After falling almost 20% in the last few months, stocks have surged over the last week. Evercore strategist Julian Emanuel says there are some signs the rally will keep going. He says that if a bear market is avoided, hard-hit but highly profitable stocks will outperform. Nobody wants to be premature and say the stock market slump is over, but with stocks up more than 6% from their lows last week, there are some signs of hope emerging.

Julian Emanuel, who leads the equity, derivatives and quantitative strategy team for Evercore, says that there are some indications that the worst is over, including the falling yield on 10-year US Treasuries and the fact that the dollar has slipped from its recent highs.

Other factors such as solid corporate earnings, a loosening of the stock-bond correlation that’s emerged this year, and improvement in China’s economy could also contribute to a more positive environment for stocks. But he acknowledges that not all of the evidence points to an imminent recovery.

“Pockets of capitulative action have appeared in some areas including a spike in Nasdaq 100 Volatility (VXN),” he wrote in a recent note. “Whether this fear in Big Tech will be followed by more traditional capitulation signs in the broader market, or was enough to signal the start of the ‘bottoming process,’ remains to be seen.”

But in either event, Emanuel says that after a steep sell-off — one that has either just missed being a bear market based on index closing prices, or one that barely got there based on intraday levels — a lot of opportunities have emerged.

“With signs that the stock market drawdown could be at or near completion, we remain focused on stock specific ideas in an uncorrelated environment that continues to reward alpha over beta,” he said.

While a bear market and a recession might force investors to take a dramatically different approach, Emanuel says that if they look at some other not-quite bear markets, it’ll show them a profitable path forward.

He says that in the almost-bear markets of 1998, 2011, and 2018, the stocks that fared the worst in the downturn ended up leading the way when investors became convinced that a recession wasn’t actually at hand.

What’s most likely to work in that scenario? Emanuel says that companies that have been hit hard but are posting strong earnings growth, and where Wall Street is unusually bearish — which means the stocks would get an additional boost when those investors change their minds, as they did after the late 2018 market skid.

He describes the group this way: “Stocks with bottom quartile Index performance since the January 4 SPX peak but top quartile 2022e EPS growth, positive earnings, and steep options skew.”

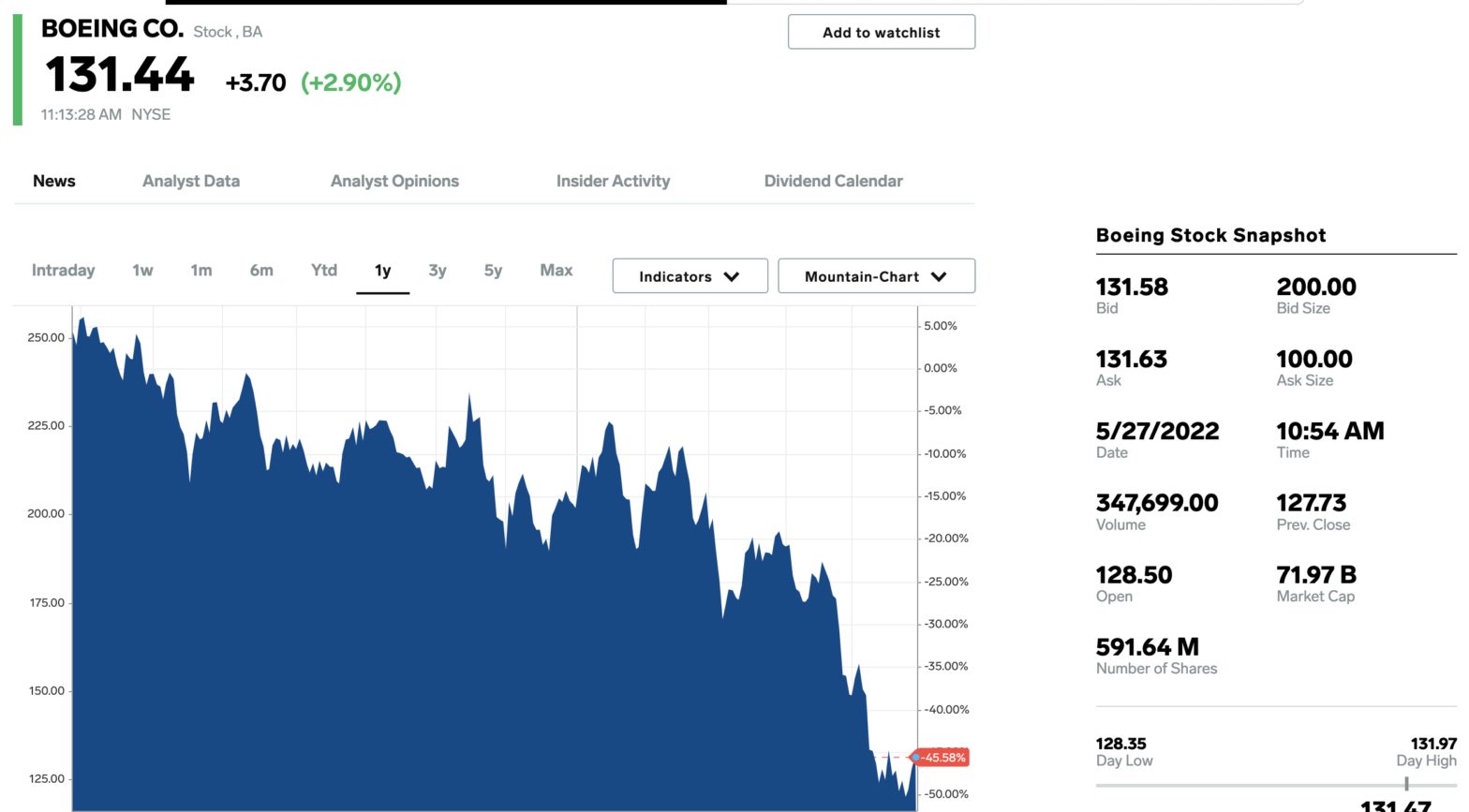

The 15 stocks identified by Emanuel and his team that fall into that category have all dropped between 29% and 64% since January 4, when the S&P 500 reached its most recent closing high. But based on analyst estimates, they’re all projected to have strong earnings growth in 2022.

The stocks are ranked below based on how far they’ve fallen since the market’s latest high. Percentages were calculated based on Friday’s closing prices.

In the case of Boeing, Snowflake, Zscaler, Lyft, and Under Armour, Emanuel also recommends buying July upside calls and selling downside puts as a way to book extra profits.