, in the second quarter, market sentiment among traders is unquestionably skewing bearish,” says Barry Metzger, head of trading and education at Schwab. But market participants do see investing opportunities, the report notes.

Among the sectors survey respondents are most bullish on at the moment are energy (70%) and utilities (54%). The industries they are most upbeat toward include cybersecurity (71%) and agriculture (70%).

And 70% of those surveyed are interested in seeking out opportunities in defense stocks. While Russia’s invasion of Ukraine has unsettled many parts of the stock market, it has also sparked an increase in global military spending, which could create a potential boon for the industry. Here, we’ve compiled a quick list of defense stocks that are poised to benefit from this spending build. The names featured include familiar names as well as some under-the-radar picks – and they all sport top ratings from Wall Street’s pros.

Why Are Gas Prices Still Going Up?

spending

Why Are Gas Prices Still Going Up?The cost of a gallon of gas is heading back toward its March highs. What’s driving the resurgence, and will gas prices go down anytime soon?

May 5, 2022

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Will Gas Prices Ever Go Down?

personal finance

Will Gas Prices Ever Go Down?A few catalysts could theoretically relieve current pressures at the fuel pump, but don’t expect gas prices to go meaningfully lower soon.

May 9, 2022

Stock Market Today (5/12/22): S&P Inches Toward Bear Market as Inflation Pressures Persist

Stock Market Today

Stock Market Today (5/12/22): S&P Inches Toward Bear Market as Inflation Pressures PersistAnother red-hot producer price index reading sent stocks on a choppy ride to modest losses Thursday.

May 12, 2022

Stock Market Today (5/10/22): Stocks Try to Find Their Legs Ahead of CPI Report

Stock Market Today

Stock Market Today (5/10/22): Stocks Try to Find Their Legs Ahead of CPI ReportGrowth stocks enjoyed a lift Tuesday thanks to a momentary retreat in bond yields. But many investors looked ahead to Wednesday’s latest inflation dat…

May 10, 2022

The Best Vanguard Funds for 401(k) Retirement Savers

mutual funds

The Best Vanguard Funds for 401(k) Retirement SaversVanguard funds account for roughly a third of the 100 most popular 401(k) retirement products. We rank Vanguard’s best actively managed funds, includi…

May 10, 2022

5 Superb Semiconductor Stocks for 2022 and Beyond

stocks

5 Superb Semiconductor Stocks for 2022 and BeyondSemiconductor stocks haven’t had quite the year many were expecting, but all the drivers remain in place for success once the macro clouds clear.

May 10, 2022