Returns muted by volatility in markets ‘not seen since the outset of the pandemic’

Publishing date:

May 19, 2022 • 11 hours ago • 3 minute read • 21 Comments

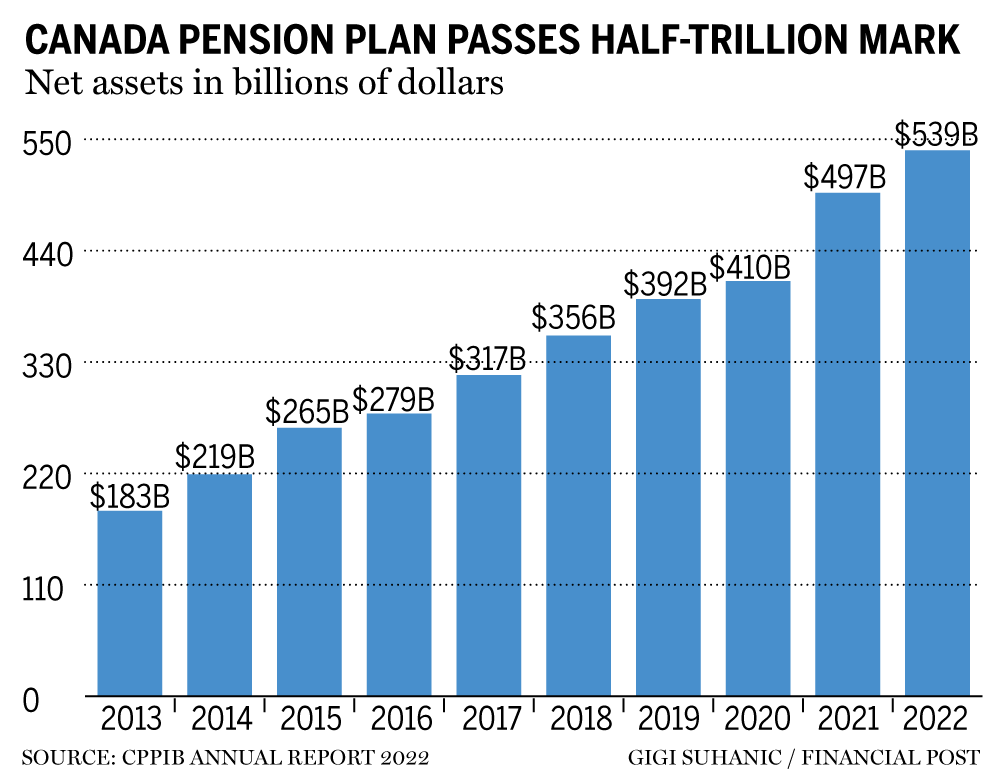

The CPP fund’s five-year return is 10 per cent, with the ten-year return coming in at 10.8 per cent. Photo by Sean Kilpatrick /THE CANADIAN PRESS The Canada Pension Plan Investment Board crossed the half-trillion-dollar threshold in its most recent fiscal year, reaching $539-billion in assets as of March 31.

Advertisement 2 This advertisement has not loaded yet, but your article continues below.

The net return for the year was 6.8 per cent on last year’s $497-billion, with $8-billion of the $42-billion increase coming in the form of net transfers from the Canada Pension Plan.

The CPP fund’s five-year return is 10 per cent, with the 10-year return coming in at 10.8 per cent.

“CPP Investments delivered solid returns in fiscal 2022 despite turbulent market conditions in the wake of Russia’s war on Ukraine, supply chain disruptions caused by the pandemic and rising inflation,” said John Graham, the pension management organization’s chief executive.

“Our 10-year performance of nearly 11 per cent, the same as it stood at the end of the last fiscal year, demonstrates the enduring growth of the (CPP) Fund over the long haul … with steady resilience during uncertain times.”

Advertisement 3 This advertisement has not loaded yet, but your article continues below.

Private equity, infrastructure, real estate and credit investments were the predominant contributors to the Fund’s overall performance in fiscal 2022.

The pension giant said returns in the first nine months of the year were muted by “volatility affecting public equities during the final quarter, at levels not seen since the outset of the pandemic.”

For reference, CPP Investments noted that the fund’s return in the 12 months of 2021, rather than the fiscal year that bled into 2022, was 13.8 per cent.

Bond prices also declined at a pace not seen in more than 40 years during the fourth quarter.

In addition, several factors led to a $4-billion currency loss during the fiscal year that hit returns, including the appreciation of the Canadian dollar against the U.S. dollar and other major currencies, influenced by rising commodity prices and the impact of evolving monetary and fiscal policies across global economies.

Advertisement 4 This advertisement has not loaded yet, but your article continues below.

“Looking ahead, we confront uncertain business and investment conditions with higher inflation expectations, potentially worsening supply chain interruptions, tepid global economic growth estimates and international reactions to the war in Europe, all against the backdrop of a persistent global pandemic and climate change,” said Graham.

However, he said the pension management organization’s diversification strategy and market breadth, combined with local presence and a global brand, put it in “a position of strength” moving forward.

In an interview Thursday, Graham said the pension fund is positioned to weather higher inflation than was expected a year ago because of a longstanding strategy of investing in real assets such as infrastructure and real estate.

Advertisement 5 This advertisement has not loaded yet, but your article continues below.

“It is actually an area we’ve been trying to grow. It has good, strong total returns and then it does have some protection against inflation,” he said.

“It’s been growing faster than many other areas.”

In a report this week, Fitch Ratings said Canadian pension funds tracked by the ratings agency, which include CPP Investments, are “well positioned” to withstand higher inflation and modest economic growth amid heightened market volatility.

More On This Topic CPPIB takes aim at management missteps with vote-no proxy plan CPPIB partners with Lennar in US$979 million U.S. apartment push While stock market volatility and the Asia-Pacific region created some “headwinds” during the final quarter CPP Investments’ fiscal year, Graham said his teams will continue to invest across geographies and market sectors.

This advertisement has not loaded yet, but your article continues below.

Article content “We have a benefit of diversity (and) will continue to be active in the in both the public and the private equity markets around the globe,” he said.

The Asia-Pacific market provides an example of the benefits of the strategy, he said, noting that despite some pullback in recent months amid growth and geopolitical concerns, the region has been the second-highest performer for CPP Investments over the past five years.

“We certainly appreciate that how we invest really matters and we spend a lot of time thinking about how we invest in these different countries around the globe,” he said, adding that access to large and emerging economies is necessary for the longterm performance of the fund, which invests contributions and profits to pay for the retirement of Canadians.

“We don’t put in hard allocations to countries,” Graham said. “We think about the exposure in emerging markets and how much of our portfolio we want global, and then the capital goes to where the best opportunities are.”

• Email: bshecter@postmedia.com | Twitter: BatPost

Financial Post Top Stories Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.

By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc. | 365 Bloor Street East, Toronto, Ontario, M4W 3L4 | 416-383-2300